A new study about watch consumer behavior and e-commerce has come to some important conclusions about how people make decisions when it comes buying watches online. The report, “How To Increase Your Online Sales: Mastering The Online Consumer’s Purchasing Process,” was spearheaded by veteran strategist and software engineer Gael Parfaite and is intended to offer data-based insight into the luxury watch industry. Most luxury watch brands today have a primary mission to better understand how to capture more online sales in an era when in-store commerce will be limited for the foreseeable future. Gael Parfaite has 22 years of experience in the space and is currently an E-Commerce Optimization & Conversion Consultant Specializing In Luxury Watches.

The independent study began by taking 20 websites Mr. Parfaite identified as being relevant to the watch industry or the watch consumer buying process, then scoring them against one another using a process specially created for the project. Parfaite’s methodology includes a metric called the “GPP Score,” which is a totality of performance metrics across a few inquires, such as search engine rankings, on-site assets such as the value of community comments, and how a website overall is demonstrated to assist in the consumer decision-making process. The report further tracked how the 20 websites performed in various search engine inquiries across 45 different popular watch brands. The goal of the report is not only to rank the importance of the websites against one another but also to precisely explain the behavior employed by consumers when making decisions about buying watches online, and what tools they use to make the decisions that lead to purchases.

Insight such as that in Parfaite’s report is absolutely crucial to an industry being forced to accelerate is drive to move sales and marketing operations online. Much of the watch industry still has less than a decade of real experience dealing with consumers on the Internet, and many are only seriously beginning or attempting to ramp up e-commerce in 2020. Parfaite’s specialty is the consumer behavior side of the equation, which combines an understanding of psychology as and an ability to track the paths consumers currently take in their journey to learn about and subsequently purchase luxury watches.

To further discuss the “How To Increase Your Online Sales” watch industry report, I spoke to Mr. Gael Parfaite himself with an interview below. Allow me to share an important disclaimer on account of how favorably the report has positioned aBlogtoWatch.com. I feel compelled to remind our audience and readers of this article that aBlogtoWatch not only had nothing to do with the creation of the report , we also had no knowledge of the study and report until it was completed. Mr. Parfaite was not known to be me prior to the conclusion of assembling the report, and while the aBlogtoWatch team is proud of the report’s results, it was accomplished entirely independent of us.

Now that I’ve been transparent with our lack of involvement in the process, I can say that Mr. Parfaite’s report came to the conclusion that aBlogtoWatch.com is the most influential website when it comes to the watch consumer decision-making process. For this, I can only thank the aBlogtoWatch team, as well as the larger wristwatch enthusiast and buyer community who have both followed and believe in our core mission as being a trusted resource for the people who love and purchase timepieces. The following is my conversation with Gael Parfaite about the report. A link to the full PDF of the report is available via a link at the end of this article.

Ariel Adams (AA): The report you created seeks to help watch brands identify where consumers go to make decisions about buying watches online. Share some context as to both why you created the report.

Gael Parfaite (GP): Alongside the eCommerce revolution, perhaps a bigger transformation has taken place. The Internet has changed how we make purchase decisions.

In 1999, for my 30th birthday, I wanted to buy a top-of-the-range home cinema sound system. Professionally, I had achieved some of my goals, and I was making a decent amount of money as strategy director. I thought it was time to reward myself and buy a top-quality home cinema sound system. I did not know much about sound systems and did not intend to become educated about it. I just wanted the best home cinema sound system to please myself. I visited high-end specialty stores, asked questions, got brand and model recommendations from the store clerk, and asked a friend who knew a lot about the subject. A couple weeks later, I bought the sound system of my dreams in a specialty store, at a price to match the high opinion I had of myself.

Today, this buying journey would be totally different. I would go directly to Google and search for the best home cinema sound system, visit a couple of dedicated websites to get brand and model recommendations, read online forums and online comments about it, and finally go on Amazon to buy it. Then, I would wait for it to be delivered, with the total confidence that, if it did not match my expectations, I could return it to Amazon.

