If you are a serious watch collector, then at some point, you’ll be faced with the ability to trade versus buying or selling watches in your collection. Trading watches will appeal to owners who wish to exchange a current watch for a desired watch. As an alternative to the buy/sell cycle and rental schemes, trading watches will interest those who prefer to experience variety, while owning their watches and working within a limited budget. The idea of trading is familiar to those who may have swapped baseball cards, comics, or coins; convert what you have into what you want. As the luxury watch hobby expands into the mainstream of popular culture, many owners are beginning to explore the potential of the “watch trade” concept. Before testing the waters, trade-seekers can empower themselves and maximize enjoyment by acting with facts in hand.

The Yardstick: Factors to Consider Before Trading

Whichever trade type an owner decides to pursue, it is important to keep three core concepts in mind: value, purchasing power, and flexibility. The best trade for an individual will be the one that maximizes his ability to preserve value while providing the greatest purchasing power and flexibility in trade and payment options.

Value is a broad concept, but it boils down to the security of an owner’s investment in a watch. For example, trading ensures that an owner continues to hold a durable asset with value while renting does not. When trading, collectors always have the options to change their minds and hold the watch or to sell for cash. Renters do not.

Purchasing power concerns a trading owner’s ability to obtain more for his watch than when opting to sell. Pre-owned specialists frequently offer more value for a trade than for outright purchase of the same watch. And the purchasing power of a trade is greater due to the ability of both parties to obtain desired pieces with fewer or no income and sales tax consequences.

Finally, flexibility in selection, repayment, and holding timeframe – there’s no mandatory “return” date – affords traders far more opportunity to evaluate a watch than a rental service can economically permit. Rented watches are the proverbial carriage that turns into a pumpkin. Traders must make a larger upfront commitment to purchase a first watch, but once purchased, a watch can be converted into cash or another watch of equal value.

An overview of the modern luxury watch trade landscape reveals two main options for traders. The first is a pre-owned luxury watch specialist. This type of dealer focuses on watches that are in circulation after having been sold by an authorized (primary) dealer. Private owners represent the second option for trade-seekers. These are end-users, not dealers. Online pre-owned specialists and personal transactions between collectors offer different advantages and drawbacks. By considering each option, an owner can find the best partner for his trade.

Pre-Owned Dealers: Trading With a Commercial Partner

Online pre-owned watch specialists are the most available, the highest-volume, and the most straightforward trade partners for individuals seeking a swap. Many pre-owned dealers now rely upon trades for over one-third of their inventory turnover, so their business incentive to accept attractive trade offers is significant. Due to their commercial nature and large stockpiles of available watches, dealers always offer greater flexibility in payment and trade selection than private trading partners will offer.

In terms of value, traders can benefit from a dealer’s desire to deal from inventory. Trade-in value offered to an owner is likely to exceed the value of the same dealer’s outright purchase offer for an owner’s timepiece. Pulling from a dealer’s existing inventory can be the key to securing more purchasing power and receiving the greatest possible value in return. Given the chance to turn his watch into purchasing power, an owner looking to swap can receive the best return for his trade if he opts to pull from a commercial partner’s standing supply rather than request a “watch hunt.”

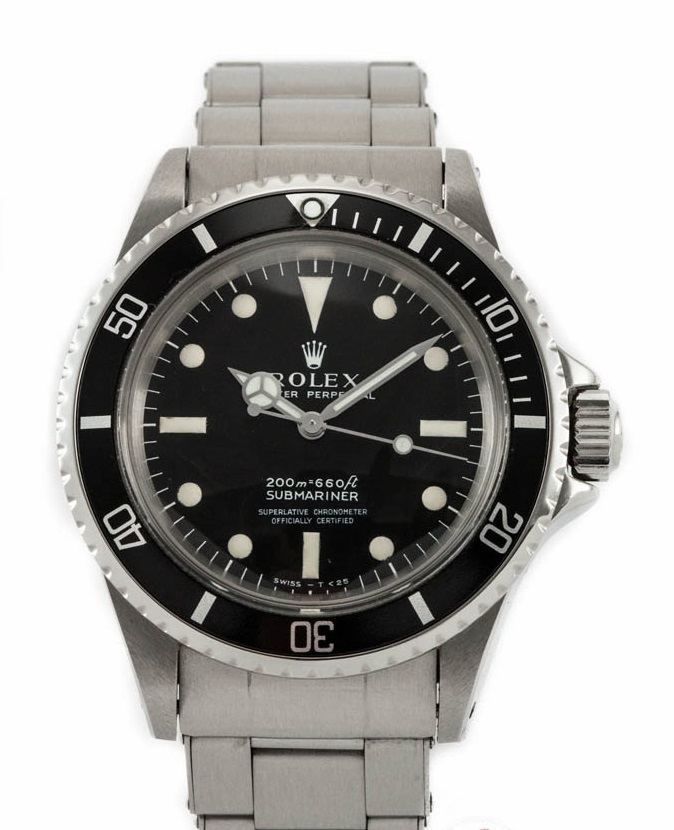

Pre-owned specialist dealers acquire the majority of their watches from secondary channels at wholesale cost. Having taken the first depreciation hit when it left the authorized dealer (generally, 25-50 percent), a luxury watch takes another hit when its owner sells it to a pre-owned dealer. Because dealers will offer the owner wholesale value (generally, another 25-30 percent off), the dealer’s actual cost for a watch may lie considerably below original MSRP. If a dealer purchases a year-old $8,450 Rolex GMT-Master II from its first owner for $4,250 in cash, that dealer may be willing to offer a more attractive trade proposal than the original private buyer who paid retail for the watch.

