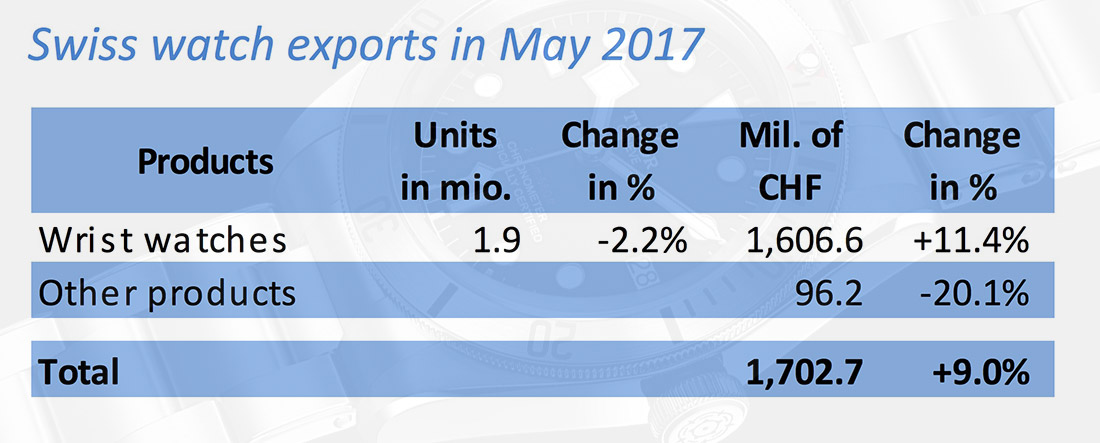

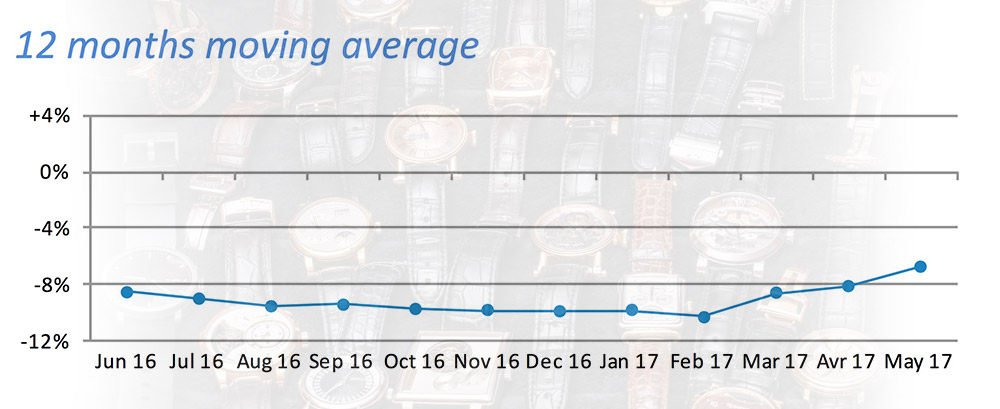

Finally, some positive numbers from the embattled watch industry. In a short release from the Federation of the Swiss Watch Industry (FH) titled “Strong Growth,” the non-profit trade association reported an overall 9% rise in exports in May 2017 over the same period in 2016. And it follows a couple months of consistently positive figures. A good part of the CHF 1.7 billion bump came from exports to China and Hong Kong, but there was also good news from the European market. According to the report, this confirms the “recovery which has been under way since the start of the year.”

Thank god. We can finally stop worrying and get back to just enjoying watches, right? After a long time of continually falling exports, the FH (not to be confused with the FHH, or Fondation de la Haute Horlogerie, which is a different organization) is very optimistic – or maybe 2016 had just marked a bottoming out.

