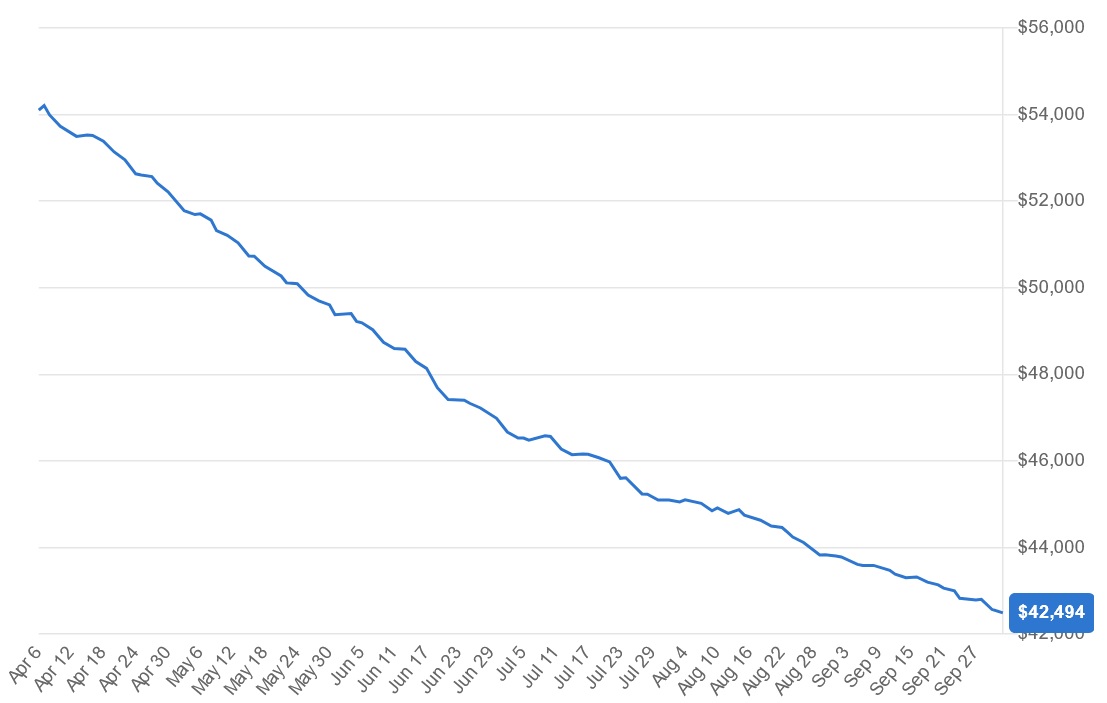

Source: WatchCharts Six-Month Market Index uses the average price of 30 popular watches (including the Rolex Daytona, Patek Philippe Nautilus, and AP Royal Oak) as an overall market indicator. This graph represents the six-month period ending September 2022.

“A lot of people got screwed,” laments a fellow watch enthusiast during a recent discussion about the state of the hobby. He was specifically referring to the current downturn in watch prices (let’s be honest, primarily Rolex prices) in China. His point was that a lot of people overpaid on a lot of watches they were told would hold or go up in value. In China, as in many hot zones of wristwatch enthusiasm, many people have (for one reason or another) been asked to pay above retail — often way above — for the watches they want.

Why would someone be motivated to spend over retail price to get a wristwatch? There are two simple answers. One is that they really want a hard-to-get item and feel that the status upgrade of wearing one is worth the asking price. This is, for the most part, an entirely subjective value proposition, but the allure of owning something exclusive does have value. The second reason someone would want to pay more than retail price for a wristwatch is that they view that watch as an asset. No, you aren’t buying a watch to wear, but rather you are buying a commodity that could go up in value. So if you buy “low,” maybe tomorrow you can sell “high.” This is the predominant psychology behind the practice and is, in large part, based on a lot of pundits in the marketplace (mostly watch retailers) pumping up the promise of value increases and future demand. I wrote a great deal about the topic of wristwatch purchase and sales speculation when it began to really take off back in 2018.

