Looking at the company’s past trends, Swatch’s cash conversion cycle is at a 10-year high. This has almost doubled since 2013 indicating a very large growth in inventories, a major driver of the cash conversion cycle. As of the 2015 annual report, most of the inventory growth was the result of increases in finished watches and spare parts for service.

The watch industry is unique; however, decreasing the Swatch cash conversion cycle back to previous ranges (and closer to standards of other industry comparables such as Tiffany, Richemont, or LVMH) would improve profitability. Reducing the cycle requires improving inventory turnover and potentially improving some of the other metrics that are signaling a tightening financial belt. Swatch’s biggest lever to pull to improve the cash conversion cycle is decreasing inventories.

Inventory practices need to change

Complex outside economic factors are the cause of decreased sales — that cannot be discounted. The slumping sales figures are the effect, and inventory & cost management can either dampen or amplify the outcome. Growing inventories and high fixed costs act as an amplifier.

The long cash conversion cycle is the result of large inventories. Some of the luxury watch companies carry very large inventories compared to other industries. This creates a problem during times of declining sales. I will walk you through the problem this creates:

1) Long Forecasting models. One top industry executive I spoke with told me that his and many companies forecast their production schedule 2-3 years out. This is a very traditional model of production scheduling but results in factories either over- or under-producing, leading to large inventory holdings or shortages. Watch companies build large inventories as insurance against shortages. However, large inventories also cost a lot of money to build and maintain.

Some of the luxury watch companies have had massive declines in net income during 2016 due to “excess capacity” in their factories (i.e. too much equipment, too many employees, too little demand for watches). 63% of Swiss watch executives surveyed by Deloitte in 2016 think that production capacities are “far too high” (up from 21% in 2015). In a Financial Times article from November 2016, the CEO of Richemont group said: “We’re just going to have to slim down, and not just in production but throughout the whole Group. I don’t have to tell any of my colleagues about the urgency.”

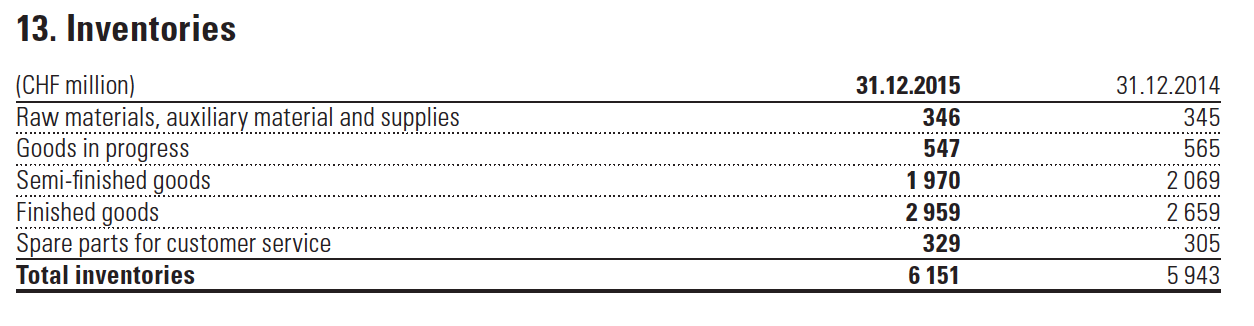

2) Which leads to growing inventories in times of slumping sales… Based on the last annual report, Swatch Group has relatively high levels of inventory. Analyst estimates range from 300 days to the (about) 1,200 days of inventory reported on Morningstar, depending on cost-basis method used. Regardless of the method, inventories are significantly higher than competitors and are trending towards 50% of the company’s assets, up from 40% six years ago. Days of Inventory Outstanding is a metric related to the Cash Conversion Cycle that is used to measure the efficiency of a business.

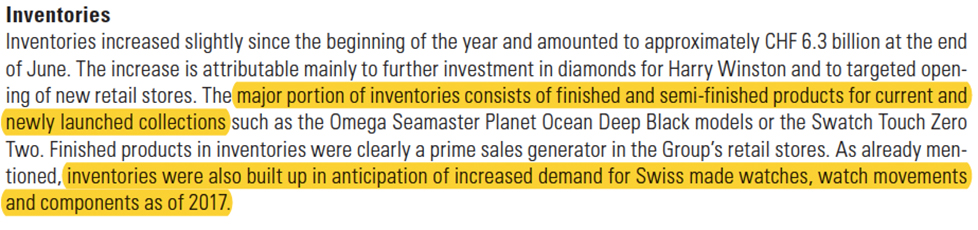

In the case of Swatch’s large inventories, their June 2016 letter to shareholders says they are growing inventories (note: to their highest levels in 10 years) due to their belief in growing demand in 2017. As of the 2015 annual report, 89% of inventory consists of Goods in Progress, Semi-Finished Goods, and Finished Goods; only 5.6% is due to raw materials.

