Further consolidation of the industry …and perhaps some huge shakeups

The oil and gas industry is weakened, but some players are weaker than others. Larger, diversified oil companies with cash on their balance sheets now find themselves in an advantageous spot since they are in a position to acquire their peers’ best assets at a discount, which could include skilled labor or manufacturing equipment.

Some consumers may bemoan large conglomerates such as Richemont, LVMH, and Swatch for buying up the industry’s heritage but from a business point of view, the strategy works: buy different brands to target different market sectors, or acquire their knowledge capital and spread out all remaining back office, non-revenue generating functions.

I can almost guarantee you that the executive team at each of the large luxury conglomerates is tracking as best they can the fortunes of the industry’s smaller players and assessing how they would fit into their portfolios. They are probably also looking at other strong companies and considering how they can partner together to offer new and exciting products to consumers. In fact, don’t be surprised if some moves that seemed unthinkable just a few years ago (Asia-based private equity firms buying up distressed Swiss manufacturers?) become reality now that the tides of good fortune have receded and the industry looks to enter a new paradigm.

Manufacturers will not enjoy the high margins of years past without a course correction

Above is some data I compiled from the latest Swiss Watch Federation figures for the number of exported units and revenue generated. Already in the year 2000, exports of mechanical watches only accounted for 8% of total unit shipments, but nearly 50% in terms of revenue. Today, mechanical watch shipments account not only for more of the total of unit shipments, but also even more of the revenue total, making up just over 80%.

You can see how that happened if you take a look at how the average prices of both types of watches evolved over that same time period:

Prices have increased much more for mechanical watches (to start with already more expensive than quartz models by a steady factor of around 10x) since the year 2000. Given that this category makes up such a large part of the industry’s revenues, a drop in exports and/or pricing of those watches will have a big impact on the top lines of many of its constituents.

Going forward, the data points to these potential scenarios:

- Manufacturers will price their offerings lower and live with lower margins

- They will find ways to cut costs and boost efficiencies in an attempt to maintain margins

- They will embrace other ways of increasing revenues

This leads us to the 800-pound gorilla in the room…

The smartwatch.

The mechanical watch won’t disappear, but the Swiss watch industry needs to diversify to remain strong

I strongly support the development of alternative fuels, but practically speaking, hydrocarbons will continue to be an important “bridge fuel” to solar and wind power. Likewise, there will always be a place for mechanical timepieces, but I view the smartwatch as the “alternative fuel” facing Switzerland.

There will increasingly be a demand for both, and Swiss brands ignore the latter at their own peril: just because one person can afford to pay $50,000 for a watch, why ignore the thousands of people with less than $1,000 to spend, or even less than a few hundred dollars? Indeed, for many consumers, a watch is supposed to be affordable and utilitarian, if it’s even necessary at all.

And yet, thanks to the Apple Watch, my hypothesis is that many of those same consumers now see a number in the high hundreds as acceptable for putting towards something you strap on your wrist. Apple has done a huge favor to the watch industry by shifting the traditional mindset, and a key question for Swiss watch manufacturers going forward will be how they take advantage of these raised price tolerances.

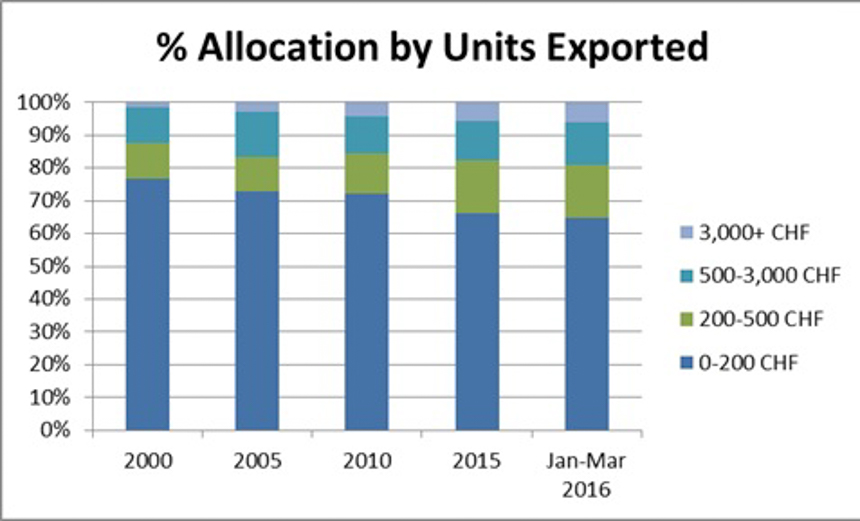

This becomes apparent when you graph the previous data set by price segment:

The volumes at the lower bracket are large, which suggests a few possible avenues:

- Develop a smartwatch in the 200-500 CHF range that is compelling enough to convince a portion of consumers in the 0-200 CHF range to spend more

- Develop a lower-cost yet still compelling smartwatch in the 0-200 CHF range

- Develop more hybrid options in that same price range, similar to Montblanc’s “e-Strap”

- Going back to the previous point of a “new normal” in pricing, develop much lower cost mechanical watches in the 0-200 CHF range (remember the data above shows the average mechanical watch cost is today over 2,000 CHF) and make up for the lower margins on higher volume. Swatch has done this with the Sistem51 but that is the exception, and my working hypothesis is that the average consumer is not yet interested enough in the specifics of watch movements to choose this consistently over a similarly priced quartz model.

Deciding which of these options to pursue (among others, perhaps) will be extremely difficult. Executives will have to collect and analyze both internal and industry data, cross-reference those findings with their experience, and then ultimately trust their business instincts in order to determine which way forward will work best for their companies.

That decision made, they must move to planning and execution, which present their own sets of challenges. Not everyone will be successful, but some will, and for that reason I believe strongly that tomorrow’s “rock stars” of the Swiss watch industry are making their moves today.

Legends will be made

In every industry, a couple of names always tend to loom large, and many times these statuses were cemented not because of performance in boom times, but in hard times. We have our legends in oil and gas, and the watch industry is no different- it’s hard to separate the watch industry’s recent success from the visions and deliberate choices of people like Nicholas Hayek and Jean-Claude Biver in the aftermath of the Quartz Crisis.

It is my belief that tomorrow’s leaders of both the oil and gas as well as watch industries will identify themselves today, with the choices they make faced with negative industry conditions. It may appear that these executives will be coming out of nowhere, but trust me: they are laying the seeds of the industry’s future success at this very moment.

Parting thoughts

Today, consumers can enjoy fantastic products from Germany, Japan, and there’s even a fledgling manufacturing scene in the US. Further analysis of the watch industry’s future should include more in-depth study of those areas as well. Nevertheless, to the extent that Switzerland looms so large, I do believe it’s fair to say that the industry’s fortunes are tied very closely to that of Switzerland.

With that, I’ll close on one last similarity. A few weeks ago, I attended the Offshore Technology Conference, our version of Baselworld. The tone was somber, but hopeful. I have reason to feel the same way for the Swiss watch industry, and look forward to many more of its products on my wrist!

David Vaucher is currently based in Houston as a Director in the energy practice of Alvarez & Marsal. He can be reached at [email protected]The views expressed here are his and his alone, and do not necessarily reflect those of Alvarez & Marsal.