Investor services firm Morgan Stanley recently released a research report on what its analysts feel are the most pressing issues that will affect the profitability of the watch industry now in 2018 as well as in 2019 and beyond. Predictably diplomatic in vocabulary, the report nevertheless offers stern warnings to investors expecting profits to increase anytime soon from publicly traded-companies that rely on the revenue from wrist watch sales. I think Morgan Stanley does not get everything right in the 44-page report – especially in some of their analysis to explain the relatively sound data they use.

While the analysts do understand the larger structure of how the watch industry more or less produces and profits from watches, the report doesn’t take into consideration important details about the watch purchasing or marketing experience that is crucial to explaining certain aspects of buyer behavior. More so, I’ve come to understand that until recently, much of the watch industry and those who report about (such as other investor services or third-party management firms) it for investor purposes have mostly espoused optimistic news about the current state and near future of the watch industry. I’m now starting to see more sobering accounts of what the watch industry is actually going through. Especially reports that confirm and support the very same analysis and conclusions myself and the aBlogtoWatch team have already come to and written about at length. Yes this is positive for the ego, but more important it confirms the saliency of many reforms aBlogtoWatch routinely recommends to the watch industry that makes the products its community loves. Let’s now take a look at the Morgan Stanley report (which you can download here).

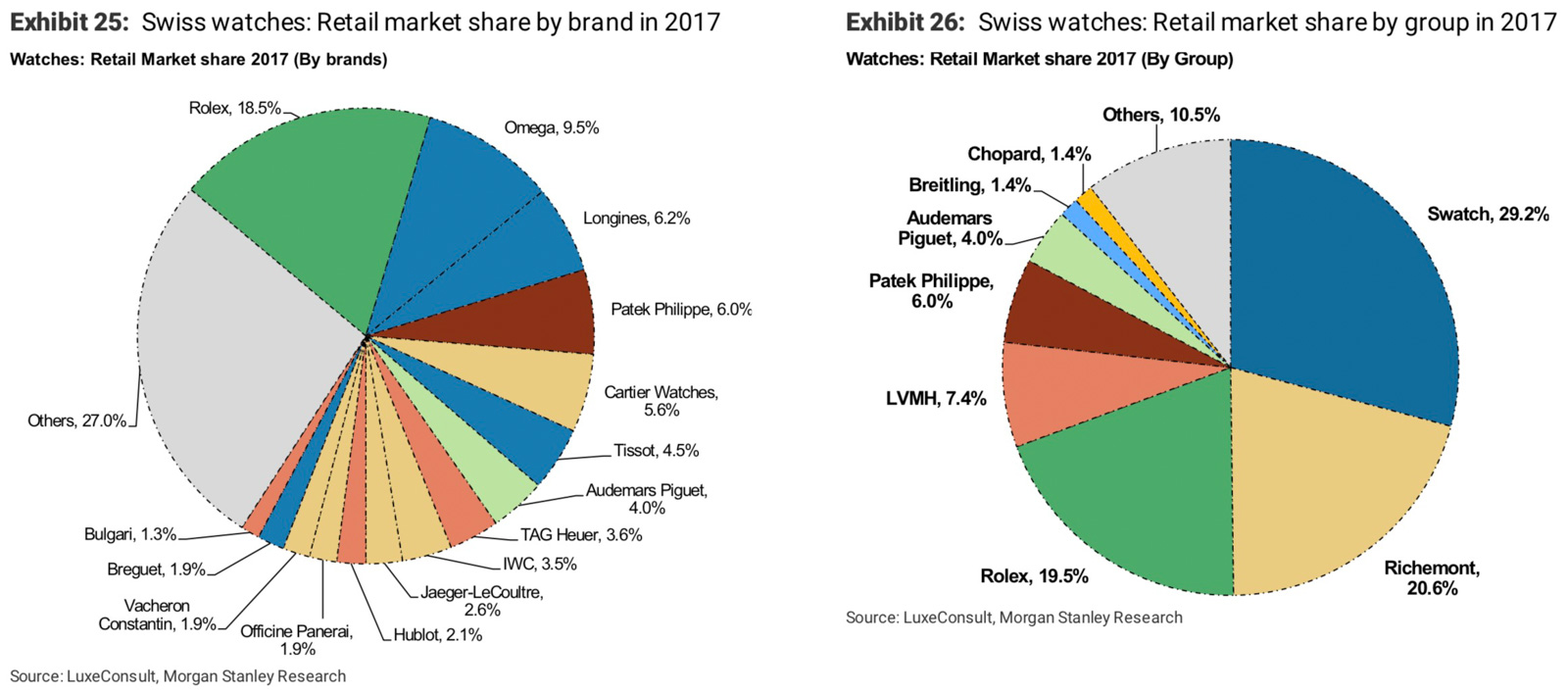

The name of the Morgan Stanley report (which is surprisingly dry) is “DTC and the Bullwhip Effect: A bumpy transition ahead for the Swiss watch industry.” Bumpy transition, eh? Well that might be an understatement, as the watch industry is facing more than mere turbulence according to Morgan Stanley. The main purpose of the report is actually as part of an investment recommendation for what to do with stock from The Swatch Group AG and Compagnie Financière Richemont SA, i.e. the Richemont Group; both of which are publicly-traded. I believe that only qualified and licensed people should be giving investment advice and if you are keen to read the reasoning behind why Morgan Stanley downgrades its stock purchase recommendation for both conglomerates then you can easily reference the report.

