This article is contributed by Mr. Thomas Baillod, a watch industry consultant and marketing expert in Switzerland. More about Mr. Baillod after the article:

This article is contributed by Mr. Thomas Baillod, a watch industry consultant and marketing expert in Switzerland. More about Mr. Baillod after the article:

After decades of trying to increase their penetration in the markets, watch brands now seem to be backing off and starting to cut their networks of authorized retailers significantly, while predicting an improvement in their operating margin. In other words, the watch industry has finally started to realize that exclusivity is important in luxury watches and they absolutely must hold back from producing too much product. To keep balance sheets healthy (or at least to attempt it), the remaining players in the watch industry (brands, distributors, retailers…) are fighting for who gets to take home sales margin profits.

No intermediaries, only direct to consumer sales! Audemars Piguet’s announcement in the second half of 2018 was at least very clear. The strategy of François-Henry Bennahmias, CEO of the brand, was unveiled in the context of the announcement of his withdrawal from the SIHH. It highlighted a major trend for watch brands: to integrate their distribution network more and more.

Another example: in an interview with the NZZ (Neue Zürcher Zeitung) March 23, 2019, Jean-Christophe Babin, CEO of Bulgari, announced that he wanted to reduce his points-of-sale from 600 to 300. The remaining 300 stores now represent 85% of sales, and the man at the head of this Roman brand, who joined the LVMH group in 2011, is confident: By refocusing sales on half of its partners, he will allow them to better promote the brand, which should enable Bulgari to recover the 15% of lost business. Most of the major brands are currently doing this calculation and no longer hesitate to state it clearly and openly. But what they don’t necessarily confess is that, in most cases, they have a joker in their pocket.

If you are a consumer, then this article should help explain a bit of what is to come in the wristwatch sales space and should also help explain some of the current activity many watch buyers are probably experiencing.

Margin Recovery

Let’s take a look at lifestyle brands to gain understanding. With no complexes and a past as short as their life expectancy, these brands take risks and try new experiments. During Baselworld 2018, the entire Daniel Wellington brand staff left the exhibition on Sunday morning, leaving only the bartender and DJ. From a fair already shortened to six days, the sales teams spent just three days in the booth, from Thursday to Saturday. What did they do during those three days? They drilled their network resellers and cut off all those who wouldn’t follow (or whom the brand didn’t want anymore).

It is impossible to obtain official figures for this disengagement campaign, but one hypothesis is enough to reveal the very nature of the wildcard: Let us suppose that, during these three days, the Swedish Filip Tysander, founder and owner of this brand, closed 20% of his network and that this led to a 20% decrease in his sales. Being very active in online sales through its official portal, the Swedish brand was reasonably able to expect, through this direct channel, to recover part of its sales.

Let’s be pessimistic by estimating that it’s only half, meaning 10%. This allows the brand to generate a 50% increase in his profit! How? By eliminating intermediaries — distributors and retailers — the brand can recover around 70% of the public price value of its watches and, thanks to this direct sales inflow, boost its profit by up to 400%. The calculation is quickly done, the profit being equal to the margin multiplied by the quantity. A loss of 20% of the volume is compensated by 50% of the additional margin, which leaves a profit of 30%. This probably allowed the bartender to feast on cocktails on the stand until Tuesday at the end of Baselworld.

Digital Breaking Wave, The Targeted End-Customer

This new direct-to-consumer sales trend is currently shaking up the boards of directors of most brands and resonates like the new El Dorado of watchmaking, at a time when sales are down for many of them. In fact, the rush to the margins of the market has become possible because of the combination of two phenomena — the first, which served as a trigger, is conjectural; the second, irreversible, is structural.

In 2009, the economic air gap in the world economy was a wake-up call for the Swiss watch industry. Most of the brands were able to successfully absorb it, and six years of record sales followed. But the crisis that began in 2015 had a much deeper impact, as it officially persisted until the end of 2018. (Officially only, because unofficially not all brands have emerged unscathed.) The global economic downturn, the advent of connected wristbands (a term I prefer to “smartwatches”), and a change in consumer purchasing behavior are the main factors that may explain the reasons for this recession in watch sales — especially since, during these four years between 2015 and 2018, the digital groundswell, the same one that previously transformed marketing in a fundamental way, spread to distribution and changed the very foundations of traditional commerce.