I reached out to Swatch Investor Relations for further insight on their forecast of increased demand in 2017 given the current declining sales environment. They responded by saying:

Inventories growth was in line with acquisitions and the retail expansion. With the very low verticalization inventory is key in the production process, i.e. no parts in the pipeline, nothing can be produced, therefore inventory is also kept for safety reasons. A lack of parts (bottleneck with certain parts) would be a disaster => still fixed costs no turnover. The stock is seen as an “investment,” firstly, because it is profitable…creating a positive margin with the sale of the products and because the own stock is more secure than money in some banks (especially as CHF cash is a burden with negative interest rates).

In other words, Swatch views the large inventory as an investment to aid in growth and a protection against negative interest rates given their recent acquisitions and plans for growth. Given current market conditions, it is not clear where the increased demand in 2017 is forecasted. Regardless, inventory is growing at a rate that outpaces current sales growth, weighing down the asset side of the balance sheet. This is the source of the long cash conversion cycle.

For Swatch’s competitor Richemont Group (which includes Cartier and Montblanc), inventories were large enough that the Group spent €249M in 2016 buying back excess inventory from retailers (and in some cases destroying it). Swatch and Richemont are responding to inventory management in very different ways.

3) Slowing sales & growing inventories lead to decreased financial returns. Complex economic factors are the cause of decreased sales — that cannot be discounted. The slumping sales figures are the effect, and inventory & cost management can either dampen or amplify the outcome. Growing inventories and high fixed costs act as an amplifier.

As a result of sluggish sales figures and growing inventories, profit margins are shrinking. Swatch’s net income is down 52% from 2015, and its annualized Return on Equity (another measure of business efficiency that measures how effective a company is at generating returns for shareholders) is down from 10% in 2015 to 4.8% as of the June 2016 letter to shareholders (reporting for comparable periods). Richemont reported a 43% decrease in operating profits in the six-month period ending in September 2016. Earnings per share are down 50% from a year ago for both companies. While sales are down only about 11%, profits and returns take much harder hits due to high fixed costs.

Without changing the current production forecasting systems, reducing inventory holding periods, quickening cash conversion cycles, and reacting quickly to changing demand signals, the luxury watch industry will continue to face increasing financial pressure. This further builds the case that at least some companies, if not all of the industry could benefit from new production forecasting systems, allowing them to maintain less inventory and employ capital through quicker inventory turnover. Continuing large inventory holdings will weigh down the industry and potentially result in large future losses due to inventory write-downs or buy-backs.

Swiss Made: Continue to fortify what it means

The industry should continue to fortify what it means to be “Swiss Made,” continuing to push for more stringent requirements of manufacturers. The Swiss are increasing this requirement in 2017 by 10%, but there is still more to be done to fortify the brand equity.

To call something “Made in America,” the rules require that “all or virtually all” components be made in America and “all significant parts and processing that go into the product must be of U.S. origin.” In Switzerland, this standard is currently 50%, increasing to 60% in 2017. Surprisingly, the global watch industry has a historic tradition of manufacturing pieces and parts in other countries with cheaper manufacturing costs. Most notably, when English watches were in vogue in the 1700’s, they frequently had the Swiss produce substitutes and stamped them with “Made in London”.

Many of the mid-tier and above Swiss companies already exceed the 50% standard. For example affordable luxury category Raymond Weil, which manufactures watches $1,000-$3,000 USD, exceeds the 60% standard. But few price points make 100% of their components in Switzerland (in fairness, few or no American companies indisputably make 100% of their parts in America either). Luxury watch companies have been trying to improve this by making more of their parts and movements in Switzerland and moving towards “in-house” movements made by the individual companies (known as vertical integration). However, many of the affordable category luxury watches you buy have at least some components made elsewhere. For many affordable or lower category Swiss Made watches, you are paying for 40-50% of parts made outside of Switzerland and the rest of the parts made by a machine in Switzerland, and finally, assembled by a technician in Switzerland.

