The Momentum Of Producing Too Many Watches Will Only Slow, Not Stop

I commend Morgan Stanley writers for their ability to exercise restraint when discussing the dilemma groups like Swatch and Richemont have when dealing with oversupply and the ensuing results of it (because they have some hard decisions to make). Morgan Stanley correctly argues that the biggest reason for the watch industry to reduce its production of watches is because the future for much of it is direct-to-consumer sales. At the least with a foundation of direct-to-consumer sales the watch industry will no longer be subject to the bullwhip effect. Morgan Stanley does however neglect the fact that overproduction is not likely to end very soon. Though they seen less and less reasons for the watch industry to put up with the negative results of it.

Direct to consumer (DTC) sales mean that watch brands no longer get to enjoy selling watches in bulk, but also don’t need to make as many guesses about how many watches to produce. Morgan Stanley still doesn’t quite understand that some watch brands produce too many watches to sell into the market via wholesale in order to meet short-term goals while neglecting the longer term problem of unsold watches in the market (inventory glut). This is a managerial problem in the watch industry related to the systemic problem of having too few educated, experienced and competent managers available to hire. On top of that, the Swiss watch industry has no educational programs at this time designed to produce effective watch industry managers. For those reasons I believe there is no short-term outlook to feel that overproduction will stop soon given that the watch industry has a Faustian bargain with their factories.

