One of the biggest complaints among watch enthusiasts is that luxury watch prices are too high. This can be observed in the numerous forums and comment threads devoted to the greed of luxury watch companies for increasing prices. The truth is that watch prices and their increase depends on which side of the US Dollar you sit on and which economy you live in. Recently, on my own Watch Ponder blog (where I cover the business and history side of the industry), I wanted to find out how Swatch could only be reporting a 9% profit margin while also being accused of greed? I wanted to know why Rolex had increased the prices of their watches so much over the years. I wanted to answer the simple question: What could my grandpa have paid for a Rolex in the US decades ago?

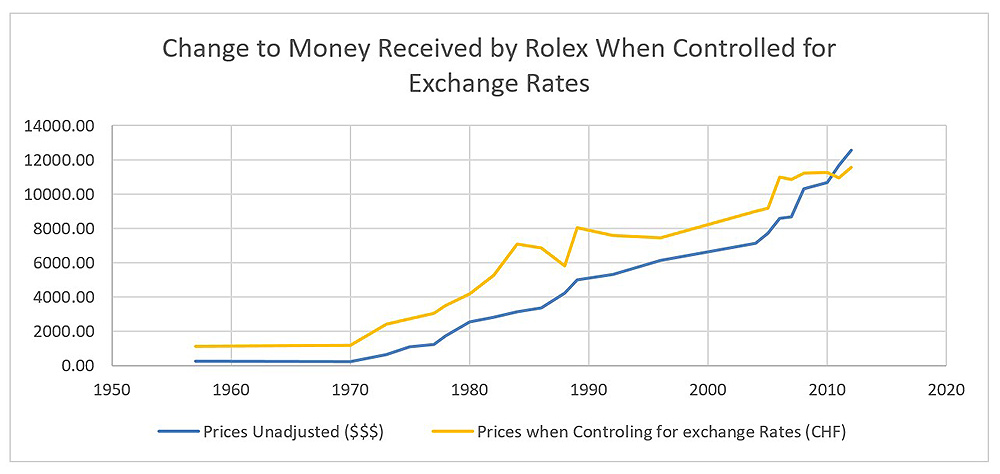

I turned to some of the basic realities of the global economy and used changes to consumer price inflation and exchange rates to discover that watch prices haven’t changed as much as people seem to think. I found that in the United States prices have increased only by about 6x since 1957, and from the perspective of the Swiss manufacturers, their income from watches has been virtually stable with no significant increase despite the price increases in the U.S.

Over a three-article series, I will present an argument explaining that watch prices are high but aren’t as out of control as they may seem, and why we aren’t likely to see massive price decreases (>10%) anytime soon. The three articles will cover these topics:

- Are Swiss Watch Prices Too High? I will use historical pricing data, consumer price indices, and exchange rates to demonstrate what my grandfather would have paid if he bought a watch with today’s money.

- Why Luxury Swiss Watch Prices Grew Faster Than Inflation. I will use anecdotal examples to walk through the basic economic fundamentals that led to price increases.

- Why Luxury Swiss Watch Prices Are Not Likely To Fall. I will finish the series by using company profit margins and financial situations to explain why a >10% (or any) decrease is unlikely in the near term and discuss what it could mean for future demand.

This article will only focus on the sales between the U.S. and Switzerland. What this article will not address is why price increases go up across the world once adjusting for exchange rates. Shouldn’t each country’s prices be unique depending on the exchange rates for its currency? The interplay of global currencies makes the exchange rate and purchasing power of major currencies important. If prices depended only on individual countries and purchasing power, the prices would vary by thousands of dollars. The recent Brexit devaluing of the British Pound and subsequent skyrocket in watch sales in the UK give us a very clear example of how much a large fluctuation in an exchange rate can increase the purchasing power of a visiting tourist and drastically increase watch sales.