Flexibility to trade up or down is an advantage of working with a pre-owned specialist. It is far easier for a dealer – which buys inventory at wholesale – to offer an attractive trade package than it is for an individual trading partner who may have paid list price. Given the fact that dealers have little emotional attachment to inventory, they can offer trading partners a more predictable market-based platform than collectors. Private trade partners often lack a broad perspective on depreciation and true market value due to sentimental factors and limited experience.

A specialist dealer with a large inventory and commercial finances can simplify asymmetrical trades such as those involving a cash component, an uneven three-for-one trade, or visa-versa. This type of trade can complicate private deals between collectors, and the challenge grows when supplemental cash is required to ensure an even trade.

Know Your Partner: The Background Check

Anxiety about trading with a remote commercial partner can be overcome by doing simple homework.

Preserving value and vetting a trade partner are one and the same when approaching a pre-owned specialist. As the online watch vendor community moves out of its adolescent period of the 2000s into the realm of BBB accreditation, Trustpilot ratings, and eBay feedback in the five-digit range, dealing with leading online specialists has assumed routine status for many traders. Vendors who will offer owners the most straightforward and equitable trades at fair value are the ones who already have a long track record of doing so.

Above all, trade-seekers should demand full names of references who agree to be contacted. For watch owners pursuing a trade, the references are the most important part of the research process. Recent, numerous, accessible, and satisfied trading partners are the best safeguard for an informed trade-seeker. Don’t just request a dealer’s references – contact them.

Owners shopping for a commercial trade partner should seek signs of high vendor volume, extensive history, many available and identified references, and outstanding online feedback. As recently as 2005, this type of “buying the seller/trader” wasn’t possible, but in a mature dotcom market, bad faith is difficult to bury. Examine a dealer’s eBay feedback including the content of the individual compliments and complaints. Google the dealer’s name and look for long-running threads of repetitive horror stories. Ensure that a dealer-of-interest actually maintains a corporate website beyond the eBay storefront. And never deal with a vendor who won’t put a human being on the telephone to discuss a trade.

Make it Personal: Trading With a Private Owner

Private collectors are the alternative to pre-owned dealers. Trading watches like baseball cards is a whimsical notion, but that’s the essence of this option. Sources of partners include local watch club members, online classified listings, and web forums that can serve as a starting point for a trade. Advantages of this approach revolve around the social value of finding collectors with similar interests as well as the potential to come out “ahead” in a trade. Risks involve the challenge of verifying identities, avoiding fraud, and the obstacle of proving one’s own credentials to a skeptical partner.

It’s easy to understand the appeal of the engaging conversations and relationships that can result from mutually beneficial private trades. The idea of “swapping horses” with owners of similar interests is warmer and more personal than the commercial trade market, so private trades are appealing on an emotional level. When a trade is agreed between close friends, watch club members, and individuals in close geographic proximity, trading between private owners can be rewarding and socially engaging.

In terms of value and purchasing power, trades between individual owners offer more potential for one to “come out ahead” – without bad blood. Dealers don’t become emotionally captivated by watches, but collectors can be. A private trade partner seeking an elusive piece to complete a themed collection may be willing to take a value hit if that sacrifice secures a coveted target model. If owner “A” can offer a rare or sentimentally appealing model that partner “B” favors over his current, albeit more valuable piece, “A” can walk away with more monetary value in hand than B received. Find the ideal match, and collector trades can be mutually gratifying.

However, flexibility is not a hallmark of the collector trade scene. Trades between individuals are more dependent upon finding perfect one-for-one matches than when individuals trade with dealers. Between end-users who plan to keep watches after the trade, the purchasing power of either owner’s proposed trade watch can be reduced to a go/no-go in which the match must be exact. Often, multi-watch trades and partial cash trades are out of the question, too risky, or too contentious to negotiate.

Trading with an end-user means that flexibility in selection will be limited by the willingness to trade, collection scope of each party, and access to ready partners. Whereas the largest pre-owned dealers will see 50-70 new inventory items per week (with access to more), collectors tend to rotate slowly.

Additional considerations involve agreed value, payment and shipping. While professional dealers will be familiar with routine business challenges such as transferring money, insuring shipments, dealing with international customs, function-checking a watch, and appraising the value of a trade, individual partners may have no experience in these critical tasks. Forwarding a luxury watch to a personally unknown overseas partner may be the ultimate leap of faith, and the private collector trade scene is the arena where this choice carries the greatest risk.