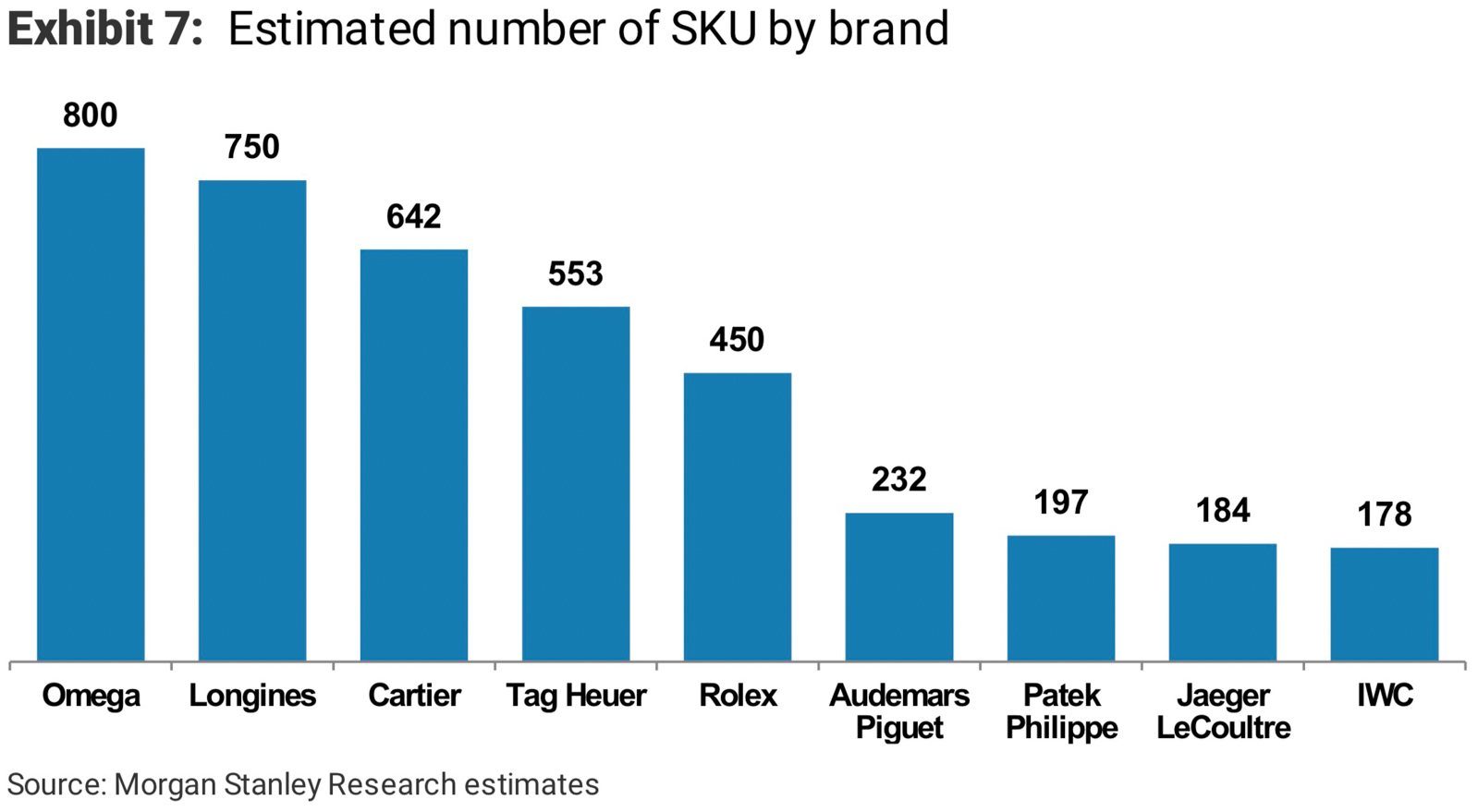

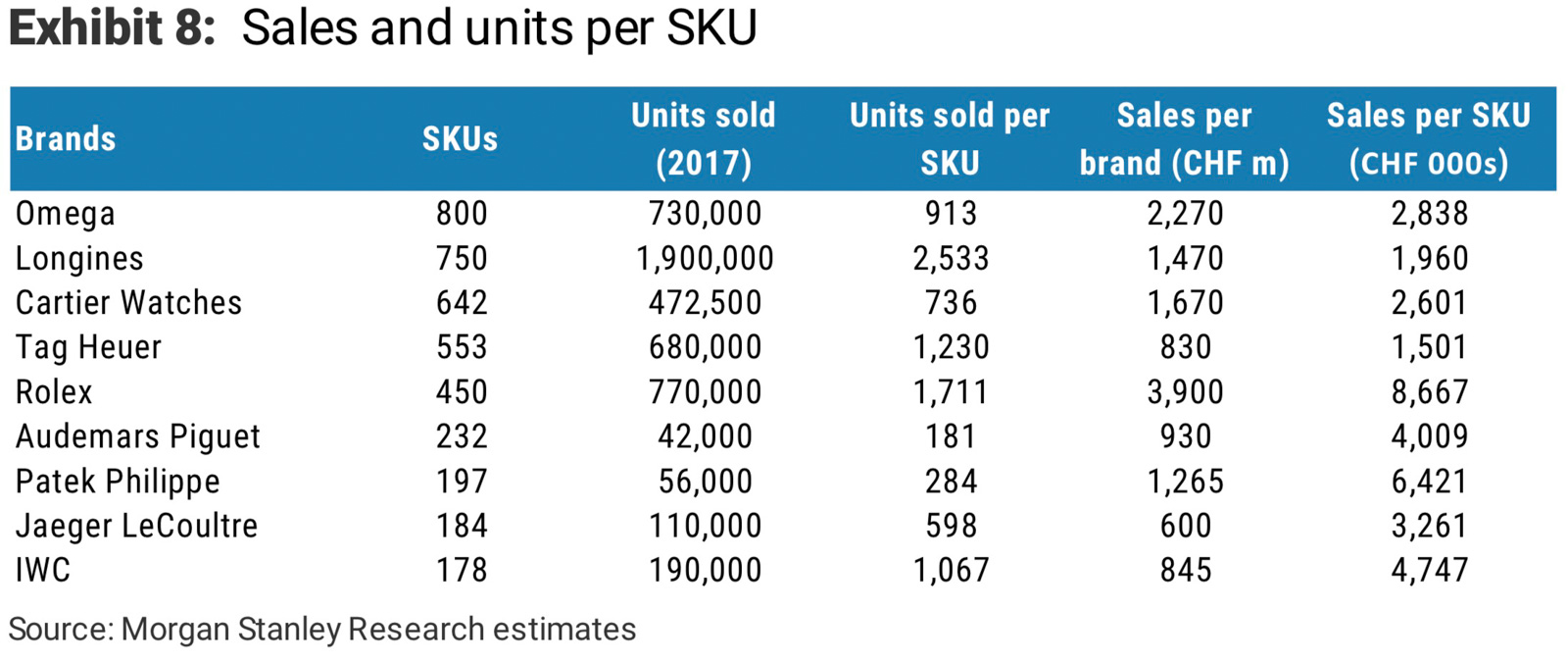

Morgan Stanley offers one solid piece of advice for how to create more manufacturing efficiency – that is for the watch industry to focus on narrower ranges of products. There is merit to this argument. Noticing that there are so many different types of unsold watches, Morgan Stanley recommends that more Swiss watch brands follow a Rolex-like model of focusing their production capacity on a relatively narrower range of products that have common parts. They are essentially telling the watch industry to reduce costs and risk by producing less parts that might prove useless if a particular line of watches isn’t a marketing success. Morgan Stanley even directly compares Rolex and Omega by suggesting that Rolex has a more streamlined (focused) product range – still with a lot of SKUs, but that Omega was and is too overly diversified in their product range.

At first this advice might seem sound, but in reality a lot of it isn’t likely to happen. First of all, it is notoriously difficult to predict what watches will be a hit with consumers and thus what products to bulk manufacturing effort around. Brands that have “iconic” models are already producing the hell out of them, or a controlled and deliberate underproduction in order to stoke demand flames. Watches, like art, can in many instances be accidental successes – from the perspective of their producer, at least. In order for the watch industry to succeed with successful products, it must by definition sacrifice other, often more failed, products. Morgan Stanley’s advice would be akin to recommending that the movie industry stop taking risks on new ideas and just keep doing the same safe thing over and over again. Ultimately you may sell tickets to the mass market, but you’ll rarely satisfy serious aficionados. In the watch industry it is style and fashion aficionados who set major trends. Without novel hits produced by “unfocused” product development, the watch industry will quickly lose its artistic (and thus emotional) appeal with many consumers. Besides, who working in the watch industry that actually likes watches wants to run a brand that produces the same things over and over again?

