How Did The Problem Begin & How Did We Get Here?

With the watch industry suffering from a series of systemic issues ranging from mismanagement to overproduction – how on earth did we get into a situation where the street price on watches is actually going up? Imagine how irritated the brands themselves are because people are paying more for their watches and they can’t see a piece of that action! How exactly did we get to a point where supply doesn’t seem to meet demand, and the supply available for watches seems to be increasingly in the hands of private dealers?

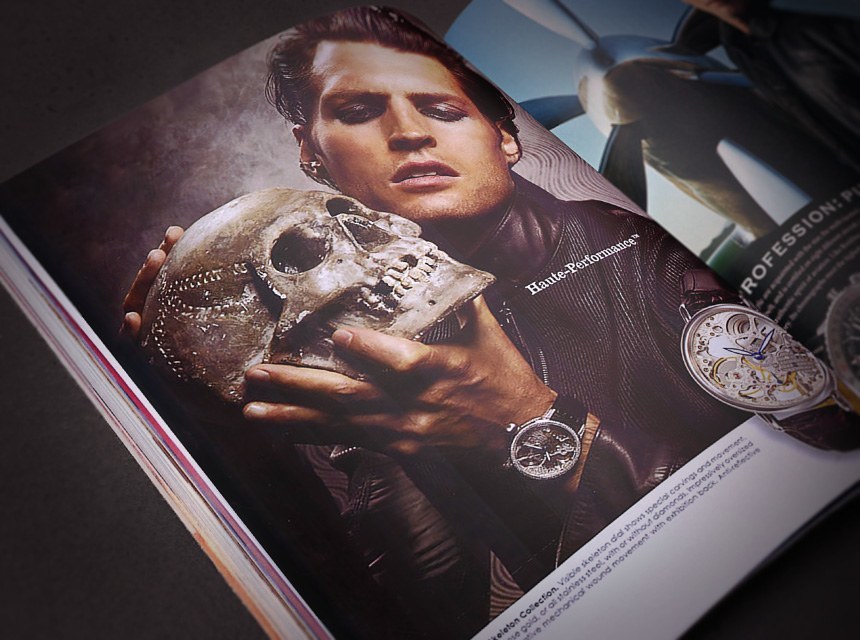

A quick note on terminology. I use the term private dealer, scalper, third-party retailer, and gray market dealer to refer to, in some instances, the same entities. “Scalper” as I put it is the least flattering description of a watch retailer, and that certainly doesn’t describe everyone. Gray market dealers are merely those who sell outside of an authorized dealer relationship with a brand. A third-party retailer is anyone selling a watch who isn’t the brand themselves – authorized dealer or not. A private dealer is a store or an individual who acts in some way or another as a sales agent between the brand and an end-consumer.

Let’s focus our attention on the fallout of the 2008 financial crisis. One of the biggest consequences was the decrease in interest rates, as well as in the overall returns for a lot of equities and mutual funds. A major impact of the recent financial crisis was an overall massive reduction in the expected returns one might count on getting from a large number of traditional investment vehicles. For an entire industry reliant on increasing the wealth of its clients by investing their money, this was a really unfortunate situation.

What, then, do you invest in if you don’t put your money into stocks, bonds, saving certificates, mutual funds, etc…? There is real estate – but that is complicated and often requires a huge cost of entry, and let’s not forget how the real estate market was affected by the crisis. A rebound was imminent, but where, when, and to what extent was not. There are commodities and futures which few people understand. There are traditional investments such as precious metals and gemstones. And then there are alternative investments more closely associated with collecting that include art, wine, cars, antiques and, of course, watches. Investors seeking value for themselves or clients eventually stumbled upon watches as a potential investment vehicle while hungrily hunting for new ways to earn a return. This is where I stop myself from being a smart ass and suggest that they might actually do more than push around money for a living.

The focus on watches as investments was also promulgated by auction houses which went to great lengths to promote the value that items they were selling were going for. Auction houses are old enough to know that during any economic recession buyers increasingly focus on resale value. During better economic times buying at auction is more a pleasure for wealthy consumers. During poor economic times, speculators looking to later resell collectibles mingle in with actual collectors. What started as a focus on art, automobiles, and other known luxury collector’s items probably ended up with a focus on watches. Watches suddenly became the darling of auction houses because vintage ones were often unique, difficult to easily discredit, and already popular with wealthy male clients. Finally, something manly they could buy which wasn’t a car… Now a lot of them had high hopes of getting in on the high vintage watch price action.

Auction houses are – for lack of a better term – unregulated securities exchanges. They are inherently subject to credibility and incentives problems. Lawmakers apply few serious regulations on them (especially in advance of sales), maybe because they feel that most of the buyers are financially secure enough not to be ruined by one bad auction deal and perhaps also because the selling of used/pre-owned items is generally more difficult to regulate than the market for new products. Unlike the broad consumer protections set forth by the SEC (US Securities & Exchange Commission), auction houses aren’t nearly as closely scrutinized. Not all auction houses are crooks by any means, but you know what, a lot of them don’t operate with the ethical standards most consumers might hope for. In order to better understand the watch auction world, I recommend this article I wrote a few years ago on aBlogtoWatch.

