Lay watch consumers and collectors typically aren’t interested in the business or contemporary economics of the industry which produces watches and jewelry today. They prefer to be dazzled with inspired new products and be given compelling reasons to buy them – and who could blame them? Coverage of the watch industry’s products is not complete without understanding the people and businesses that create them. Among those entities is the Richemont Group which is a conglomerate that owns a number of watch and jewelry brands. Richemont has just recently released their 2018 annual shareholders report. In fact, Richemont has been sharing a lot of news lately as the group continues to renovate its internal structure while adding new corporate acquisitions. I follow the activities of Richemont as well as its competitors closely and, especially for the many investors that I help consult for, I’d like to take some time to talk about Richemont’s stated performance, important new corporate additions, as well as my analysis on their stated plans for upcoming projects and developments.

Richemont Group Overview and Watch Industry Performance Context

Richemont is mostly invested in high-end luxury brands whose businesses rely on steady relationships with high-income regular buyers of luxury goods. With that said, two of Richemont’s largest brands (Cartier & Montblanc) indeed serve the high-end luxury market but also have a range of more mainstream luxury products intended for mainstream consumption. I state this in order explain what part of the luxury goods market Richemont is most keenly interested in. Richemont also indicates that 40% of its sales come from Asia (mostly the Far East) with Europe being its second largest market accounting for 27% of sales. The United States interestingly only accounts for 16% of sales. To put that into context, the country of Japan alone accounts for 6% of Richemont sales.

It would be challenging to summarize the last several years of activity across the larger luxury watch industry to help put Richemont’s performance and struggles in context. Suffice it to say that systemic watch industry practices almost entirely across the board have negatively affected most luxury watch brands and groups over the last decade or two. Richemont has and continues to experiment to deploy its own strategies to reform business practices as well as modernize the time-honored tradition of producing, marketing, and selling luxury wearables for status-seeking men and women. Some of its latest strategies will be discussed below in light of some important new corporate acquisitions by Richemont designed to help it bolster its resources and intelligence related to digital marketing and e-commerce.

Richemont’s annual report to shareholders is often known for its lack of specificity in a range of key areas such as the specific performance of any of its individual brands. The report also makes a point to evade specific promises, strategies, or performance metrics for a wide range of activities that investors would likely be keen to have more information about. Gross operating numbers don’t offer much insight as to what business practices are really working and which need reformation at Richemont and, to be honest, these same issues exist in the shareholder reports of Richemont Group competitors The Swatch Group and LVMH.

What cannot be shrouded is the fact that the luxury watch industry isn’t growing. By that I mean the number of watches sold is not increasing in a manner which leads to growth, something shareholders generally demand. Then again, many watch industry insiders have scoffed at the notion of regular growth for an industry that they feel should be striving for stability versus year-on-year increases. The context of the last 20 years of the watch industry has been one of excess and a lot of irresponsibility, if one were to ask me. The most egregious problems relate to the intentional overproduction of inventory as well as mismanagement of digitally-connected global sales, product distribution, and marketing. I would also add that the larger watch industry has routinely failed to attract and retain talent in most all sectors of management and creative direction. The good news is that serious efforts (at Richemont and otherwise) seem to be currently underway to at least begin resolving many of these systemic watch industry issues.