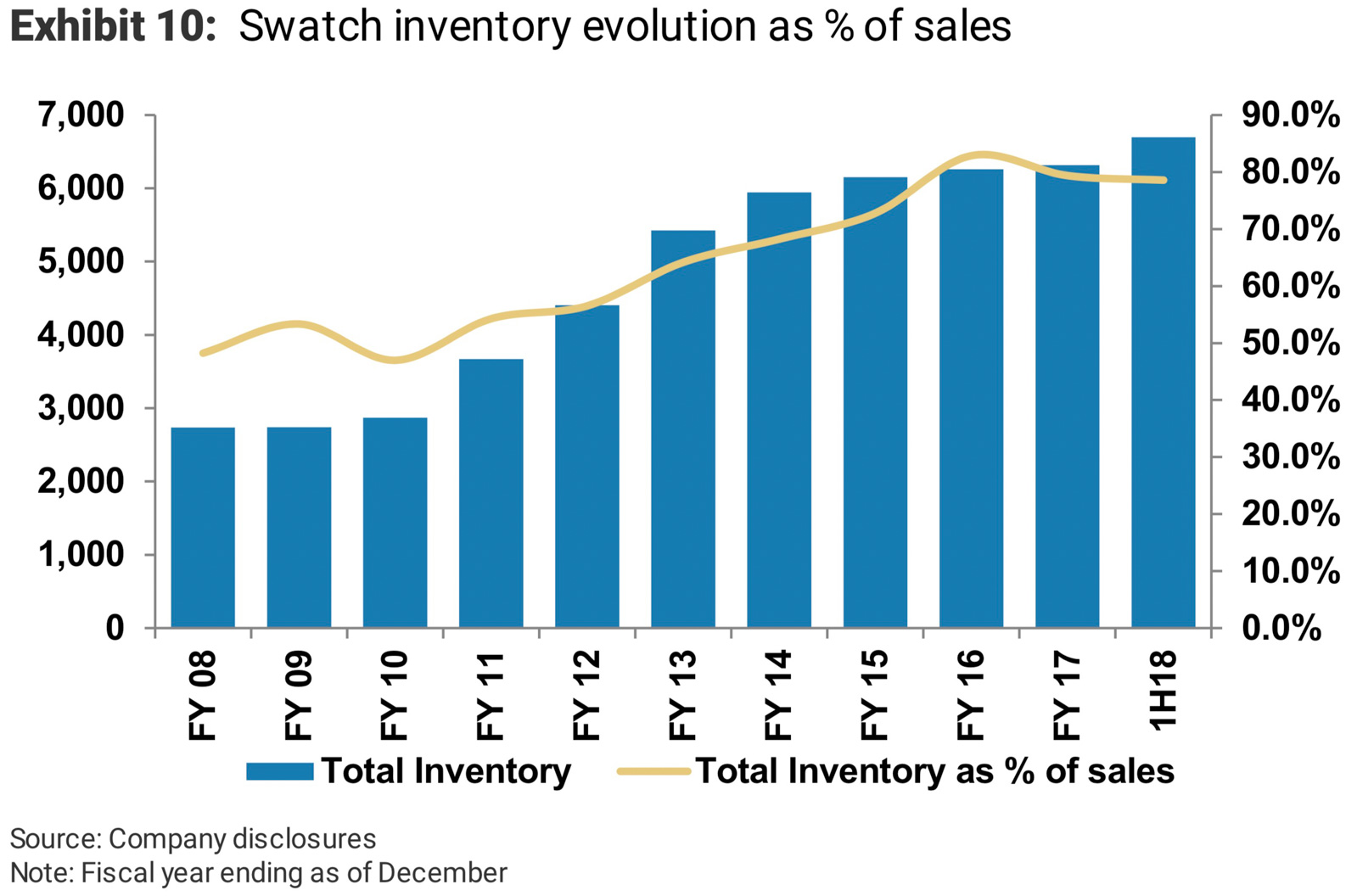

The Expensive Cost Of Cleaning Up Gray Market Watch Inventories

Things get very tricky for the Swiss watch industry when it comes to Morgan Stanley’s prediction of a difficult business shift brands will need to make soon related to unsold inventories. Again, overproduction of watches leads to inventory gluts that have the effect of invalidating trust in retail prices due to uncontrolled discounting. If you want to have a healthy market where people will pay retail or close to it, then you can’t have the existence of too many discounted watches that are discounted because they lacked demand. Morgan Stanley in effect recommends mass unsold inventory buy-back.

