With the United States back in focus as the world’s most important market for luxury Swiss watches, after the coronavirus pandemic is over, luxury brands will need to start working on redeveloping the American market. The 2008-2009 financial crisis more or less ended a generations-long love affair between socially mobile American middle- (and upper-) class consumers, and European luxury brands — often watchmakers. At the time, luxury watch brands shifted their attention from the West to the East and invested most of their time and money into non-Western markets.

Today, the luxury watch industry looks upon the United States with a mixture of hesitation and anticipation — hesitation because of both history and the intimidating size of the market, and anticipation for “some other brand to get it right” in the United States, as few luxury firms these days have the stomach for experimentation in a known tricky market. As an American, myself, who has spent nearly 15 years looking into the watch industry from the side, I wanted to speak to a lateral colleague of mine in Switzerland to better understand the Swiss perspective on the matter. This is especially important to me, as I’ve often written about global marketing failures plaguing the luxury watch industry and, as a non-native, I am often aware of my own cultural biases.

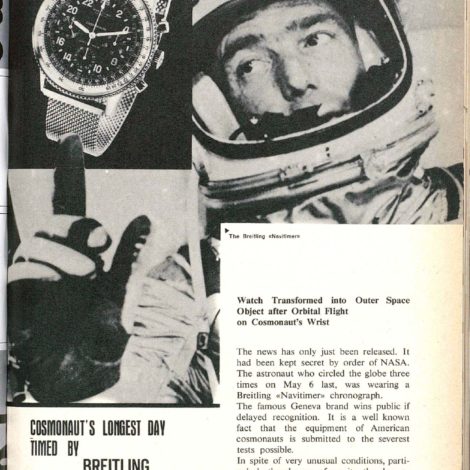

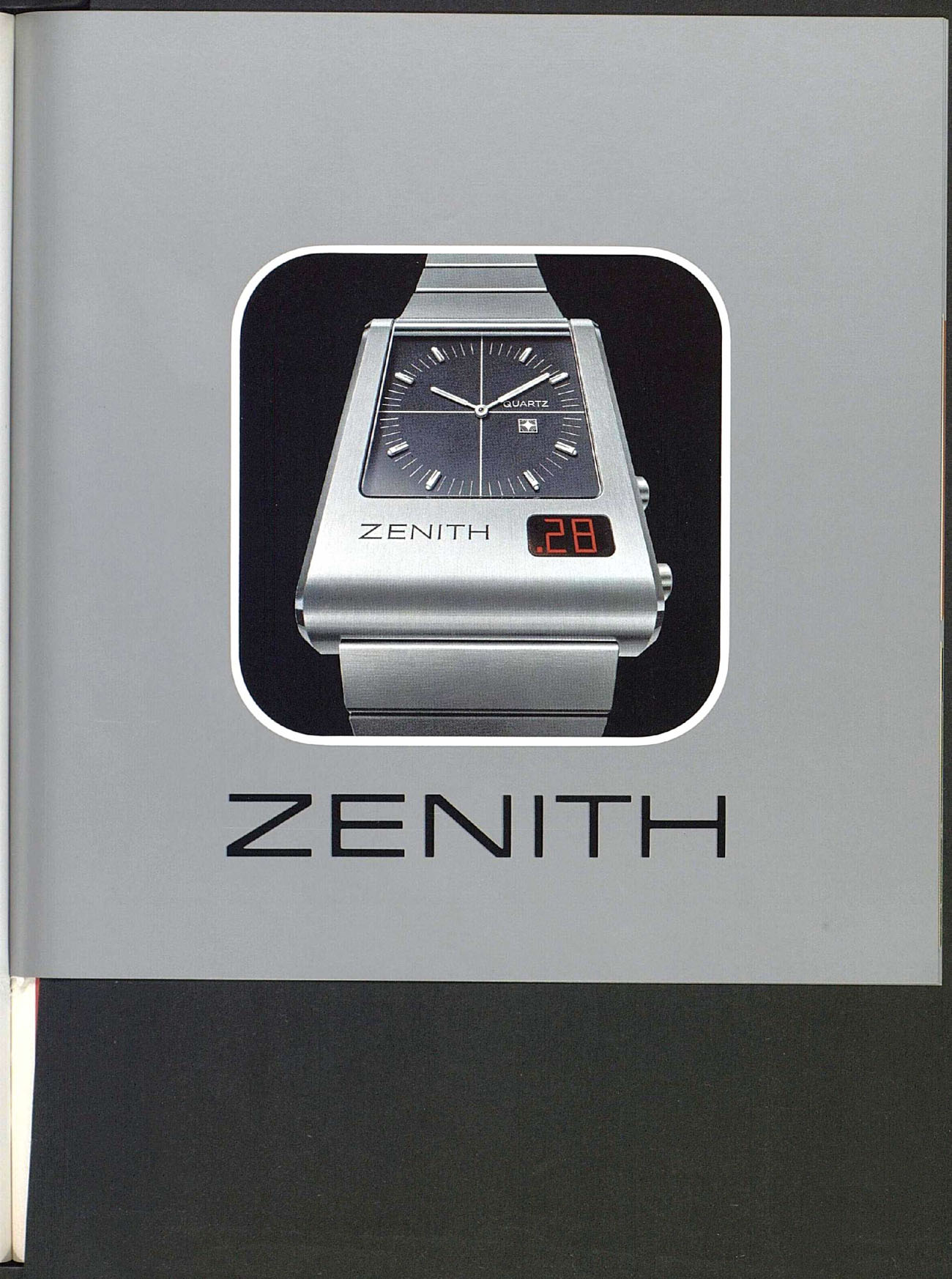

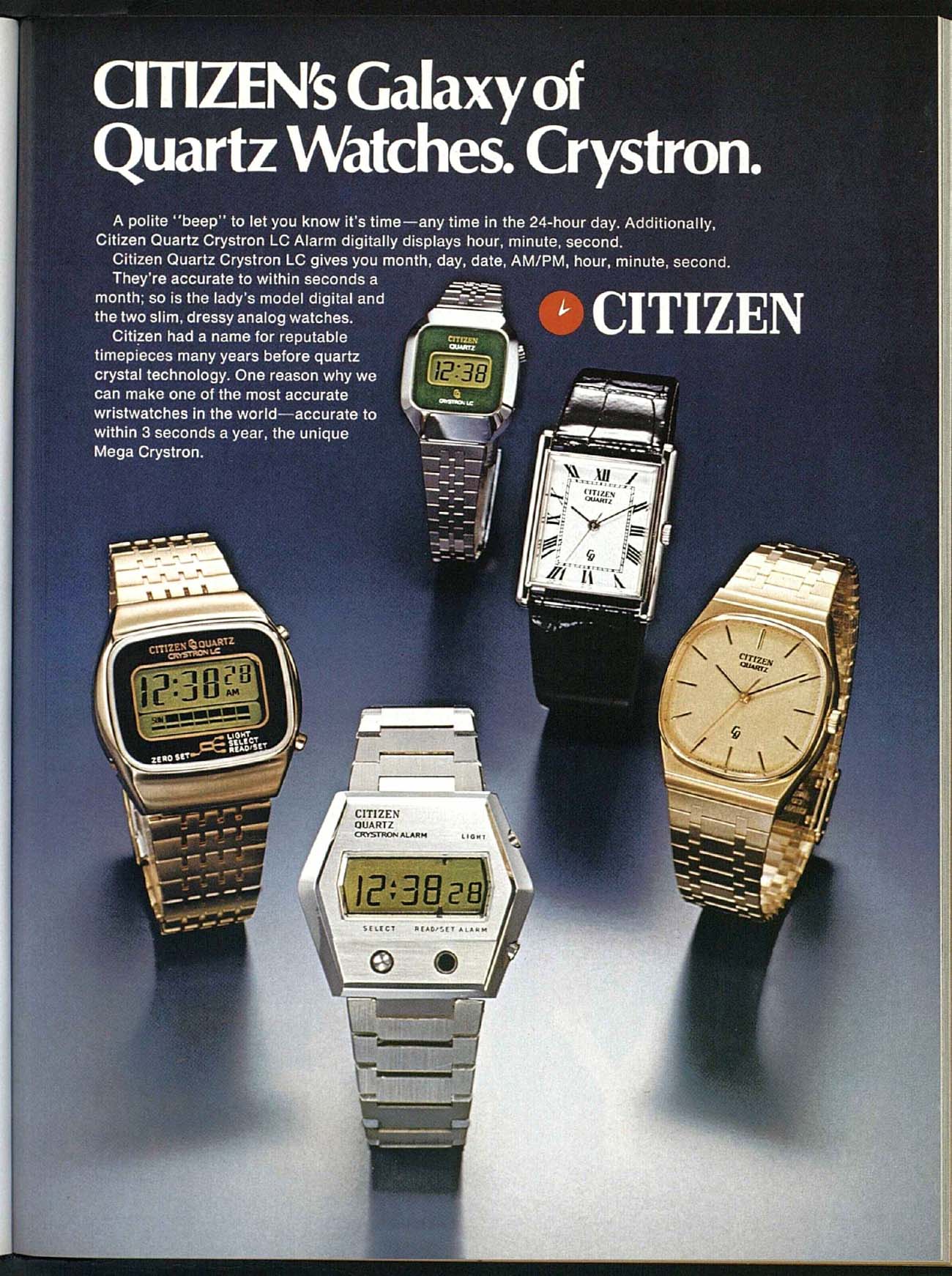

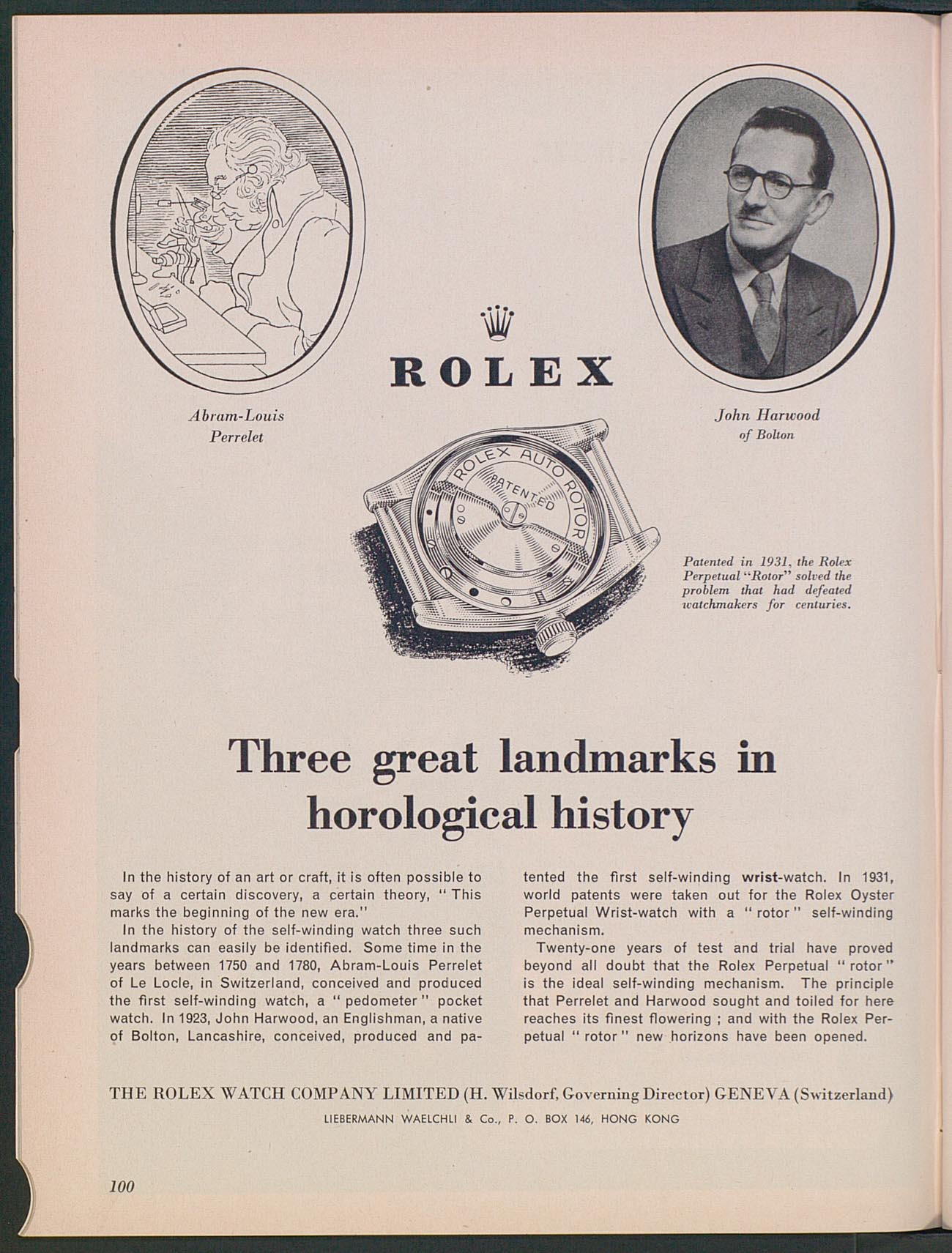

This and the below watch advertisements are from the Europa Star Magazines digital archives, used with permission.

Please welcome fellow watch industry expert, media specialist, and timepiece-lover, Mr. Serge Maillard, who is the current publisher of Europa Star magazine in Switzerland. His perspective is further enhanced by the fact that he currently lives in the United States. Europa Star is one of the very few Swiss-based publications on the watch industry — whose history has mainly been a publication serving the industry itself. Recently, Europa Star has begun to offer a paid subscription offering users access to digitized versions of decades worth of articles, ads, and interesting content about the Swiss watch industry. Maillard spoke with me about some of the history of the Swiss watch industry and America and a little bit about what luxury Swiss watchmakers will face in the United States when they return to business after the COVID-19 pandemic has abated.

Ariel Adams (AA): When looking at the modern history of the luxury Swiss watch industry, it becomes clear that business growth in America was crucial for its success. Then, something happened, and