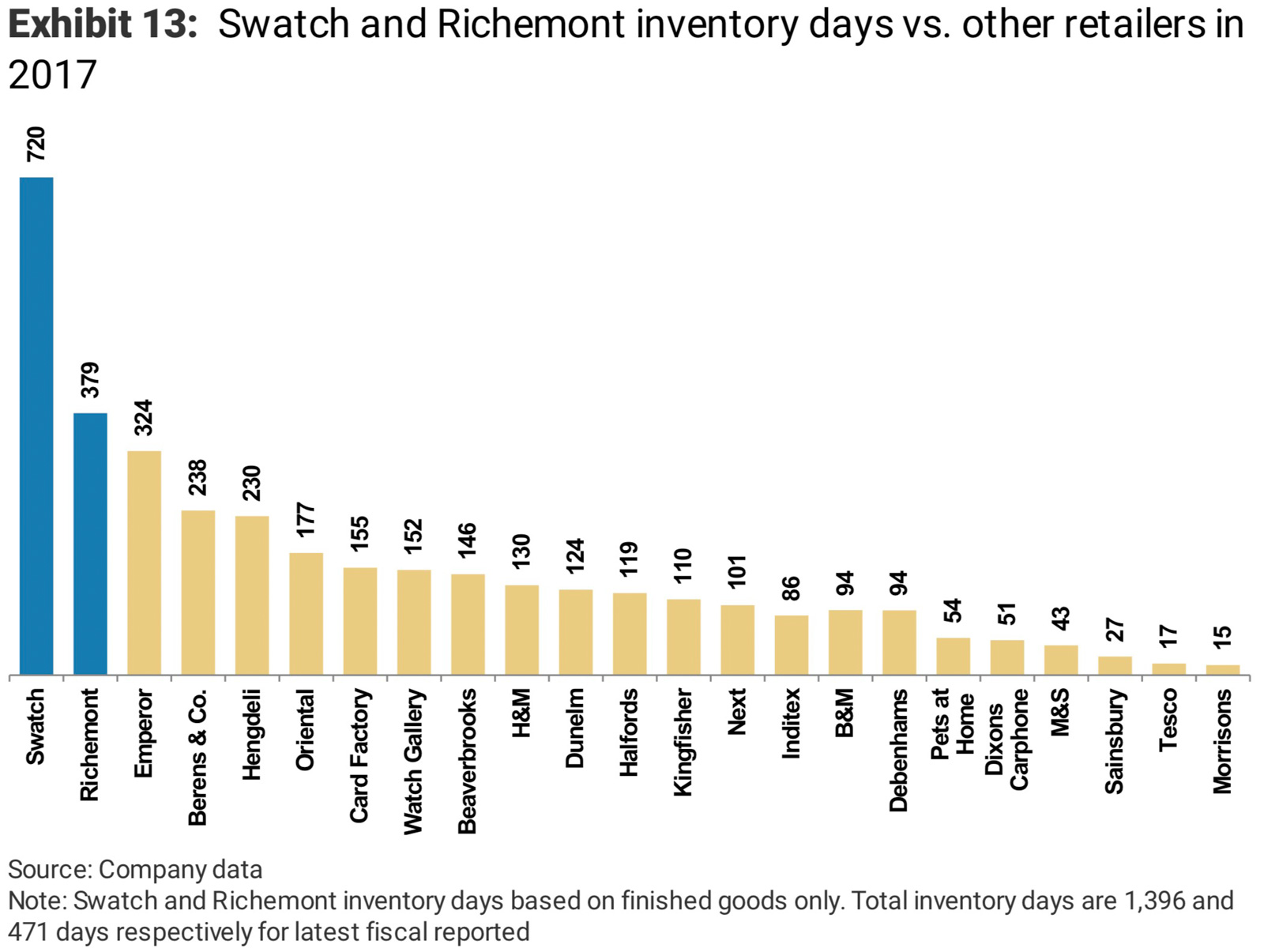

I will talk about the report’s discussion of data they analyzed about the watch industry itself as the report does not maintain its investigation to data exclusively from The Swatch Group or Richemont. In fact, there isn’t too much data to actually use. Available data comes from shareholder reports (which are surprisingly spare in material facts), information released by the watch industry regarding Swiss watch exports, and some still available data about retail sales. Much of the rest of the data was seemingly acquired using various sophisticated forms of scraping internet data. For instance, the report suggests that there is a whopping 16 billion Euros of unsold watches in the hands of third party retailers and regularly references the average percentage that many timepieces are sold at a discount for. So I credit the report for at least using the scant available compiled data on the topic as well as seeking additional data to analyze. I say this because many lesser reports of this ilk don’t even do that.

While the Morgan Stanley watch industry report focuses on problems of overproduction of timepiece products and the impact of a change to a direct to consumer (DTC) distribution model, it also touches on tangential topics such as outlooks for the watch industry in China as well as the enduring effect of smartwatch sales on the demand for traditional luxury timepieces. People trust names like Morgan Stanley and their reporting in general is of course pretty good. So if you are interested in the business of making watches today, then the outcome of the report should be of interest to you.

