Coverage of new watches and offering advice on how to better appreciate watches is incomplete without talking about the health and movement of the watch industry overall. 2014 was a really rough year for many markets, yet some luxury product makers saw record numbers in 2014. How does one explain this apparent contradiction? aBlogtoWatch will republish a letter (below) sent to us by colleague and luxury industry economic consultant Mr. Frank Muller (not to be confused with the watchmaker Franck Muller) out of Dresden, Germany. Normally, we would offer his findings in our own words, but we couldn’t really say it more succinctly, so we thank Mr. Muller for his permission. You can learn more or contact him via his consultancy The Bridge To Luxury.

The answer whether in 2014 the glass of wine was half full or half empty for the luxury industry is a moot point. It was, indeed, a challenging year. Obviously, geo-political developments occurring in the Middle East, Ukraine, Hong Kong, or China impacted business. Also, lower than expected economic growth rates in the BRIC-states, plus the still sluggish economies in Europe had a negative influence.

In general, sales in the last four months were disappointing and thus contradicting most of the positive market projections forecasted earlier the year. While some categories still enjoyed very good results, others experienced a substantial slow-down of growth.

Despite a difficult Russian market, the German premium car industry, for instance, was on the winner’s side in 2014. It reports for its main brands Audi, BMW, and Mercedes record sales. With almost 190,000 globally delivered cars, Porsche was up 17%. According to management statements, Rolls-Royce and Bentley will also achieve new all-time heights.

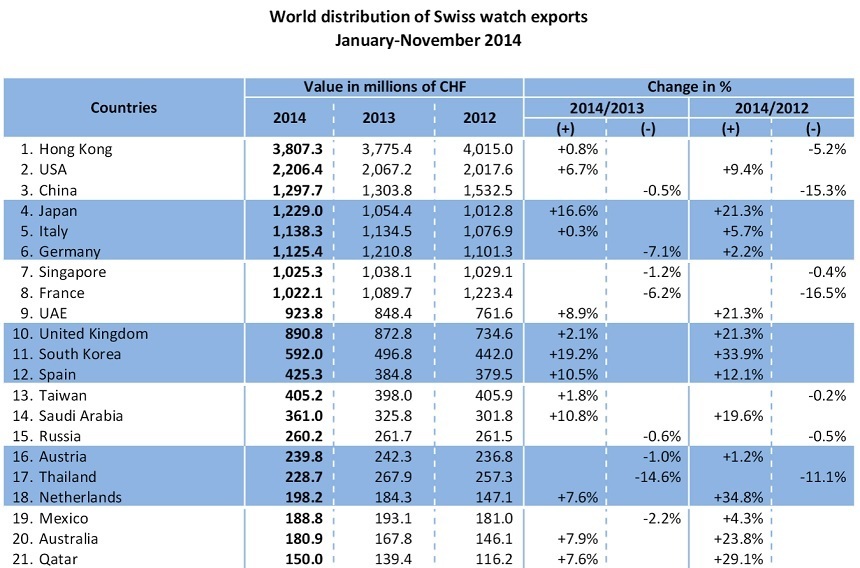

The industry of high-end watches, however, faced a difficult year. Hong Kong as a major hub for the Asian business was disturbed by political uncertainties. And China’s continuous efforts to curb down corruption decelerated growth further for two markets that alone amount for approx. 25% of the total business. Basically, only the USA and Japan substantially contributed to growth (+5% resp. 17%). However, it still can be expected that 2014 may result in a record year. The export of Swiss wristwatches, as an important market indicator, could break the 21 billion CHF barrier in 2014 with an increase of 2 to 3%. Final figures are available early February. As far as luxury watches are concerned (export value +3,000 CHF/piece), the growth will be in line with the overall trend. Yet, compared to the average annual rate of 12.5% between 2000 and 2012 (!), the watch luxury segment has strongly lost momentum in the last two years with increases of only 2.8% in 2013 and probable 2.5 to 3.5% last year. This segment will again represent some 65% of the total Swiss export values. Overall, the watch industry is in a phase of restructuring that will lead to a reduction of its more than 1,500 brands that introduce more than 10,000 novelties per annum.

High-end French wines also belonged to a category that encountered a drop in exports depending very much on the Chinese market, too, whereas leather goods are reported to have gained, especially due to stronger demands in the US and Japan.

A look at the development of last year’s share prices of the major luxury groups reflects the inconsistent industry picture: LVMH +11%, Hermès +10%, Kering +3%, Richemont 0%, Hugo Boss 0%, The Swatch Group -24%.

For 2015, the outlook promises no major changes compared to last year. China is expected to continue a controlled growth of its economy; anti-corruption measurements will remain on the political agenda. In 2014, consumption in Japan was only temporarily boosted as consumers anticipated an increase of the VAT-rate of 5% to 8%. The last months were not strong. Assuming that the conflict in Ukraine will not end soon, demand in the whole region of the former Soviet Union will stay at very low levels. In Europe, France and Italy are not expected to provide substantial impulses. After a flat 2014, Germany may return to a stronger growth, but will depend largely on foreign tourism. And the US alone will not be able to lift up the whole industry. Luxury remains a mood’s business, and currently, too many “no fun” topics pull the markets down (e.g. global terrorism). The industry’s slow-down of growth will continue for the time being. Given current high stocks on manufacturers’ and retailers’ levels and the general time lag of the industry’s dynamisms after phases of downturns, The Bridge To Luxury (TBTL) expects a stronger pace of global sales only to return in spring or mid 2016 at the earliest.

In the meantime, especially independent and smaller brands will face sometimes very tough challenges concerning the international distribution access, sufficient margins, and liquidity. Tight cost control and streamlining of operations, along the value chain will be an industry’s imperative. Although the time for anti-cyclical investments into branding and innovation is there, many especially smaller companies will not be able to afford. This will accelerate the process of the industry’s further concentration as the large groups with their economies of scale are able to leverage businesses better. As a consequence, an increasing number of independent brands under difficulties will be available for acquisition, while fewer investors shall be interested to currently venture into luxury.

Yet, in the long run, the luxury industry still can expect to expand substantially, with an increasing number of HNWIs (high net worth individual) globally, and this, especially in the emerging markets. Already today, Credit Suisse estimates the global private wealth at 260 trillion US$ and expects a further build-up of fortunes.