For nearly five years now, the once straightforward market for luxury timepieces has been markedly changed by the new type of selling philosophy that I mentioned above. At first, it was strictly limited to a few popular models that became class icons that enjoyed demand beyond your typical watch lover’s interest. Social media popularity did wonderful things for watch appreciation and awareness, but it also created pockets of mega demand for certain models — demand that remained high after consumer interest naturally shifted because, rather than a lot of those watches flowing into the hands of owners, they went into the hands of dealers who took advantage of their popularity and began a steady campaign to increase the price of those watches. This behavior gained traction due to a variety of geopolitical circumstances, including ailing interest in traditional investments, as well as loads of economic uncertainty. In early 2022, I wrote at length about the challenges watch enthusiasts faced in buying once accessible models on aBlogtoWatch here.

There are two main reasons why I have focused so much over the last few years on talking about watch pricing and availability. I think it is especially important to discuss my reasons since a lot of other watch media has either glorified overpricing or seemed to ignore that it was happening altogether. The first reason is that I disagree with the premise that buying a wristwatch is a wise financial investment and thus something to buy with the anticipation that it will be worth more in the future. The second reason is simply that so many aBlogtoWatch audience members have reached out with questions, concerns, outright shock, or deep resentment about the issue. When the marketing materials people are viewing suggest that they should be “investing” in watches by buying Rolex models at over retail price, and when the corresponding reality is something very different, I think it naturally causes cognitive dissonance in the minds of watch lovers. That results in negative feelings, something I prefer to keep away from watch collecting, which, like any hobby, is meant to bring joy.

While watch media is my job, it is a leisure pursuit for most people who spend time and money on wristwatches. Part of my larger agenda is to keep the hobby fun and appealing to the types of people who want to enjoy and wear watches as an end in itself. I also wish to ensure that people don’t have to spend more than they have to on an already expensive hobby. People also tend to purchase watches as a means to reward themselves. Things that frustrate that experience, such as rampant product unavailability or gross price markups, are hurdles that get in the way of the core economic activity this hobby is reliant upon. Not being able to get the watch you want for those reasons introduces a lot of negative emotions and can turn some people off to the hobby entirely. My desire is to be protective of the core economic activity that I believe is at the heart of a healthy modern wristwatch hobby industry. Players in the watch sales economy dedicated to artificially increasing costs only benefit themselves. Collectors don’t gain by paying more, and watch brands don’t gain by dealers earning even more on markups. So, for these primary reasons, I take serious issue with efforts designed to reduce the supply of watches or increase the cost of timepieces above their retail price.

After its release in 2021, the Patek Philippe Nautilus 5711/1A-014 was trading at over 10x its retail price

Earlier in 2022, I made one final entry to my discussion of the “investment watch economy” and offered suggestions for consumers on how to determine the value of a wristwatch purchase in this aBlogtoWatch article here. The goal of that article was to help consumers consider if a watch was worth the purchase price or if there was potentially shady business happening behind the scenes. Throughout all of these previous discussions, one sentiment has been consistent: a warning that the “watches as a financial investment” era was eventually going to come to a halt. That started to happen in earnest by the second half of 2022. Over the last few weeks, a number of articles from a variety of media outlets have been shared with me. Each of them has a similar theme and the same news: The prices of Rolex watches, especially on the aftermarket, are starting to tank. The articles published before that merely claimed that prices of the most expensive models were softening. In my opinion, we are well on our way to a full readjustment of the economy surrounding many of these exaggerated prices.