In the past, brick and mortar retailers defined what we, as customers, could buy. We relied on them to give us advice on the most suitable product for our budget. Many retailers built their reputation by sourcing the best products for their customers and gain influence on the buying decision.

Retailers used to provide the only access to local customers for watch brands; this meant that no retailers equaled no market access for their watches. As a result, watchmakers spent a large amount of money and time to secure their relationship with retailers. Some watchmakers believe retail distribution to be the most valuable and sensitive asset they have, which is not to be upset in any way. This would still be true today if consumers bought watches like they did 20 years ago. But the Internet has changed the landscape, as well as how and where consumers make their buying decisions.

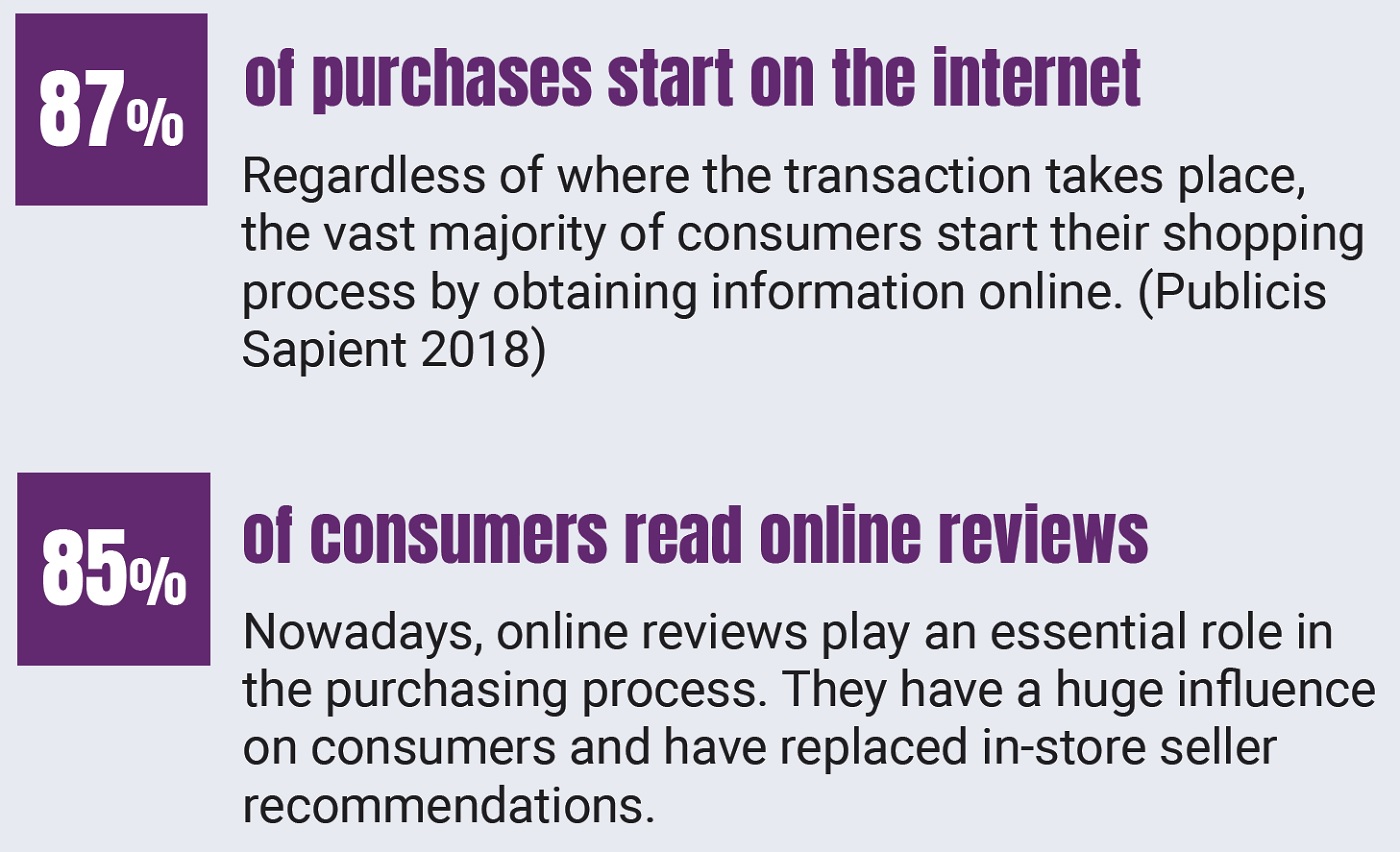

Today, the vast majority of consumers make their purchase decisions using Google. Even after a recommendation from friends and family, people go on Google to “check it out.” The information obtained from Google will make or break the buying decision. Online reviews and comments have become the most influential source of information for consumers. This trend started about 15 years ago and is getting stronger every year, influencing 8 out of 10 buying decisions in 2019. This is a major shopping evolution: It relocates the consumer’s buying decisions away from retailers in favor of websites listed on Google results.

This study initially aimed to identify which watch websites on Google are most visited by customers during their buying decisions. Most of these customers are not necessarily regular readers of watch websites. For some, it will be their first and only visit. But at this specific moment, when they are considering a watch to purchase, they want to hear what the experts and aficionados are saying about the watch they want to buy. Online reviews on these websites, including the subsequent discussions among watch aficionados, play a critical role in the success of watch brands.

AA: Why you were the right person to approach answering these particular watch industry e-commerce questions?

GP: I have now been directly involved in the digital transformation of three major industries: the travel industry, the insurance industry, and the banking industry. In each of these sectors, most of the action is now purely online.

I have advised large companies during this specific transition so they can benefit from new opportunities created by this online evolution. The transition from physical retail to an online direct-to-consumer is familiar territory that I have learned to navigate over the last 22 years.