Switzerland’s love affair with the American market ended, with so much of the luxury world’s attention being refocused to the East. What history can you provide here, and how can you explain this shift of focus by the luxury watch brands away from America?

Ariel Adams (AA): When looking at the modern history of the luxury Swiss watch industry, it becomes clear that business growth in America was crucial for its success. Then, something happened, and Switzerland’s love affair with the American market ended, with so much of the luxury world’s attention being refocused to the East. What history can you provide here, and how can you explain this shift of focus by the luxury watch brands away from America?

Serge Maillard (SM): If you look at the statistics of Swiss watch exports for the year 2005, the United States was still ahead of Hong Kong in terms of value (2,15 billion CHF against 1,78 billion CHF), while mainland China accounted for only 350 million CHF. In the luxury watch industry, as well as in luxury in general, the great boom of Chinese consumption really took off from 2005. It is closely linked to the follow-up of China’s entrance to the World Trade Organization and the ever-growing position of the country in the globalized structure of exchange of goods. The focus for many Swiss watchmakers turned to Chinese consumption, which became pivotal in allowing the Swiss watch industry to almost double its total export value between 2005 and 2015.

While Hong Kong experienced strong growth and mainland China really took off, the American watch market was strongly affected by the financial crisis of 2008. However, things have been reversing since 2015, with the decrease of “gifting” practices in China, then the political troubles in Hong Kong, now the pandemic. Interestingly, the most successful Swiss watch brands today have a balanced exposure to global markets and are particularly strong in the United States, without being overly exposed to the Chinese market. I think a new balance will appear, with a renewed interest in the American market, as dependence on Chinese consumption has clearly shown its limits. The buyout of Tourneau by Bucherer and the strong expansion of Watches of Switzerland in America are signs in this direction. The US market was a close second to Hong Kong last year in total Swiss watch exports.

AA: Switzerland in general has had a precocious relationship with the United States. Around the turn of the 20th century, America was a top dog in not just buying watches but, more importantly, making them. What can you tell us about this part of Switzerland’s watchmaking history when America was a competitor more so than a client?