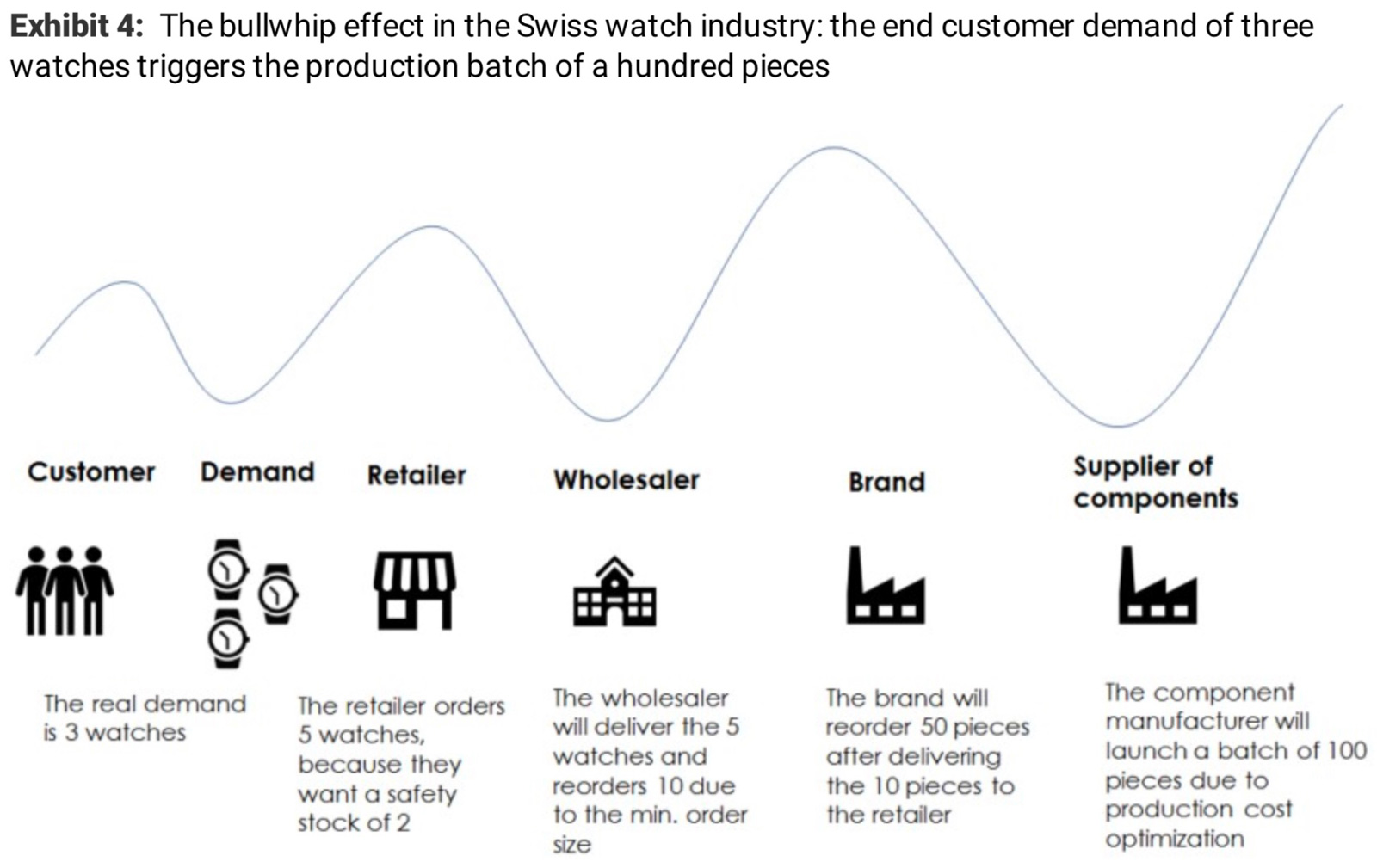

The Bullwhip Effect Means That Too Many Watches Are Being Made

Use of the term “bullwhip effect” really isn’t necessary in the report and feels like one or more of the writers felt that it was a good occasion to a few too many times try to apply this concept. The basic idea is that like the wavelength amplification effect observed in a snapping whip, a pulse of demand at one end of the supply chain ends up getting exaggerated by the time it hits manufacturing output. The result is a miscommunication between market demand and supply which, according to Morgan Stanley, caused the watch industry to produce more watches than end-consumers could ever be hoped to purchase.

Morgan Stanley remarks that the bullwhip effect of overproduction is caused by problematic communication between parties at all ends of supply and demand. It is certainly correct that the watch industry has a legendary problem of obtuse communication – even friendly companies – but I’m not so sure the overproduction issue is related to ignorance among key players. Overproduction of watches and inventory gluts are two parts of the same issue. Morgan Stanley fails to really address why overproduction occurred which led to the dramatic problems of oversupply. In fact, Morgan Stanley even goes to appreciable lengths to determine if poor production planning and management are historically common in the Swiss watch industry and why they may have done it. Their conclusions are less than flattering to the watch industry, but don’t actually offer solutions or healthy recommendations on this important area.

A couple years ago when writing about how The Push For In-House Movements Ruined The Modern Watch Industry I introduced a new motive for why overproduction of watches was happening and made it very clear such actions were intentional. In my opinion, overproduction in the Swiss watch industry is not the result of a “phenomenon” such as the bullwhip effect, but rather is related to demands from manufacturing bases to produce sufficient inventory to justify the size of those manufacturing bases. In other words, the watch industry made itself too large (needing to sell too many watches to support itself) by building up a series of unnecessary and redundant factories to produce products no one wanted. I recommend that article if you are interested in the problem of watch industry oversupply.

Morgan Stanley and I both agree that in general the watch industry has been routinely making more watches than the market can bear to purchase. Even if this happened at first because of a bullwhip effect, it has been happening for so long that it continues quite knowingly by watch brand managers. That means the Swiss watch industry was producing more watches than it knew it could sell. That has put it in a very vulnerable position that will be “highly disruptive” according to Morgan Stanley because of how dangerous long-term oversupply can be in the luxury industry.