For watch brands, the fact is that if the vast majority of your revenue is not from selling online directly to consumers offering an outstanding value proposition, you will probably be out of business within a few years. This may sound outrageous to some, but this is what we told travel agencies in 1999. Since then, many big high-street names have disappeared, replaced by lastminute.com, booking.com, or expedia.com. Today, who goes to the high street to book a flight?

Within five years, it will be: “Who goes to a store to buy a luxury watch?” Don’t be mistaken, this is a massive, once-in-a-lifetime opportunity for watch brands because the vast majority of people will want to buy watches direct from the brand. On the other hand, watch brands that do not invest in their digital transformation to direct to consumer with a great online value proposition will go bankrupt. Some watchmakers will see their brand purchased by companies that did transform into businesses selling direct over the Internet (see 1983; history repeats).

AA: Selling watches online directly to consumers is probably the most important topic being addressed by a number of major watch brands in 2020, and likely in the years to come. Can you offer your personal summary of how well brands are approaching this task and how prepared they currently are for success? Explain some of the biggest challenges facing watch brands who have a mission to sell watches online directly to consumers.

GP: There is a common misconception that direct to consumer (D2C) simply means having an eCommerce website. It’s not. If it was, we could say that most watch brands are already doing D2C because many have an eCommerce website.

Successful direct-to-consumer (D2C) organizations are those that have redefined their relationship with the consumer and whose customers have become brand stakeholders. This required a change of culture on the part of the watch brands to focus on customers’ value proposition instead of focusing on nurturing their distribution network. The real opportunity for watch brands is to engage in a new value proposition with watch aficionados, where the only thing that matters is their relationship with their customer. Feedback and comments — even negative — would be welcomed, and all contributions to the watch brand would be valued and acknowledged.

We all have seen the rewards of such commitment to customers: loyal fans, advocacy of your brand on social media, online forums, and online groups. Users generating content posted daily on the internet. Large pre-ordering of new models. Queues waiting outside to buy your product at launch.

We need to understand that D2C will only be happening inside the sphere of influence (SOI) of the brand. You may have the best product in the world, but it can only be bought by people who have heard about it.