SM: For a good part of the 19th century and most of the 20th, America was the biggest watch market in the world. This market has always been a strong focus for Swiss watchmakers, who cannot rely on their domestic market, unlike American or Japanese brands. The American watch industry made strong gains in productivity in the second part of the 19th century, in the broader context of the rapid industrialization of the country. Brands like Waltham and Elgin were companies able to mass-produce movements.

It is actually against this threat of American companies being able to export watches on their “hunting ground” that some Swiss companies in the second part of the 19th century started a modernization process of their production capacities with full-fledged factories. Until then, they had mostly relied on a dense network of smaller workshops. Longines is a good example of a brand that quickly reacted to the “American threat” by establishing a more modern system of production, under the leadership of Ernest Francillon. In this sense, Swiss watchmakers owe a debt to American watchmakers for pushing them out of their comfort zone.

AA: When Swiss watches would compete with American watches in the United States market during the 20th century, how would those Swiss watches differentiate themselves before consumers? Where they more high-end? Did they perform better? Help people understand the competitive angle of Swiss watches when their primary competition in the U.S. was American products.

SM: Some Swiss brands have always focused on the production of high-end watches, like Patek Philippe, Vacheron Constantin, and Audemars Piguet. But the mass market was for everyday pocket watches (then wristwatches) at a time when having a watch was a daily necessity! Despite the high volumes of American watch production, Swiss watchmakers were continuously able to produce more than their American counterparts in the 20th century, which is important for maintaining competitive prices. With a network of hundreds of different brands and the organization of a watch “cartel” from the 1920s to the 1960s that made Ebauches SA (ASUAG) the key provider of movements to the whole industry, the Swiss were especially skilled at focusing on design and catering to highly different tastes around the world. Product differentiation was key to seducing consumers in the U.S. and elsewhere.

Swiss watchmakers could rely on their long expertise of supplying overseas markets, as Switzerland had always been an export market, unlike the American watch market, which was mostly focused on domestic consumption. Facing tariffs, Swiss companies also started early on assembling directly in the U.S. their imported watches, so they got closer to American consumers. Beyond technical aspects and competitive prices, the high variety and density of the supply was a key element in their success.

AA: In the 1990s and early 2000s, the luxury watch industry in America transitioned from being mostly run by American leaders and American distributors to imported European leaders and wholly-owned subsidiaries that managed inventory and sales in the U.S. market. Why did this shift occur? What else can you say about this major shift in how the United States market was run in terms of the sale and marketing of luxury Swiss timepieces?

SM: The 1990s and the 2000s were a period of “renaissance” for the Swiss watch industry after the challenging decades of the 1970s and 1980s, which required a strong sense of adaptation. With the growing success of mechanical watches as a luxury product, the industry started relying more than ever on marketing and brand image on a global scale. It also got more concentrated with the arrival of large global luxury conglomerates buying out and reviving Swiss companies, such as Richemont, LVMH, then Kering.

The very nature of the industry changed, and Swiss companies started projecting a stronger global brand image with more control of all aspects linked to sales and marketing. Opening subsidiaries or flagship stores, not only in the U.S. but all around the world, has been part of this strategy of consolidation at the group or brand level. This process is still going on. The most notable recent examples are probably Audemars Piguet and Richard Mille, which aim at an integrated distribution network. This general trend is also strongly encouraged by digital tools that give the ability for brands to communicate directly with the end consumer. It’s all part of a “direct-to-consumer” approach to business and a disintermediation process that aims at controlling the brand image from the first design to the final sale — and reaps direct profit as well!

AA: In recent times, the Far East market, notably China, has become much more important for the Swiss watch industry. Can you tell us from a Swiss perspective why doing business in China is more compelling than the United States? Or perhaps why there was such a massive shift of attention away from what was the top market for luxury timepieces for so long?