Watch auction results in combination with the practices of private sellers of vintage and modern pre-owned watches began a pricing trend upwards. Not only did the overall sales proposition of a watch increasingly become “it will sell for a lot of money,” but more and more dealers kept buying up the available stock of pretty much everything. Without knowing what “random” vintage watch models might be the next item on the menu for a watch speculator feeding frenzy, other speculators simply purchased up as many watches as they could. Right now enormous inventories of unsold new and vintage watches are sitting in little plastic bags waiting for someone to begin a pricing bubble for those models. This is pure market speculation in practice, and the average watch consumer suffers greatly from it in my opinion.

As A Consumer, What Can You Do About It?

For most of the items we buy, the question of what can it be resold for is moot. There are some select purchases such as a house or a vehicle when resale values come into play because the lifespan of those products/items is quite long. In a sense, it is a testament to the longevity of watches that the best ones can enjoy a significant life after being in the hands (or on the wrist) of their first buyer. With that said, when did it become practical to hyper-focus on resale value so much that buyers of watches seem to converge on the exact same watches merely because of perceived high demand? It would appear to me that the practical sentiment of wanting to retain value in your investment is being co-opted by salespeople into convincing people to spend more than retail. That’s not right to me.

I first want to suggest that people stop thinking about watches as something you need to purchase for a price that you can sell for at the same price. It isn’t reasonable for the market and it also isn’t fun. Assuming you even get the watch you want, you’ll be stuck with the same timepiece a lot of other people have. And many of them probably aren’t interesting watch guys who share the type of passion you have. Isn’t it better to acknowledge that the value in a timepiece is how it makes you feel, and what it says about you as an individual? Do you want to communicate that you are interesting, worldly, and artistic with your watch? Or would you rather communicate that you have the same fun buying toys as a banker does, along with a similar sense of style and good humor? No offense to bankers – but as a group, you don’t exactly have a reputation for being particularly artistic or risky. My strong advice to consumers is to slowly start to divorce yourself from the notion that buying a good watch is also about retaining the value in it.

It is true that during poor economic times (yes, that’s for the vast majority of people today) investors seek the most conservative bets possible. That rings true also in a purchase for a timepiece – which is certainly a form of investment. It is sad however that this type of investor conservatism applies to something that (i.e. buying a timepiece to wear and enjoy) shouldn’t be about making the most conservative choice possible. Consider what should be valued in a watch as a personal style accessory versus a watch as an asset. You’ll lose money anyways investing in watches unless you are a master at market manipulation. Just buy sensibly and keep open-minded about what to possibly purchase. I promise that you’ll be a far happier watch owner and collector.

Finally, what to do about the problem of scalpers? The concert industry has had their own trials and tribulations dealing with ticket scalpers – which thematically is a similar situation as with watches. Only watches don’t expire like show tickets do… For me, the answer to how to deal with watch scalpers and speculators is really simple – vote with your wallet. If the profit they make from selling watches goes away, so do they. Collectors and watch consumers, in general, need to have some serious discipline here; just say no to paying above retail. That’s right, “just saying no to paying above retail” is my strongest suggestion. Starve the source and it will dry up. It isn’t as though there aren’t boatloads (probably literally) of incredible, beautiful watches you can purchase right now, brand new and not pay over retail. No doubt many of the watches going for above retail price are nice, but are they so different from the watches not being sold at retail? Not really. I guarantee that no matter who you are, or what your budget it, you can get something that will make you happy at retail price or lower. Finding that hot Rolex is too hot to buy? Sorry Rolex, but I’m going to recommend that people skip it. Unless you make sure they don’t need to jump through hoops, pay a lot of money, and are treated poorly as a result of trying to buy one of your new products, then I want to advise people to take their business elsewhere – or just buy an alternative piece from Rolex… Just an example: have you noticed how you can pick-up a steel-18ct yellow gold Rolesor Daytona (in a Rolex boutique) for the market price of a steel one?

My interest is in the health and longevity of watch consumers. Collectors help stimulate demand, push the industry in the right direction, and are the source of lots and lots of wonderful media. They aren’t, however, keeping major brands like Rolex and Omega going. Collectors are the icing on the cake. When the buying experience for a lay consumer becomes so riddled with headaches they are turned off from buying watches altogether – we have a problem. I see this problem as being so severe it is actually turning off an entire generation of watch buyers from buying watches. Those stubborn enough to stick with the industry are in many instances totally ignoring the major brands and being seduced by start-up brands who begin their life on Kickstarter. If you’ve ever wondered why so many of these little guys are doing so well, then just ask yourself what the experience was like the last few times you dealt with buying a watch from the big guys.

So, once again, watch collector community, if you agree that watch speculators and watch scalpers are a problem, then vote with your money and simply don’t feed the beast. Eventually, great companies like Rolex and others will overcome the issue and present a more fair and sustainable way to get their hot watches to you – without feeding, even if not in their will, a predatory and manipulative side of the retail market.