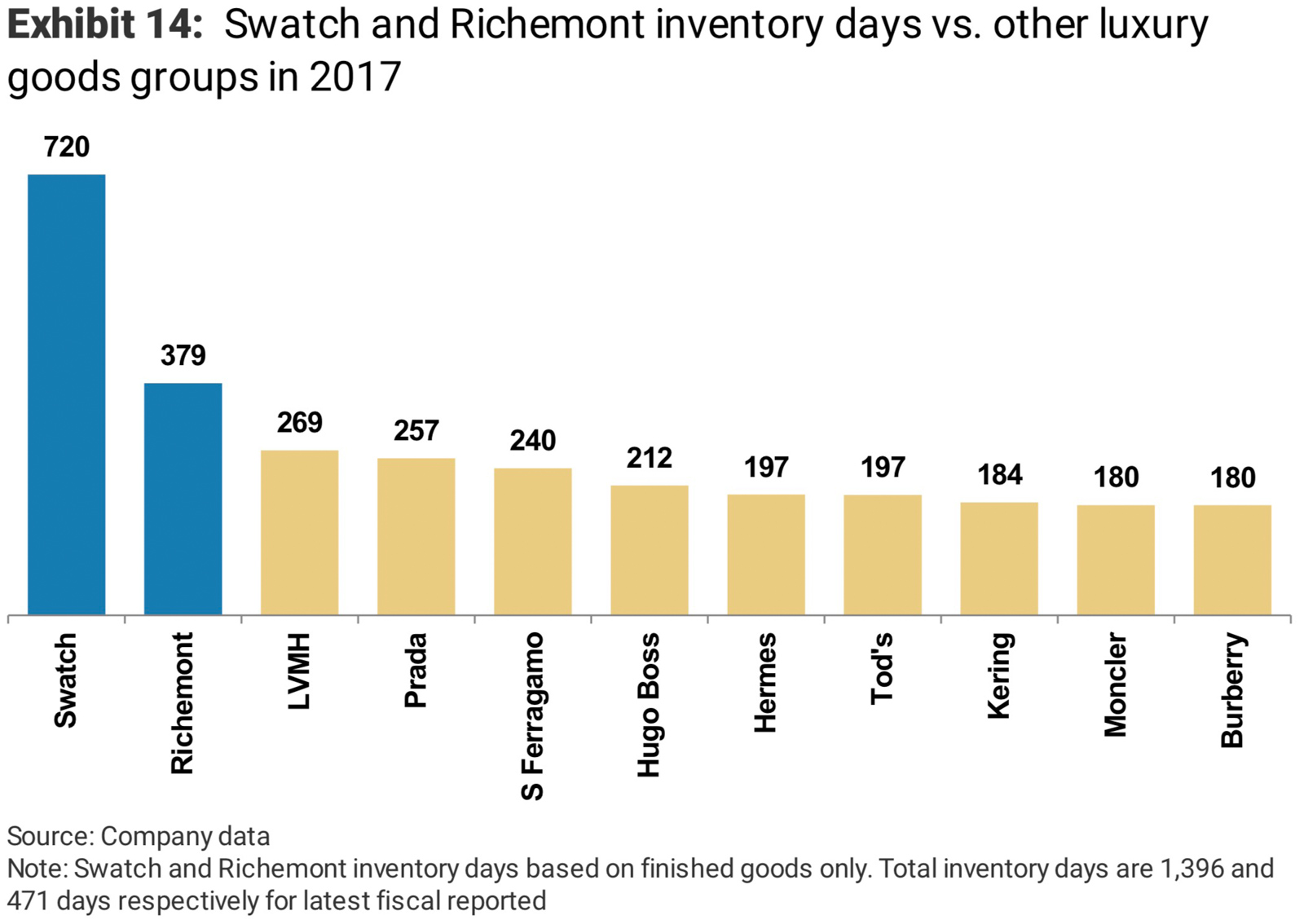

Watch makers have the ability in many instances to buy back stock of watches that aren’t sold by retailers. This happens quite a bit, and can be an effective tactic used to clean up over-saturated markers. It is however very expensive, so the question is how can brands afford it. Morgan Stanley estimates that half of the Swatch Group’s entire capital could be removed if they purchased back their unsolved inventory. This is why Morgan Stanley cautions that the short-term outlook for the watch industry is murky at best, even if long-term outlook is much more positive.

When watch brands purchase up unsold inventory they are sometimes actually compelled to directly sell it into the gray market. Under Morgan Stanley’s advice that would only make the problem worse. Morgan Stanley admit that the cost of purchasing back unsold stock while at the same time decreasing production volumes and in-market sell-in will have a very challenging impact on watch brands. They admit that larger brands will fare better and likely survive in the long run. The issue is essentially that brands need to invest large amounts of money to clean up the availability of discounted watches which hurt their markets. At the same time, they need to survive several years of potentially significantly lower sales than they expect or need. They also need a lot of the other major players in the watch industry to do the same thing. Only after a few years of that will the industry “normalize” into some performance plateau and if everyone plays nicely and by the rules can they all enjoy slow and steady growth thenceforth.