No specific advice that I can see is given to the watch industry about how to reduce oversupply – with the Morgan Stanley analysts perhaps believing the watch industry will reduce production if they learn they are making too much. Because of the needs to support a manufacturing base, my position is that the Swiss watch industry will continue to resist reducing production further perpetuating the oversupply problem.

Some Brands Overproducing Watches Can Ruin It For The Industry As A Whole

Now comes more of my own analysis which Morgan Stanley doesn’t remark on, but is related to data they are working with as well as the conclusions made in the report. Morgan Stanley discusses overproduction of watches at groups like the Swatch Group in detail, and also remark about the large availability of discounts online – not to mention the finicky nature of consumers today. All of these topics are in the report but they aren’t always connected together.

My theory is that when you have a large volume of watches listed online with published discounts, it can have a direct negative impact on all watch sales online, even for those models and brands which do not have published discounts. The reason is because mass discounting of just a few name-brands can lead consumers to believe that the entire product category is over-priced and thus most retail prices in that category cannot be trusted. Such mass discounting of watches occurs in such a widespread manner as to become the norm. Consumers for wrist watches are even loathe to purchase at full retail price unless they sense cause to believe the product is not only scarce, but prized by others. Most watches sold today cannot be sold at full retail price. This is a problem the watch industry allowed happen, and further fueled by consistently overproducing watches for many years in a row.

The Swiss watch industry as a whole must have a market place without a major deviation in published prices in order for the entire product category of luxury Swiss watches to enjoy high consumer confidence. Even though not all popular watch brands are available for readily discounted prices on the market, more than enough are, to put consumers in a defensive position anytime they are asked to spend full retail price on a timepiece they want. The perception is that it isn’t necessary to spend full retail – so if you do it is because you might end up selling the watch to someone later on if you are lucky.

This is one of the “highly disruptive” situations Morgan Stanley alludes to but doesn’t outright confront in the report. The data analyzed supports my above conclusions as Morgan Stanley comes to their next point of the two difficult options the watch industry has in order to respond to overproduction woes.