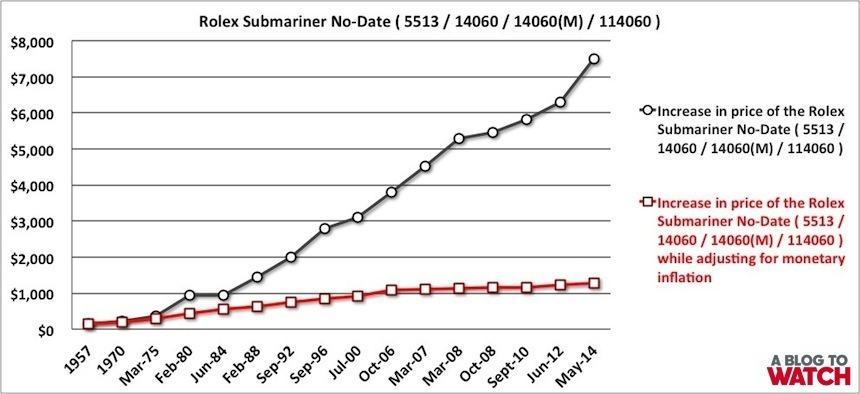

David Bredan wrote a very good article on aBlogtoWatch on this topic a few years ago, including this widely quoted chart above showing the inflation of pricing for a (No-Date) Rolex Submariner. David’s article shows how much the price of a Submariner has increased (and it seriously has gone up from $180 to over $8000). Could my grandpa really have gotten such a good deal while his grandchildren are gouged so badly? Note: I will use retail prices of Rolex throughout this article as a proxy for wholesale prices which are less public. I will address the gray market phenomenon and prices in subsequent articles.

Initial Conclusion: Prices Are High, But Not As Bad As They Look

Prices for a watch are very high, there is no doubt about it. The question is how much have they increased over the years? Looking at the chart above, it looks like a 47.5x price increase. I wanted to look into this further. I used the same data set David used but a different methodology or lens. Both are valid ways to look at it. For my approach, I really want to find out how much a person in 1957, or 1973, or 1984 would have paid for their Rolex Submariner when considering the change in consumer prices and purchasing power through the years (a.k.a. inflation of the consumer price index or CPI adjustment).

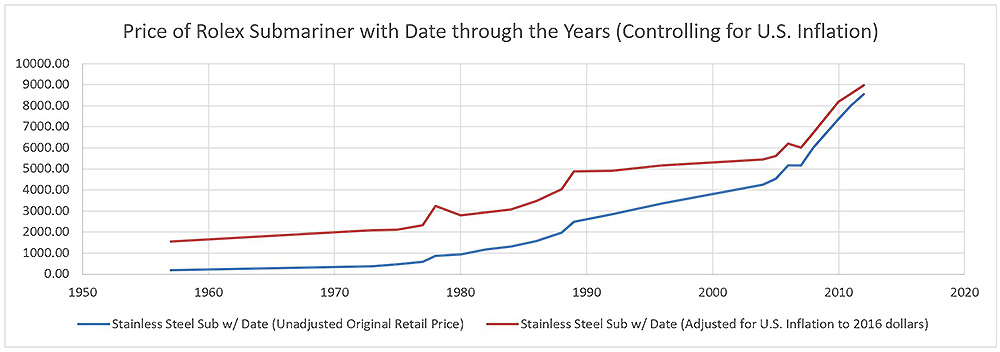

I take the prices of Rolex Subs through the years and adjust those prices to the purchasing power of 2016 dollars so that they are prices we can all relate to. What this does is to take the purchasing power of $180 in 1957 and adjusts that to the equivalent amount of money we’d have to spend in 2016 to buy the same things. When only adjusting for the changes to the US consumer price index throughout the years, I found that my grandpa would have paid about $1,550 for a Rolex Submariner with the date. That means the price of the Sub has only gone up by about 5.5x. I made these purchasing power adjustments every year there is data and adjusted them to the purchasing power of 2016 dollars. Here is what that adjustment looks like. So far, my grandpa still got a better deal.

More To The Story Than The Submariner

I wanted to look beyond just the Submariner, so I took the average prices of 11 Rolex models through the years and included both stainless models and precious metals. Buying a Rolex or any Swiss watch is an international transaction, so the exchange rate matters because it determines how many Swiss francs (CHF) Rolex actually gets from a sale.