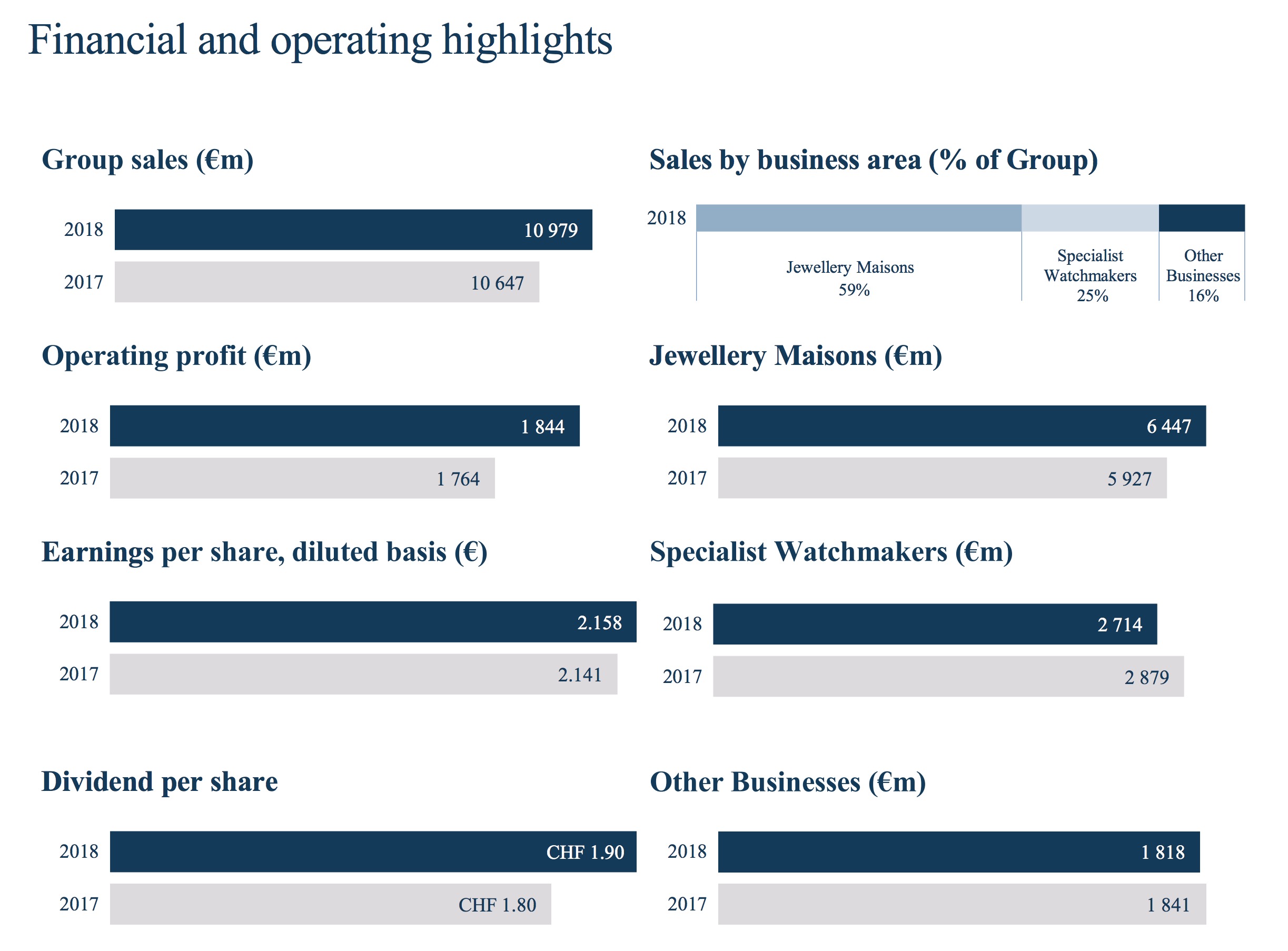

Going back to Richemont specifically, the annual report claims an overall increase in sales of 3% at actual currency exchange rates (and 8% at constant exchange rates). Growth seems to be entirely from Asia, which is Richemont’s strongest market still, with other markets decreasing or remaining flat in sales. Sales in Europe for example were the latter at best, which is likely frustrating to Richemont given that it has traditionally been so important for its brands that call Europe home. Europe will continue to be a pain point for most luxury brands for the foreseeable future. Asia will likely see the bulk of Richemont’s focus over the next few years and despite the group’s managers regularly acknowledging the importance of the United States market, I’ve not seen much evidence to suggest investment or focus on strategies to improve the group’s North American outlook in the near future.