That’s not to say that the pre-owned and new watch market is going to be identical in the future to the way it was 10 years ago. Certainly not, but I also feel it is too early to determine what the watch market will normalize into a few years from now. What I can say with a lot of confidence is that watches purchased as assets on any mainstream basis will soon come to a halt. I always said this would happen once traditional equities and investment vehicles start to earn slightly better returns, and also when major interest rates rise. The latter has already happened at full speed, and it has had a direct and observable effect on people buying watches as anything but amazing items to wear. Another effect that is contributing to the economic adjustment I am discussing is the downturn in the cryptocurrency trading market. Steep declines in the value of those prospective items had a highly observable negative effect on the volume of people purchasing watches at over-retail prices.

Don’t expect over-retail watches to go away anytime soon, though. There is simply too much vested interest on behalf of a consortium of retailers to keep the status quo going since it has been very good for their bottom lines. Even though consumers are decreasingly willing to spend extra-high prices or buy into maintained rarity, the prize of getting someone to spend more than retail price (or a fair pre-owned price for a used watch) is just too great for retailers to give up. More so, consider all the investment that went into marketing and PR campaigns by everyone from pre-owned dealers to auction houses with the message that “people are investing in watches.” These interested groups are not going to give up, and they are not going to so easily come back down to earth with their pricing policies. Where they should be offering watches at the prices consumers are willing to spend, they are instead attempting to manipulate the consumer by training them on what “these amazing assets are worth.” Again, I am not against anyone making a fair margin for products and services, but as I have described before, these overpricing practices are parasitic.

My suspicion is that the types of articles that have thus far been shared with me about decreasing watch prices are only going to continue, and I don’t want anyone to be surprised. That said, I do want to make sure people understand the limitations of what this discussion is about because, while it refers to an important part of the wristwatch market, it is by no means a comment on the entire watch market. In general, wristwatch demand from enthusiasts is high, consumer awareness is very strong, and the wristwatch industrial base is doing OK. What we are specifically referring to is a segment of the watch market dedicated to hyping particular watch models and brands, and playing a delicate game with availability (the watches are hard to get at retail price) and “market pricing” (the convoluted notion that the high prices are merely in response to high consumer demand). What we are actively seeing in the market are the prices of these hyped-up watches falling dramatically (think 20-60% year-on-year price decreases). The fragile structure needed to maintain these high prices is starting to evaporate because it simply does not meet consumer demand or demands.

Part of the price decreases are related to consumers simply no longer willing to pay higher prices, but it is also directly related to the start of large inventory sell-offs. This is what worries me the most and where I see a lot of unknowns. Right now, a lot of investors who held a lot of watches—or even just one watch—are trying to sell their watches for cash. This flooding of the market will naturally increase the competition and thus reduce prices. If enough watches are put on the market with the need to be immediately sold, all at the same time, it runs a high risk of a market crash sending prices into a downward spiral. This could have the effect not just of a softening of prices, but the total destruction of consumer confidence in the watch market and supply outweighing demand. This would first send prices into the deep negative, and after that would result in a situation similar to that of a few years ago, when huge inventories of unsold watches were on the market at very low prices. Adding to this concern is the fact that a relatively small number of entities around the world hold huge numbers of unsold and pre-owned watches. These inventories are huge financial liabilities, and if just one of those firms decides to exit the market and dump their inventory, it could have a very negative effect on watch prices, overall. This is another reason I have been so skeptical of mega-clearing houses that have gobbled up huge amounts of wristwatch inventory over the last several years.

What should this discussion mean to the average watch enthusiast? For most people, I think the wisest advice is to remember aBlogtoWatch’s recommendation that “friends don’t let friends spend over retail.” There are so many good watches out there that need a good home that you never, ever need to spend over retail price to get something nice on your wrist. I think there is also a strong message about feeling better about not wanting to spend over retail, and comfort in knowing that certain watch “valuations” are coming back down to some level of normality. It remains true that the majority of aBlogtoWatch audience members are the types of buyers who were always turned off by the idea of buying a wristwatch as an investment. Now, perhaps they have more ammunition to use when attempting to explain that wisdom to everyone else. The best thing you can do is purchase a new watch at retail price or a pre-owned watch at used product prices. Please do share your thoughts about the rest of this discussion below.