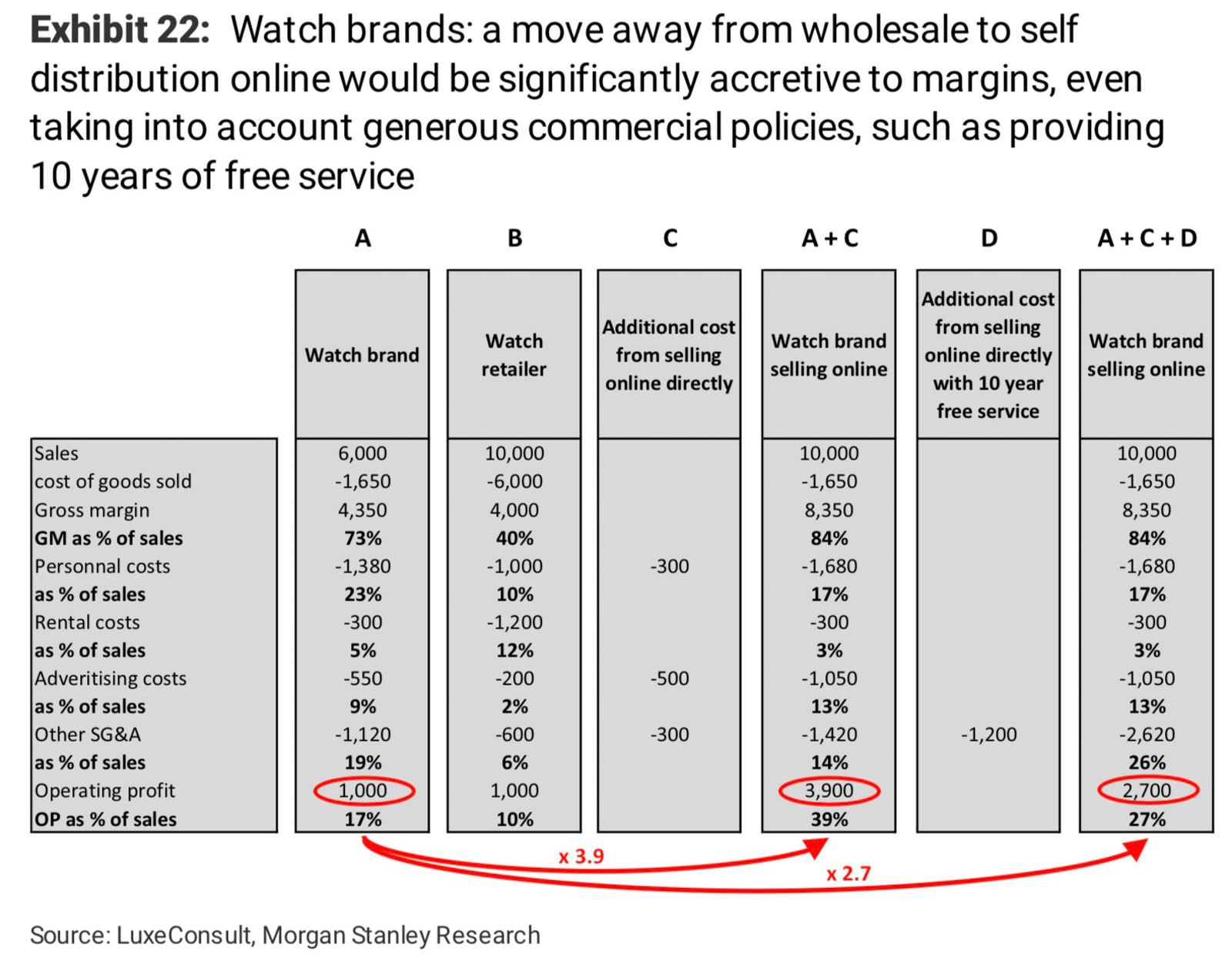

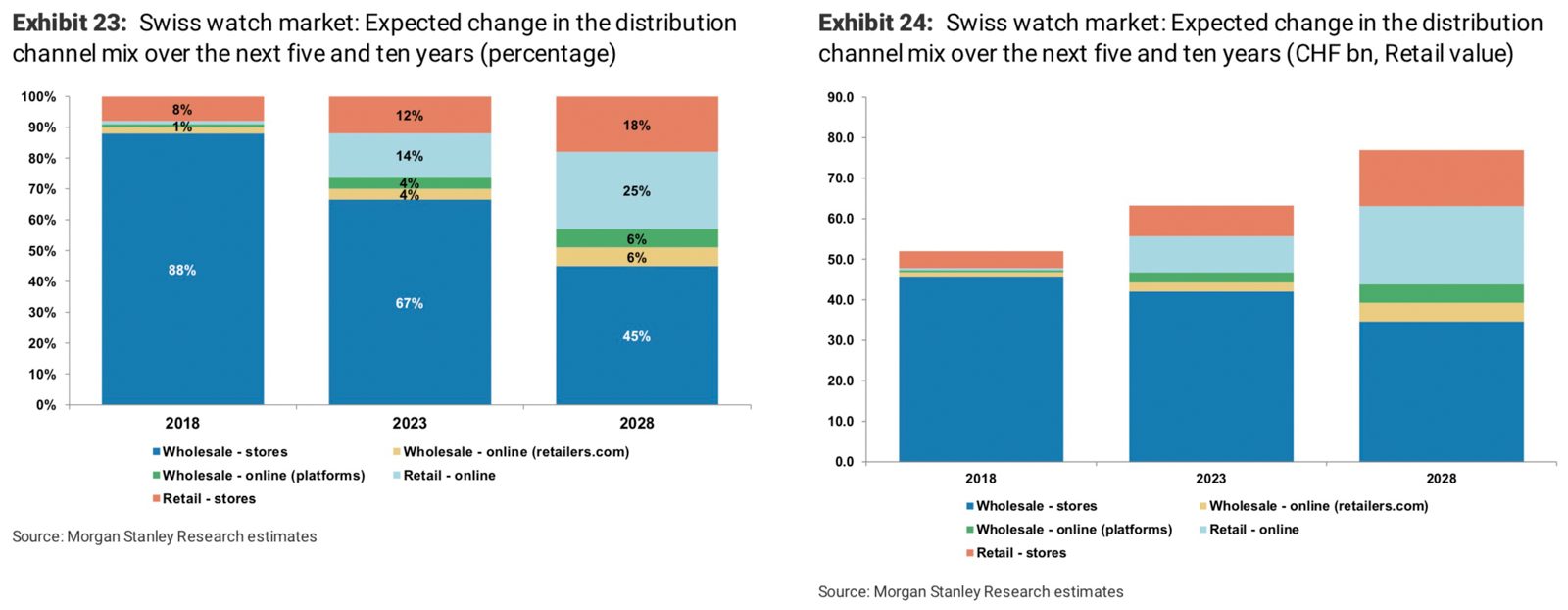

On the plus side Morgan Stanley predicts that more than half of all consumers will prefer purchasing luxury watches online in a few years as soon as the marketplace for luxury watches online is more well-established. When this happens they argue that brands will have immediate and direct access to data which will help prevent oversupply issues in the future. Watch brands will also be able to capture 100% of their retail margins if they sell direct and no longer use third-party retailers. Yes, just as we’ve seen for years in a row, traditional third-party authorized watch retailers will not only continue to decline, but serve no purpose for at least some watch brands now or in the near future. Almost a decade ago I discussed how the “doomsday for watch retailers” is coming in an aBlogtoWatch article and my predictions continue to be accurate.

What I don’t agree with in Morgan Stanley’s report is that the future of watch retail is all digital and all direct to consumer. I predict that 80% of Swiss watch sales will be direct-to-consumer and 20% will still be conducted via third-party multi-brand stores. Familiarity with the consumer will immediately lead you to recognize that at least some customers (my guess is about 20%) do not wish to buy directly from the brand but via a “trusted” third-party confidant-style sales person at an independently owned watch retailer. These remaining enthusiast-run watch retailers will likely enjoy relatively close relationships with watch brands and are not likely to directly contribute to future gray market watch supply issues and are thus likely healthy for the future of the watch industry given their role with many market trend-influencing consumers.