Three Fundamentals Upset By The Internet

How can digital technology revolutionize this traditional model? The digital space modifies three fundamental parameters: notions of time, space, and information. It eliminates the first two and makes the third plentiful and free, whereas information was previously scarce and expensive. However, if we analyze a consumer’s purchasing act, we find precisely these three parameters, since the customer goes to a store (space) at a given moment (time) to receive information on a product (service). The first and the last parameters are the most expensive; they are the ones that generate the most margin, together with the stock.

By combining digital with online stock availability, brands can eliminate the main cost factors, while providing customers with choices across their entire collection that the retailer will never be able to compete with. And, most importantly, direct sales provide brands with the key information they have sorely missed: sell-out knowledge. This information enables the brand to know its sales in real time in the markets and thus to optimize its commercial operations, its marketing campaigns, and its production: the Holy Grail.

Who’ll Move First?

If this concept offers so many advantages, why didn’t the brands adopt it sooner? First, because there was, until very recently, no alternative to selling in a physical space. Several luxury brands tried to open their own stores in the 2000s, but they quickly realized that they were leaving their core businesses and that retail required a particular know-how. This changed with the advent of the Internet. Internet users gradually became consumers. And even if online sales have taken time to democratize, the average shopping basket has never stopped gradually increasing.

When Internet users were finally ready to acquire watches online, the brake came first from the brands. Selling is a matter of territory, and they did not particularly appreciate the fact that retailers were encroaching on the territory of other colleagues in the surrounding area. It’s even worse when you go up to the level of distributors, who by contract are prohibited from exporting to another country. Yet, ironically, it is often the brands that have indirectly led intermediaries to defy online sales bans. They simply pushed them to do so when they systematically provided them with stocks that were clearly above their sales capacity.

It is difficult in this context for watch brands to apply to themselves what they refused to their partners and sell officially online, especially since the first brand to step out of line would have been immediately sanctioned by the reseller network. It was taking a tremendous risk. But with the crisis that began in 2015, the watchmaking industry as a whole has experienced a kind of generalized savings. There has been a pause in resistance at all levels. The competition for the end-consumer could begin, and the margin battle was launched.

And What About The Customer Experience?