A brand’s sphere of influence (SOI) is made up of two groups: active people who, through their actions, are expending the brand’s sphere of SOI, and the passive people who know about your brand and your product could become buyers but don’t play an active role in expanding the sphere. The issue is that for most watch brands, most of their SOI active group are retailers — the same retailers that have been in crisis/decline since 2010 and will understandably not be in favor of watch brands going directly to consumers. For D2C to happen, a brand needs to have a healthy and growing online sphere of influence.

For me, the best people you need to have in your SOI active groups are, without a doubt, the “catalyst super posters” — unpaid fans who are ultra-active on discussion forums and social media platforms who are posting about your brands out of passion. As you know, Rolex and Omega have an army of these fans, but you can, too. They are everywhere online waiting for you to engage with them and become your most active friend of the brands. Sadly, most watch brands don’t know how to mobilize them.

Online reputation is the first step in growing your online SOI with active online fans, and it is the subject of my report. Unless a watch brand becomes successful in nurturing active fans to expand the brand SOI, their D2C will just be a website on life support with a constant need for marketing campaigns to make each online sale.

AA: While there are a small number of “digital native” watch brands out there, the majority of names in the luxury watch industry are traditionalists with a long history of retail and wholesale experience. Can you explain some of the major differences between selling watches directly to consumers online versus the practice of selling watches in bulk to retail stores that then later sell watches to consumers?

GP: The differences between selling wholesale and D2C are, of course, logistics, but more importantly, a change of business culture. D2C means shipping 500 watches to 500 customers, plus 500 individual payments, versus sending one shipment of 500 watches to a retailer with a single payment. Today, this is not really an issue; the explosion of e-commerce has created a very efficient fulfillment industry capable of delivering products in 24hours.

The challenge is changing internal business mentality from a B2B to a B2C way of thinking. This should not be underestimated. It will be important to tap the skills of people with online B2C experiences. Hiring staff with luxury retail shop floor experience, people who can translate their expertise dealing with HNWIs into online luxury customer service that will include a call center facility. This could be done at the Group level with a single operation for multiple watch brands. The technologies are available.

Smaller brands may want to join forces to set up such operations. The fact is that there should be no sense of competition between Swiss watch brands but rather collaboration. The real challenge lies in growing the watch market, given that only 32% of US consumers wear watches daily (NDP 2017).

Moving from wholesale to D2C is the next natural evolution for the watch industry. Retailers have traditionally provided many services needed by consumers, including making products locally available, giving sales advice, allowing consumers to examine a product, and providing after-sales services, making sure that they have somebody to talk to when things go wrong,.

Each element of the retailer’s typical value proposition is being replaced one by one with online alternatives. Consumers are in favor of these changes, which is evident in their online spending, which has increased each year since the beginning of e-ommerce. E-commerce is far from being a perfect shopping experience. It’s still in its infancy, but it’s steadily and rapidly improving.

Buying directly from the brand is natural, and given equal opportunity, it’s what consumers want. The reason it has not happened yet in the watch industry is that watch brands are reluctant to compete with the retail distribution.

At some point in the near future, a watch brand or a watch group will realize that it is capable of offering better customer service and experience compared to the retail counterpart while keeping their margins up. They will break with the tradition and move to the online Direct-to-Consumer model while optionally maintaining two or three flagship stores worldwide.

The levy will break and the flood of watch brands will follow the trend. The media coverage and gain in brand reputation will only be reserved for the pioneers.

AA: Help summarize some of the major findings of your report. I feel obligated to remind people that neither I nor aBlogtoWatch had anything to do with its creation and only learned about the report after it was completed. That said, it shows aBlogtoWatch.com in a very favorable light. In addition to the report summary, what is it that aBlogtoWatch.com has done particularly well to receive a top score when ranked against all the other websites you tracked?