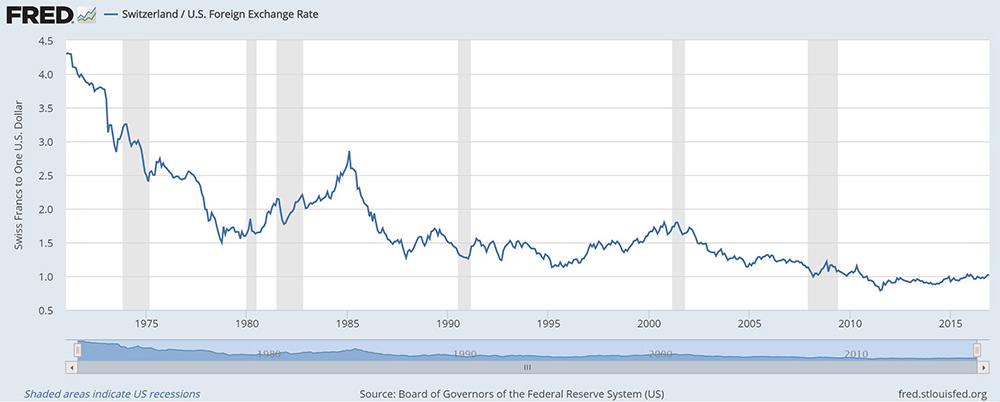

As you can see, the Swiss Franc / US Dollar exchange rate has been very volatile over time (US Federal Reserve)

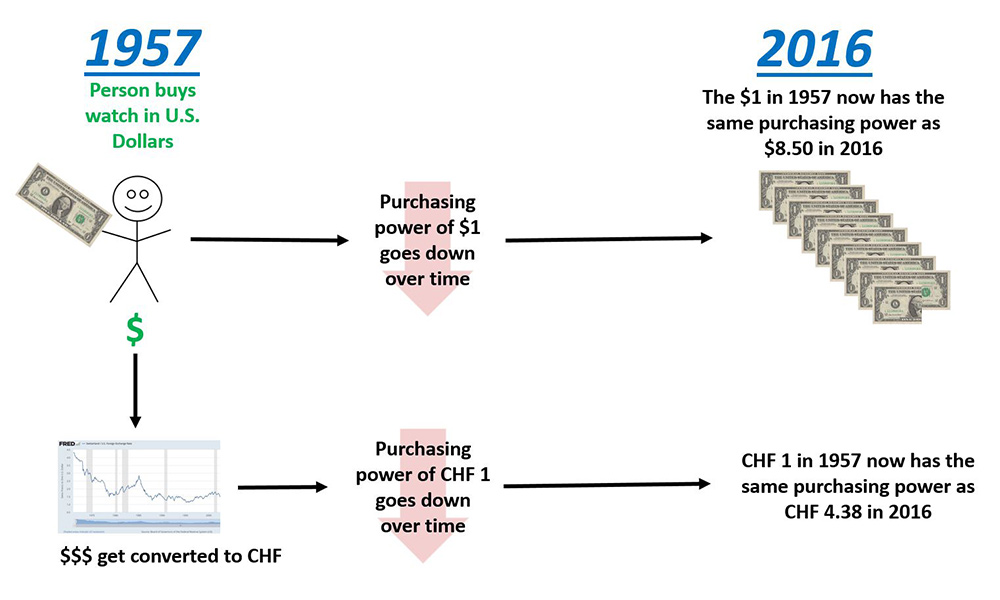

The second thing that matters is change to the purchasing power of money in Switzerland since it determines how much Rolex has to pay its workers. When factoring these in, it gives us a very different perspective. Since we are dealing with U.S. prices, I am only looking at sales inside the U.S. I acknowledge prices have gone up in other countries too, but I have only looked at U.S. data and the effect it would have on the actual perceived prices consumers pay in the U.S. and the money Rolex would effectively earn from the sale once converted back to Swiss francs. Consider the flow of money when you buy a watch which I have drawn out below:

The first step: When the watch is sold, those dollars are then converted to Swiss francs at the exchange rate of the time. This is the amount of money Rolex actually received through the years for an average Rolex. As you can see below, the price increases (yellow line) start to become somewhat less steep when you factor in exchange rates.

The next thing to consider: Adjustments to purchasing power (i.e., how much would grandpa have to pay if he purchased that watch today as opposed to decades ago given changes to the value of money?). This is similar to the initial comparison I made for the Submariner in the opening paragraphs.

Because Rolex (the company setting the price) is located in Switzerland and producing watches there, we have to look at the changes to the value and purchasing power of the Swiss Franc as well. Rolex adjusts prices up to continue to cover their costs, employees’ wages, and also to continue making a profit.