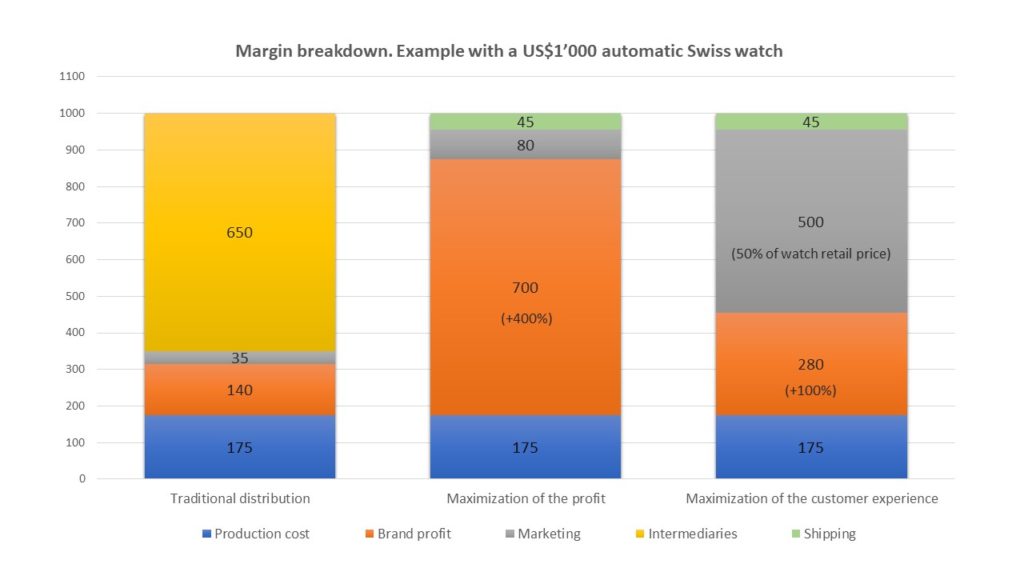

What about service, in-store customer experience, and physical contact with the watch? As shown in the graph, a brand that sells directly could decide to allocate half the price of a watch to the customer experience. By extrapolating this margin to a luxury watch sold for CHF 40,000, a direct sale would allow the brand to spend CHF 20,000 to provide its customer with an unforgettable experience. Which retailer is able to compete with such an investment?

In this context, what will happen to multi-brand retailers? Jean-Claude Biver said, in Spring 2018, “Specialize or lose to watchmakers selling direct.” The games are over, and the race for specialization will force many retailers to convert. But they certainly haven’t said their last word. Digital will perhaps be their best partner when technology allows the connection of the retail network, the traceability of the service, and increased sales in stores.

Watch Distribution In The Secular Business Model

The centuries-old business model associated with watch distribution is based on a network of intermediaries who successively own and transport the stock of watches to the end-consumer. Offering potential customers a permanent stock of watches that patiently awaits their visit to a store is a very expensive business model, and therefore very greedy on the margins. The retailer, the last link in the distribution chain, bears the three main costs: the rental costs of the store (the location), the salaries of the employees (the service), and the watches owned (the stock). This largely justifies the high margins they have to charge. In addition to being expensive, this approach also induces a fundamental bias: The business model of watch brands consists, above all, in selling watches to intermediaries (the so-called sell-in) and leaves it to intermediaries to sell them to end-consumers (the sell-out). Traditional watch retail is, therefore, an industry that sells and thinks “wholesale” and delegates the link with the end-customer.

How Margins Are Subdivided & Distribution Keys

This theoretical example is based on the sale to international distributors of a basic Swiss-made watch, a three-hand automatic model. The production cost for such a model is around CHF 175. Since the brand takes a reasonable margin of 50%, it adds CHF 175 to it, which can be calculated by its gross profit (CHF 140.–) and marketing budget (CHF 35.–) equivalent to 10% of the resale price to intermediaries. (Note that, in general, the distributors will replicate the CHF 35.– in marketing expenses, bringing the marketing budget to a total of CHF 70.–.) The CHF 350 obtained is called ex-factory value and represents the brand’s turnover. The intermediaries in our example represent 65% of the final price, or CHF 650. This brings the watch to an in-store selling price (excluding tax) of CHF 1,000.00. In the event that this brand decides to sell directly, it can theoretically multiply its profit by 5 (+ 400% increase), while increasing its marketing budget by 14% (from CHF 70.00 to 80.00). If, on the other hand, its priority is to maximize the customer experience, it can dedicate half of the watch’s price to marketing, while doubling its sales.

Intermediaries, The Counterattack Is On The Move!

Pioneers of online watch sales, intermediaries — retailers in the lead — now find themselves trapped in the Pandora’s box they have opened. The well-established watch brands that first fought this trend are now rushing into the loop. They are directly addressed to end-customers. Retailers have not yet had their last word. The digital revolution also brings them new solutions.

Two hopeful trends:

> Augmented reality: The user experience is the key to a successful sale and, thanks to his or her mobile phone, the customer can have an enhanced experience in-store with displays that come to life, watches that tell you a story and that you can try on virtually.

Commissioned service: More and more retailers are providing a service to customers for which they are not paid, as they come in to try the watch in-store, only to buy it online later. New systems are being implemented such as Meotion, in order to be able to qualify the interaction with the customer in-store and earn a commission even if they later buy it online.

A version of this article originally apeared in June 2019 in the French publication JSH Magazine.

Thomas Baillod — Member of the JIMH board of the Journées Internationales du Marketing Horloger, market expert Thomas Baillod founded the Watch-Trade Academy, an organization entirely dedicated to teaching watch sales. Offering online courses, conferences, and consulting, Baillod is in tune with the digital advances that may help the retail network, for which he is building a global database.