GP: This report is an independent study for the benefit of watch brands to identify the top 10 most influential watch websites on google.com to help brands to get the most online exposure by having their product featured in key online publications and effectively managing their online reputations. The key finding is that the Google algorithm is polarizing the vast majority of watch inquiries on a handful of watch websites.

Within this handful of websites, aBlogtoWatch.com turns out to be the most influential by being the most consistently listed watch website on Google.com for 45 Swiss brands, from entry-level TISSOT (with no disrespect) all the way to ultra-luxury brands such as A Lange & Söhne or Jaeger-LeCoultre.

Because the prominence of aBlogtoWatch.com on Google is bigger than the sum of its two following competitors, this site is currently the market leader for answering the public’s key questions about Swiss watches.

I must state that aBlogtoWatch.com had nothing to do with this research. The results and the conclusions are drawn purely from the data for the benefit of watch brands. The framework and methodology of the study are detailed in the report.

aBlogtoWatch.com has the format that matches what studies have revealed to be the most suitable for the reader to form an opinion. Online researches have found that readers need both expert points of view and the opinions of other consumers’ to formulate their own opinion about a product.

AA: Speaking directly to watch brands, explain what should they do with the report’s information, and how to best use it in their efforts to sell watches directly to consumers via e-commerce.

GP: I wrote this report for watch brand management teams to increase your sales online and in-store by understanding the customer purchase decision process — because today, the vast majority of customers make their decision to buy your brand on the Internet.

It explains how to manage your brand reputation online to grow its sphere of influence. The report is setting the foundation for successful Direct to Consumers eCommerce. It highlights the handful of websites that are reaching the vast majority of people on Google that are interested in your brand.

AA: No doubt many watch brands are investing heavily in e-commerce solutions and selling luxury watches directly to consumers. That said, the practice isn’t right for all brands, especially those that don’t have the ability to invest time and effort into ongoing marketing. Help identify which types of watch brands are ideally suited to pursuing e-commerce as a serious source of revenue, and which watch brands (in terms of brand assets and ability to invest time and money) are at this time better suited to more traditional sales distribution models such as retail and wholesale?

GP: I am passionate about the Internet and e-commerce. When I speak with watch brands, I realize that they have a wrong understanding about what is e-commerce and direct-to-consumer. It is not about building a WooCommerce website and waiting to see whether customers will come or not.

I see that D2C’s real opportunity for watch brands is to create a new customer value proposition by redefining the shopping experience. To redefine consumer experience is to make possible something that was not possible before.

I have observed that successful companies have always redefined consumer experience. For example, Uber, Deliveroo, Amazon, Facebook, Google, and Netflix, to name a few, have made possible something that was not possible or available before.

For example, just to illustrate the realm of possibilities, if buying directly from the brand could mean I can try a $22,000 luxury watch for a month before I decide to buy it or return it for a full refund if I don’t love it, no questions asked, this could be a value proposition for consumers. The gray market will struggle to compete with it.

Because looking at the gray market from an HNWI perspective, what is the point of a 20% discount on a $22,000 watch only to find out, three weeks later, that it is not the right one for you? You will still have spent $17,600, and now you have the hassle of trying to resell it to recover some of your costs.

If a watch brand is serious about a direct-to-consumer approach, I would tell them to go speak to luxury watch customers and watch aficionados to understand their shopping experience and concerns.

aBlogtoWatch.com and other similar sites are perfect places for the watch brands to start this dialogue. Watch enthusiasts on this website have great ideas about how watch brands can improve their products and customer service.

Only when enriched by the information gathered would I design a new outstanding online value proposition to resolve their concerns. From what I read about watch history and famous watchmakers, that is the spirit of watch pioneers: to create something new that resolves an issue for the consumer. D2C is about creating new possibilities. If you look around, you will see that these are the attributes of successful brands you come across every day, online and offline.

Let’s start building a D2C conversation together. In this interview, I raised controversial points or elements that you may disagree with. If you would like to contribute to the definition of a real value-added Direct to Consumer eCommerce, please don’t hesitate to share your perspective in the comments below. I would love to hear your views.