SM: The high growth in demand of luxury goods in China shifted the focus away to the Far East, although Hong Kong had already been a hub for Swiss watches during the previous decades. There was a kind of “luxury frenzy” in China, especially between 2005 and 2015, but this is now changing: we already see a more individualistic watch consumption in China. The challenge in this country is that it is subject to rapid changes of the business climate, as we’ve seen in 2015 or last year in Hong Kong. The same may be true in the U.S., as in 2008 with the financial crisis. With the current pandemic that is truly global in nature, rapid changes can now happen on a global level. I think the lesson to take away is that watch brands should be more aware of the risks of focusing too much on one single type of consumer.

AA: Geo-politics and economics has shifted so that, once again, the United States is the top market for luxury watches in the world. This hasn’t happened because of any great focus on the United States, but rather because of steel declines in the Chinese market. Now that the European luxury watch industry has to refocus attention the Western markets such as Europe and the United States, they face all sorts of problems in these markets. Can you tell us about some of the challenges these markets face when it comes to brands being able to successfully market and sell their goods there?

SM: These are more “conservative” markets, compared to the adrenaline rush that brands have been experiencing in the Far East in the of 2005-2015 period. It raises the question of finding new ways to communicate the relevance of owning a watch today to audiences that have experienced decades of wealth and are not “new money” like the emerging middle class in China. New topics could be explored, such as sustainability. Also, the ability to buy watches online is being greatly accelerated with the confinement caused by the pandemic. Brands that did not propose their models online have been doing so since the outbreak of the coronavirus. The key interrogation is about the impact of this pandemic on clients’ behavior in the longer run: Will there be a limited consequence with a rapid return to the “normal,” or will mindsets have really been influenced toward a more frugal and sustainable lifestyle? Whatever happens, the globalization in action for the last 20 years means it is more and more difficult to talk about single, isolated markets. Even in Europe or the United States, a good chunk of the luxury consumption is foreign, so brands have to take that into consideration.

AA: As a Swiss person who currently lives in the United States, you have an interesting and blended perspective that combines Swiss and American sentiments. This puts you in a unique position to explain how the Swiss see the American market and the American consumer. Can you please explain what insights and observations you have that you feel are worth sharing?

SM: Historically, America was the first overseas market for Swiss watch brands, and it is reclaiming today its number one position. There has been an obsession with the Chinese market during the last 15 years; it is somewhat understandable, as there were greater returns in the Far East. Today, many emerging markets have matured in terms of watch consumption, and we don’t really see any “new China” on the horizon. I think the global industry will strive for a more balanced allocation of sales. In this new configuration, America as a watch destination will be re-evaluated. It is a very interesting moment to be in America, as it is a laboratory for contemporary watch consumption. For instance, it is very advanced in terms of home delivery — I’ve experienced it first-hand since I’ve been here, although not for watches! Also, let’s not forget about the huge impact of the Apple Watch. The Silicon Valley is probably where much of the future of the watch industry is being written now. And I’m a bit appalled by the lack of interest there from Swiss watch brands. I’m not talking only about connected watches, a segment that is still quite distinct from the luxury mechanical watch’s environment, but more broadly about new consumption experiences being crafted there at this very moment.

AA: Do you think that the West has a good chance of helping to revive the luxury watch industry? If so, what do you recommend watch brands do over the next few years in both Europe and the United States that will help give them the best possible chances of success?

SM: I strongly believe in the future of the luxury watch industry. I think two moves are relevant: moving from a Swiss watch industry towards a global watch “community,” in which all shareholders, including aficionados around the world, as well as retailers and the media, are engaged around a shared passion, which requires a collective effort; and using the most innovative new technologies to convey the passion for watches. I think that the watch industry has a unique opportunity to show how the past can be blended with the present and the future — it is, after all, the industry of time! As long as there will be the level of enthusiasm that I see all around the world for watches, not as a commodity but as a piece of personal lifestyle, I will not be excessively worried. But this passion has to be nurtured with more transparency, more genuine initiatives, more openness, and more solidarity among shareholders.

A good indicator of the relevance of the watch industry today is the number of new watch projects on crowdfunding platforms such as Kickstarter. These projects have surprisingly been flourishing during the first three months of 2020! The watch industry still kindles entrepreneurial vocations. That’s a healthy sign.