Richemont claimed an impressive 10% increase in profits over the previous year [2016]. The details inherent in such a claim are muddier as increased profit isn’t always related to increased sales. Specifically, Richemont points to “tight” cost controlling which inevitably frees up more cash as profit. On a related note, watch groups often bulk unsold watch inventory as an asset, treating the goods like money. I offer a warning to those who might misinterpret this information since unsold inventory is not like currency – at least such has been the case in recent years. While luxury goods such as watches and jewelry have appreciably longer “expiration dates” than many other goods, it would be incorrect in my opinion to suggest that unsold watches can be valued at their purchase or wholesale price, for they cannot be returned to market easily. Nevertheless, I can certainly understand an accountant’s requirements to classify unsold inventory as an asset with a static value.

Richemont is typically good to their investors and once again will issue a stock dividend to shareholders between 1.80 and 1.90 Swiss Francs per share (depending on the class of shares held by investors). Now let’s look at what Richemont seems to have planned for the near future after taking a look at the Chairman’s message.

Johan Rupert’s Message To Investors & The “Transformation Agenda”

South African-native Richemont Group Chairman Johan Rupert opens the annual report with his customary letter that in my opinion typically contains the most important information in the document. It isn’t what Rupert claims but rather the topics he chooses to address which I find the most interesting. Typically bullish though always sober in his tone, the 2018 report sees a very candid Mr. Rupert when it comes to addressing key concerns that shareholders have brought to his and the board’s attention. The majority of the issues that Rupert addresses in his letter are also ones that I and the aBlogtoWatch team have been almost solely discussing and tracking in the larger context of watch industry media. I am certainly comforted to know that those areas of watch industry performance that we are most concerned with seem to be echoed in Mr. Rupert’s own agenda.

Decreasing sales (reported to have averaged to a 6% reduction) at the “Specialist Watchmakers” (basically any brand that primarily produces watches as opposed to Cartier and Montblanc that have much more diverse product portfolios) and sluggish consumer spending thanks to uncertain economic conditions are of understandably great concern to Richemont and Mr. Rupert. Sales at the jewelry “maisons” (houses) accounted for most of the profits including Cartier and to a degree Van Cleef & Arpels – one of the group’s well-performing shining lights when it comes to super niche, super high-end products mainly for women. These two helped keep profits steady disproportionately as it seems most of the group’s watch brands either did not grow or reported sales decreases.

Johan Rupert did not detail the full scope of the group’s so-called “transformation agenda,” but elements of this plan can be seen throughout the group’s activities. What is transforming at Richemont? Well, a lot actually. The last several months have seen a difficult time internally at Richemont from a human resources perspective as part of both planned team restructuring and the expected result of impatience from ambitious employees who saw greener pastures mostly outside of the watch industry. Effective leadership and labor standards have rapidly changed as understaffed teams at many watch industry companies have been unable to cope with the rapid pace of market changes and consumer expectations. Remedial measures to improve conditions have not turned out as well as some managers and executives have hoped. My understanding is that major hierarchical and leadership changes across the board at Richemont properties are intended to not only inject new talent into existing brands, but also because new planned strategies often require staff with different types of training and backgrounds. It is impossible to tell at this point whether Richemont’s new staffing and leadership plans will have the desired outcome, but the fact that Richemont is so heavily investing in demolishing and restructuring teams and brands are positive indicators that the group takes these transformation projects seriously.

Perhaps the most interesting transformation on the group’s agenda relates to their focus on “digital.” Here we are talking about both digital marketing and digital sales. Related to this is the topic I discuss more below which is how Richemont plans to engender and maintain relationships with its customers. This is an area of particular interest to me since aBlogtoWatch is a digital publication so anything related to internet sales, distribution, communication, or service will have some effect on our business. An interesting trend I’ve seen over the years is that rather than develop assets or skills internally, Richemont – like so many other conglomerates – prefers to purchase companies it wishes to learn from or utilize for their audiences or performance in the context of internet sales of watches and other luxury goods. This is a risky strategy because it is not always the case that a well-performing company will continue to perform well under new ownership. Despite Richemont’s best intentions, it has a corporate culture and sets of expectations that not all teams or companies will thrive under. More so, it isn’t clear exactly how Richemont will cross-collateralize the needs of its existing brands with the abilities of its new companies.