The new law has been lauded by most industry executives and collectors alike. The Swiss improvements to the “made in” standard will continue to improve quality and fortify the luxury-end of the industry. Yet today, even educated watch enthusiasts don’t know whether most brands are a 100% standard. Companies that are manufacturing their watches 100% in Switzerland should publicly advertise this to consumers and make their own 100% label known (it is the standard in many countries for most products). In a 2016 article on the Swiss standard, Jack Forster wrote “Even in Switzerland, there are those who say the Swiss Made label has been so badly abused that it’s meaningless to consumers.” Ariel Adams has suggested the meaning has eroded to minimal importance to mainstream consumers. I have spoken to Swiss watch company executives who certify their watches are 100% made in Switzerland. If a company is going to the effort and cost to meet a 100% standard, this should become a point of differentiation they benefit from regardless of which price category they are in. The consumer is already willing to pay more for Swiss Made, driving companies to produce 100% in Switzerland, yet consumers don’t know who is and who isn’t. This needs to be advertised and hallmarked. Jack Wagner wrote an argument suggesting similar is needed — I agree.

Consumers’ demands to know sourcing has worked in several other industries and led to positive changes in manufacturing or production (though it has been misused too). Most consumers aren’t willing to pay a premium for knowing the source, but the niche few who buy expensive luxury watches are looking for transparency. “100% Swiss Manufactured and Made” is an unambiguous statement and leaves little room for what is actually implied.

Changes should be made to online marketing

The luxury industry has only recently embraced online presence through e-commerce and social media forums such as Instagram, Facebook, Twitter, etc. There were some early ventures into social media presence including Raymond Weil’s 2007 participation in Second Life, an alter-reality video game popular between 2007-2010. However, most companies looked on from the sidelines. In 2016, most of the luxury watch companies now have a presence online, but many still have a long way to go. Business intelligence firm L2 Inc’s 2016 report on e-commerce states that “gray marketers like Jomashop have built successful online businesses with aggressive digital marketing tactics selling brands’ products online—in order to take back e-commerce share, brands must scale digital investments in personalization, targeting, and search optimization in order to compete.”

L2 Inc analyzes online presence and currently ranks Tiffany & Co. and Cartier as having the strongest ‘Digital IQ’. Rolex, IWC, and Jaeger LeCoultre perform well. Meanwhile, many of the brands that watch collectors love (Patek Philippe, A. Lange & Sohne, Vacheron Constantin, Audemars Piguet, Breguet) are much lower on the list, categorized as either “challenged” or “feeble.” Digital IQ comprises much more than social media presence. It also includes their website features & usability, e-commerce (which many companies still refuse to do), online customer service, and other e-metrics. Industry executives report that “social media is the most important element of their marketing strategy, followed by internet blogs.” Overall, this points to an industry ‘catching up’ on social media in order to stay relevant with younger customers and increase awareness among a generation that increasingly learns from social media and wants to do as much as possible through the internet.

L2 Inc’s 2015 Watch and Jewelry Digital IQ tool showing the Watch Industry digital averages (— line) and Rolex (green line) shown for comparison (source: https://www.l2inc.com/research/watches-jewelry-2015)

Many people will firmly disagree with my perspective on using more social media. The opinion over whether ultra-luxury brands need strong online presence is mixed; some view that it would ultimately harm the brand image. Others argue that lack of online presence will make the brands unknown and therefore not aspirational as 20 and 30 somethings grow older. For the first time ever, Swiss watch executives said they no longer consider social media as the biggest reputational risk. Every industry CEO and executive I have spoken to acknowledge this as a challenge. Because the industry has refused to publish prices online or sell online (until recently and only for a few companies), it has given rise to gray market sales such as Jomashop, which watch industry executives now view as the top threat to brand reputation and the industry (according to the 2016 Deloitte Industry report).

Social media is not going away and sales continue to move closer to the internet (whether the industry or enthusiasts like it or not). Overall, how well the industry embraces the internet in the future will determine the survival of many brands.

First, Companies must be willing to publish prices, figure out how to use direct online sales, and engage with millennials to ensure watches remain aspirational products. Financial services firms and consultancies also agree with varying degrees on the online pricing and sales strategy. Deloitte concludes: “companies should continue to focus on social media and bloggers to attract Generation Y and therefore potential future customers. However, it is also essential to have a marketing strategy that consists of different elements including print media as well as radio and television channels to broaden the audience of target customers.”

Second, there is evidence to suggest that brand ambassadors actually have little effect. As such, Baume & Mercier has abandoned paid brand ambassadors entirely (this does not include unpaid ‘friends of the brand’). An L2 Inc study on celebrities endorsing products on Instagram found that only the top 10-20 endorsing celebrities actually had a meaningful effect on Instagram engagement for a brand (Justin Beiber being the top influencer). After the top 10-20, the rest had very little influence. This data was presented recently at L2 Inc’s Fall 2016 Consumer Behavior conference.