China & Smartwatches Continue To Confound The Swiss Watch Industry

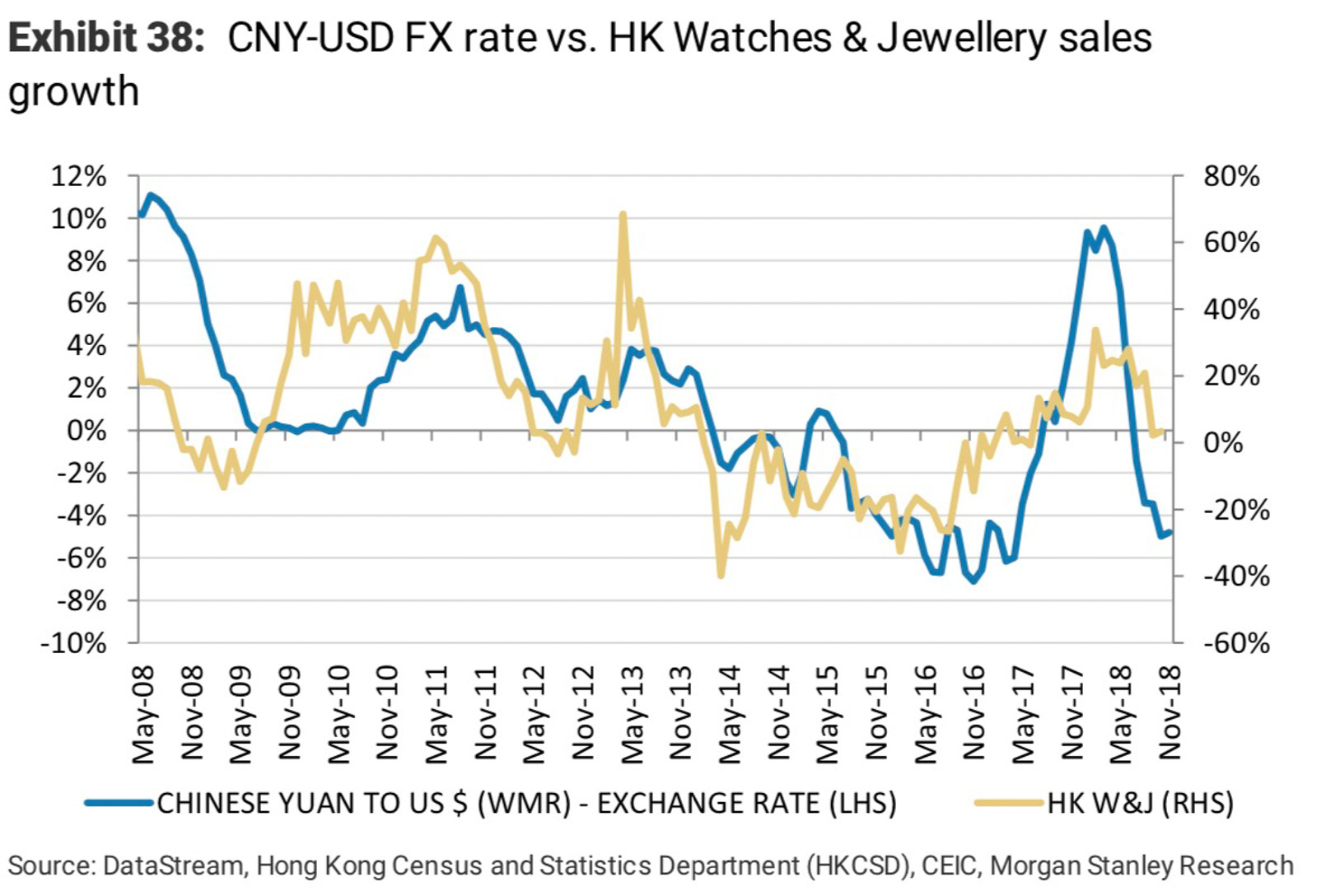

Growth in China is necessary for a healthy future for the Swiss watch industry. Previous attempts to enter China’s large market under a regime where grafting was accepted ended a few years ago with the introduction of new Chinese government clampdowns on perceived corruption. Today, the real growth in China will be related to its burgeoning middle class – a statement Morgan Stanley’s analysts agree with. Entering China has its rewards because the culture currently is still very receptive to European luxury products as well as status-indicating accessories. China’s market growth depends more on the Swiss watch industry carefully cooperating with local officials and business partners and less about marketing challenges or current market size caps.

China is mentioned in the report primarily because it is among the only regions on the planet with a watch-friendly growing middle class able to feasibly support demand to fuel Swiss watch industry production needs. Other important markets around the world need to be reformed in one way or another presenting their own sets of complex challenges and uncertain outlooks. It would have been appropriate in Morgan Stanley’s report to include some comparative data on the status of other watch markets and why a focus on China alone was not a wise direction. My instinct tells me that while China is indeed a market ripe for maturing, there are other more established markets that can return to more profitability by applying studied reforms. In reality, the watch industry needs to consider a global market, taking into consideration cultural preferences and tastes on a regional level, while not letting any major market feel neglected or mismanaged in regard to marketing or service. In fact, it may be the case that watch brands are better off serving fewer markets well as compared to many markets haphazardly.