Know Your Partner: Safety First

Special precautions should be taken by those determined to pursue a private trade. In general, trades with another owner should be undertaken between existing acquaintances and in person. Watch collector clubs, close friends, and regular associates are good candidate trading partners. But even trusted trading partners should be engaged to trade in public locations and, if possible, in the company of friends who know watches and can vouch for the original terms of trade should the need arise.

Selecting a public setting to conduct a trade is a simple but smart security precaution, especially when the exchange involves carrying high-value goods to and from the meeting. Bring a friend or two for good measure. Popular restaurants, social clubs, and specialized watch enthusiast meet-ups such as Red Bar are good venues. The more watch-literate witnesses on hand, the better. If one’s proposed trading partner is a sincere enthusiast acting in good faith, he should be reassured by these measures. Any reluctance to deal in person, in the company of witnesses, or in an active public location should be viewed as a serious red flag and cause to reconsider.

One’s bank can serve as an excellent setting for a private trade. In addition to the public factor, the presence of cameras, and a high physical security presence, a bank can offer immediate access to a safe deposit box where the received watch can be left secure. With his new watch in a safe, an owner can depart without carrying valuables. Although these security measures may seem excessive when the deal involves two close friends, family, or club members, there is another advantage that a bank provides: access to a notary public. When a private trade involves a cash component, a notarized promissory note is a smart precaution. While it may require a lawsuit for legal enforcement, the mere idea of a binding document witnessed by a third party should be enough to dissuade a partner from reneging on a partial cash deal. If this isn’t reasonably certain – as in trades involving a visiting foreign resident – walk away.

The Jigsaw Puzzle: Other Private Trade Considerations

When pursued beyond mutually familiar individuals or over distance, trades can become very complex. In this case, common on Internet sales forums, personal character references often are necessary. More than a matter of forwarding a boss’ endorsement or a friend’s phone number, “references” in this context mean other collectors of standing in a given forum or brand community. For casual enthusiasts looking to trade a watch or first-time traders seeking a swap, the requirement to be “someone” in the eyes of an online clique can be an impassible roadblock and huge turn-off to the collecting scene.

Authentication is the final major consideration when pursuing a private trade. Between anyone but experts, fair private trades involving watches depend on the good faith of the individuals and their willingness to “show all cards” concerning originality and origin. In contrast, major pre-owned dealers with BBB standing and professional reputations are unlikely to misrepresent a watch intentionally. Also, a dealer’s experience and resources are more likely than private owner’s eyes to weed out questionable watches before they reach the trade market. When individuals trade, the entire responsibility and liability lies with the participants. Errors – even honest ones – concerning watch value and originality are more likely to occur.

Be Prepared: Know Your Watch

Having examined the two main channels for trading a watch, it is important to consider final measures trade-seekers can take to arm themselves with knowledge, preserve value, maximize their purchasing power, and ensure that watch trading is a positive experience.

Beyond vetting a trade partner, an owner seeking a trade must become an expert in two watches: his own, and the one he desires. Part of preserving value is understanding it in the first place. Whether dealing with a pre-owned specialist or an individual owner, the most valuable trading chips are watches in superb cosmetic condition, functionally excellent, and complete with all factory accessories. Trade-seekers should know where they stand in each respect.

Online resources are the best destinations when researching a watch. Many dedicated collectors are available with specialized knowledge, and virtual encyclopedias have been written on the most popular models from top brands. The online marketplaces such as eBay, JamesEdition, and the watch-specific sales site Chrono24 permit trade-seekers to view many examples of a single watch reference.

By cross-checking the listings to compare accessories depicted, asking prices, and conditions of many units of the same watch, it is possible to gain a more complete understanding of one’s own watch and one’s trade target. This sets an owner on the path to a successful trade by engendering confidence and helping to envision a realistic return on the value of a trade. Comparing conditions, equipment, and prices assists in one of the most challenging tasks for a watch trader: managing expectations.

Virtually all new watches take a depreciation hit after purchase, but many owners fail to realize this until a trade negotiation is in progress. That’s too late. It is important to meet a trade partner half-way with an honest assessment of one’s own watch and a realistic expectation of trade value. Always be certain to know your watch before you trade.

Watch Trading: The Bottom Line

The growth of trading continues to surge in a luxury watch sector that moves closer to the consumer mainstream each year. More watches in the hands of more collectors, the emergence of professional pre-owned specialists, and expanding online information resources are driving the trading trend. While outright sales and rentals will continue to ride the same rising tide, the value, purchasing power, and flexibility advantages of trading represent a unique “third way” for collectors with eclectic tastes. By choosing the right partner, taking simple precautions, and knowing his timepiece, an owner can open the door to this exciting branch of the modern watch hobby.

Tim Mosso is the Horology Officer and Product Specialist at watchuwant.com of Fort Lauderdale, Florida.