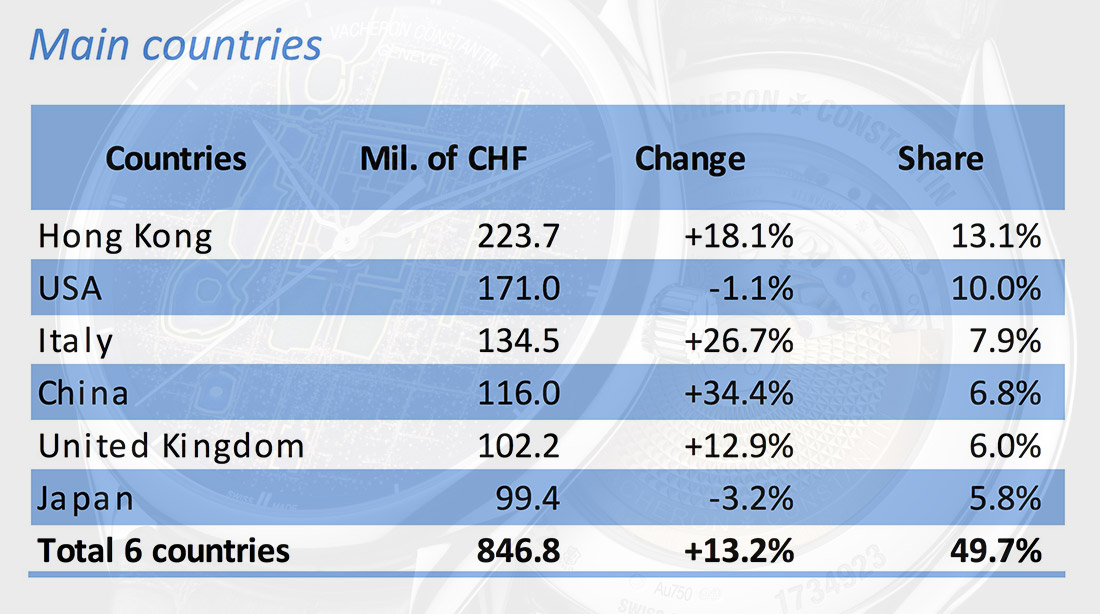

For May 2017, a couple of strong regions particularly helped lift the numbers. In Asia, mainland China-bound exports in May grew 34.4% while Hong Kong represented 18.1%. In Europe, exports to Italy rose 26.7%, while those to the United Kingdom were up 12.9%, France 9.5%, and Germany 3.7%. The United States and Japan, on the other hand, slipped to -1.1% and -3.2%, respectively.