Mr. Rupert did not formally mention the group’s acquisition of the UK-based pre-owned watch retailer Watchfinder.co.uk. Watchfinder UK has both traditional retail stores and a slick internet-based platform for the sale of pre-owned watches. Watchfinder UK is unique because it has a creative director in-house (as I understand), which is not the norm. Doing so has helped them in one key area of importance for luxury watch sales – and that is to effectively and attractively present their products. In addition to price, product presentation is crucial to e-commerce conversion rate (sales) success.

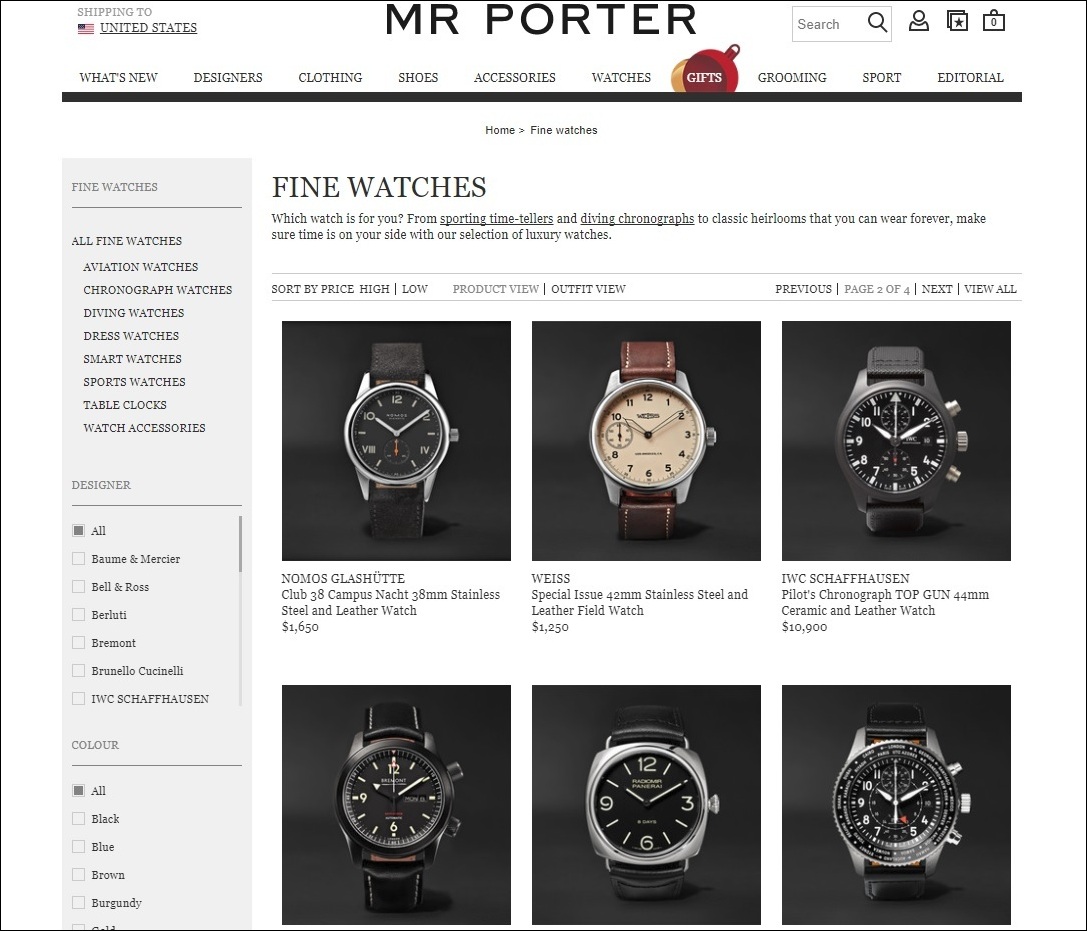

The recent internet retail acquisition that Mr. Rupert does mention is the group’s total acquisition of YOOX NET-A-PORTER Group – which it originally controlled, divested, and recently reacquired. Included in the acquisition is the luxury men’s fashion and accessory e-commerce store MR. PORTER. Between these various e-commerce company acquisitions that Mr. Rupert is no doubt proud of, Richemont now technically has a foothold in companies that sell both new and pre-owned watches online. The market for both is extremely important to Richemont, as it should be.