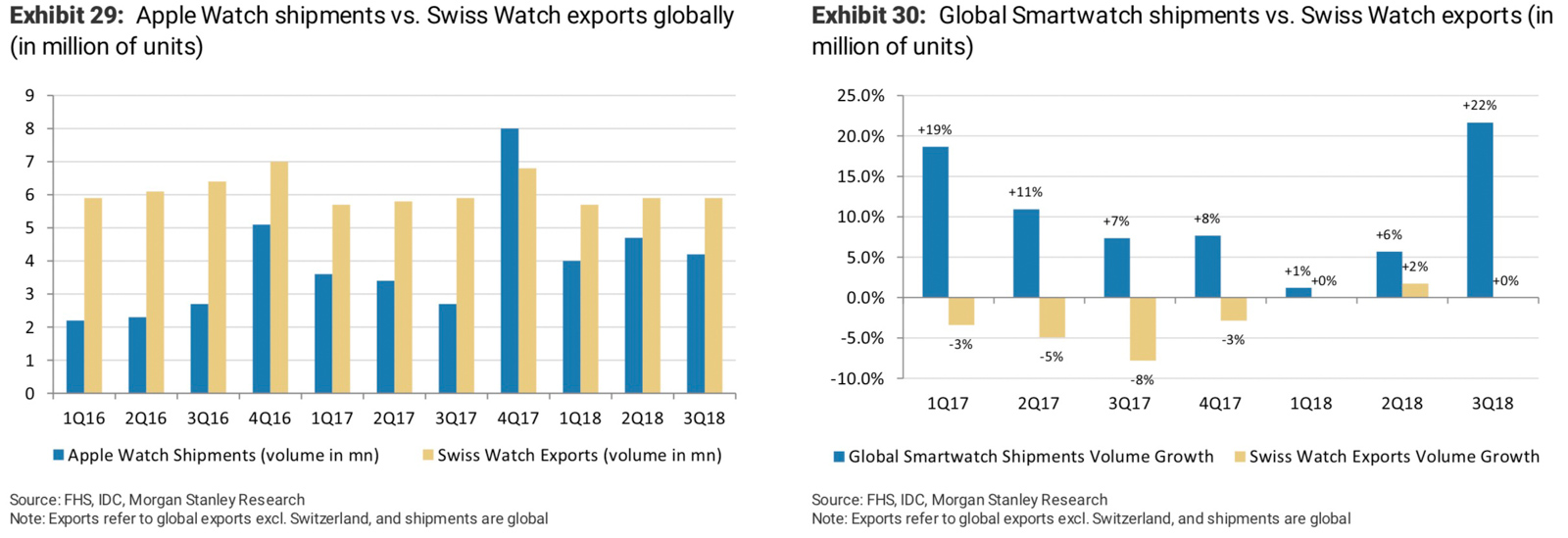

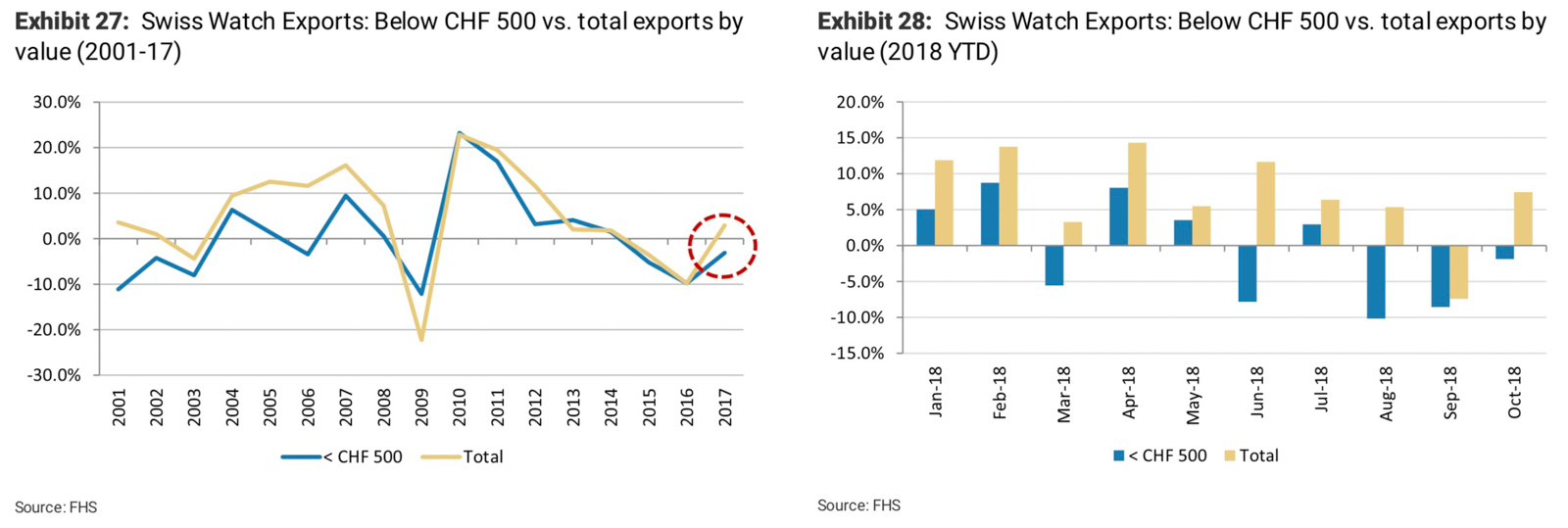

On smartwatches, Morgan Stanley suggests that their impact on Swiss watch sales is growing, but not in a way that would defeat the Swiss watch industry. I’ve said this as well, stating that the real luxury side of the watch industry would remain appealing for enthusiasts even in an era dominated by smartwatches. Morgan Stanley cites that it was previously suggested that Swiss watches priced at 500 Swiss Francs and under would be those primarily affected by the sales effects of smartwatches as a competitive product on the market; a statement which Morgan Stanley says is supported by recently collected data. No evidence exists suggesting that smartwatches are having any current appreciable impact on Swiss watches priced at 3,000 or more Swiss Francs since watches in those segments have, according to Morgan Stanley, consistently outperformed watches priced at 500 Swiss Francs or lower over the last several years.

“Highly Disruptive” Defines The Swiss Watch Industry For The Next 3-5 Years

To summarize the outcome of the Morgan Stanley report, they suggest that the problem of over-inventory of watches, the cleaning up thereof, as well as the cost and stress of transitioning to a more direct-to-consumer distribution sales platform will be “significantly disruptive” to the Swiss watch industry. Outlook for the next three to five years are bleak with regards to profits, with likely losses coming as necessary sacrifices in order to build a foundation for a solid Swiss watch industry future. Brands unable to stomach the cost of disruption will be part of the fallout, but with disruption comes innovation and the promise of new talent and creativity in the watch industry.

None of Morgan Stanley’s discussion or conclusions are novel and have been preempted by a number of entities including aBlogtoWatch. It is good however to see that our conclusions survive intense scrutiny under the standards of Morgan Stanley’s reporting department. In my words, the watch industry will need to get smaller before it can start to grow again. There is a beautiful future ahead for watch lovers, but the next few years are going to be chaotic and contentious for many players in the industry. That is especially true for those whose profits come from a branch of the watch industry now considered an overgrowth that must be trimmed. The best brands and employees will survive even if “three to five years” is an underestimation of how long it will really take for the industry to reform itself.

What I see as the biggest challenge isn’t the eventual discovery of effective means to produce, market, and sell watches in the future. This will also come as a natural result of trial and error by players in the market. My worry is that brands will predictably disagree about when changes must occur and thus all proceed to the future at different paces. In other words, a few stubborn brands not wanting to get with the times can effectively hold back the entire industry. As I discussed above, the industry’s ability to earn profits is being damaged by there being too few willing consumers interested in paying retail prices. Just a few brands with widely published discounted prices has a very deleterious effect on consumer confidence and thus buying behavior.

If any part of the bullwhip effect is true, then it is related to poor communication across various regions of the watch industry. Poor communication will lead to differing ideas about how to proceed according to the prescriptive advice given by Morgan Stanley. Not only that, but some brands could “get the message” years too late. What is needed sooner than later is an industry-wide consensus on what they want the future of the watch industry landscape to look like. Without a unified agreement about smoothly transitioning to the next era of the watch industry, the next several years will be fraught with avoidable conflict and resource waste. If the collected watch industry manages it, then effective consensus about strategy and diplomacy will lead the watch industry forward. Hey, and aren’t those qualities what Switzerland is supposed to be known for? They won’t even break a sweat on the road to recovery.