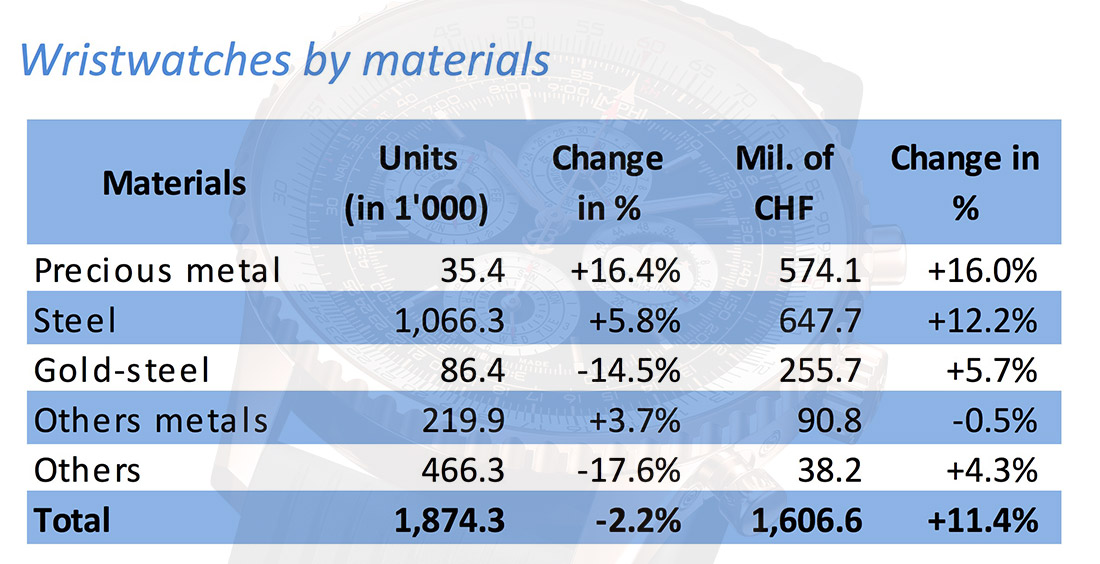

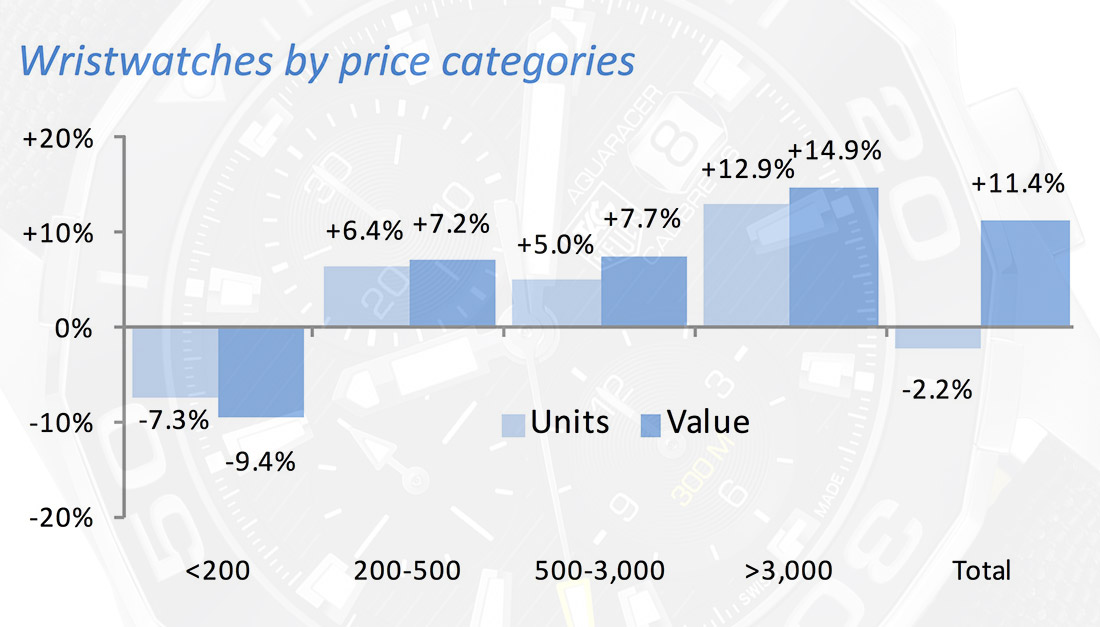

The types of watches exported, too, suggest retailers are confident that consumers are starting to feel like spending money. The value of precious metal watches exported showed an increase of 16%, which is interesting as many brands have recently been introducing more entry-level and steel models in reaction to the turbulent business climate. Steel watches were also up, though, 5.8% in terms of units and 12.2% in terms of value – which means more expensive steel watches. Watches priced over CHF 3,000 (export price) saw the greatest increase, while the only segment that had negative growth was watches under CHF 200.

We have reported ad nauseam on the challenges and woes of the watch industry, the causes for its troubles, and what needs to be done about it. The major groups that control many of the important luxury watch brands have reported drops in profit, and along with the bad news, there have been management shakeups and a general sense of scrambling across the industry. A combination of factors has worked against the watch industry, stemming largely from its own practices. A slowing of demand from China, overproduction, and a distribution system that seems to ignore the Internet and the end consumer have all contributed to the poor performance.

Only yesterday, we discussed Panerai’s PAM731 “E-Commerce Micro-Edition” watch as a sign that brands were starting to take action as we have been advocating for, such as selling directly to consumers online. As the FH notes on their website, their statistics “are based on export figures and not on sales to the end consumer.” The distribution model common in the Swiss watch industry focuses on selling wholesale to authorized dealers and distributors, with an inventory glut leading to deep discounting and a thriving gray market. This and other problems remain to be addressed despite good export numbers.

So, is it time for cautious optimism? At least a break from all the gloom and panic is welcome. As consumers and enthusiasts, of course, we are rooting for a healthy watch industry so that we can enjoy more great products with inherent value and fair prices. fhs.swiss