There are only about a dozen notable companies/groups in the watch industry that are publicly traded in a stock market somewhere around the world. Compagnie Financière Richemont SA (CFR) is one of them. Richemont, the owner of major watch brands like IWC, Jaeger-LeCoultre, Panerai, Vacheron Constantin, and others, recently released the consolidated results for the 2017 financial year that ended on March 31, and the numbers and statements contained within are certainly telling of the overall timepiece business environment that the industry is facing in 2017.

aBlogtoWatch regularly reports on the business of making and selling watches, which we feel is crucial to the health of our industry, as well as to the buying and collecting experience for timepiece enthusiasts. If you’ve been following our work, then you’ll already know that due to a series of systemic (i.e. non-cyclical) reasons, the watch industry as a whole is experiencing falling sales, lower profits, and an overall contraction of size.

If you query a survey of financial advisors they will typically have good things to say about the Richemont Group’s long-term performance. In our experience, CFR has a reputation among finance industry professionals and investors as being a “good buy,” or at the least a well-run company. In fact, stock prices are in a relatively good place right now, trading at just above CHF81.60 per share after a 5-year low of CHF53 in June 2016. One main reason for this is an ongoing stock buyback program that has been going on since 2014 and while one such program ended on Friday, Richemont started a new, 3-year stock buy-back program the same day. Such programs are designed to help stimulate positive investor confidence, as well as to increase the value of remaining shares in the marketplace.

Another way that Richemont keeps investors happy is by paying dividends – a value which they now, despite 2017’s results, are increasing by 6%. The Richemont board has proposed a dividend of 1.80 Swiss francs per share, thus, even though profits are down, the company is using their healthy cash position to maintain investor confidence as much as possible by making the group a more attractive investment.

Even though Richemont has to and is running itself as a responsible company, it, like other watch groups, is facing steeply lowered sales compared to just a few years ago. There has been a strong, 14% decline in wholesale sales into the market, meaning that because consumer consumption for luxury watches has drastically changed, the groups can no longer achieve nearly the same types of profits from the wholesaling of watches to retailers and distributors. Not just wholesale is affected: growth in retail sales has been limited as well and Richemont closed some 38 of its own boutiques during the year.

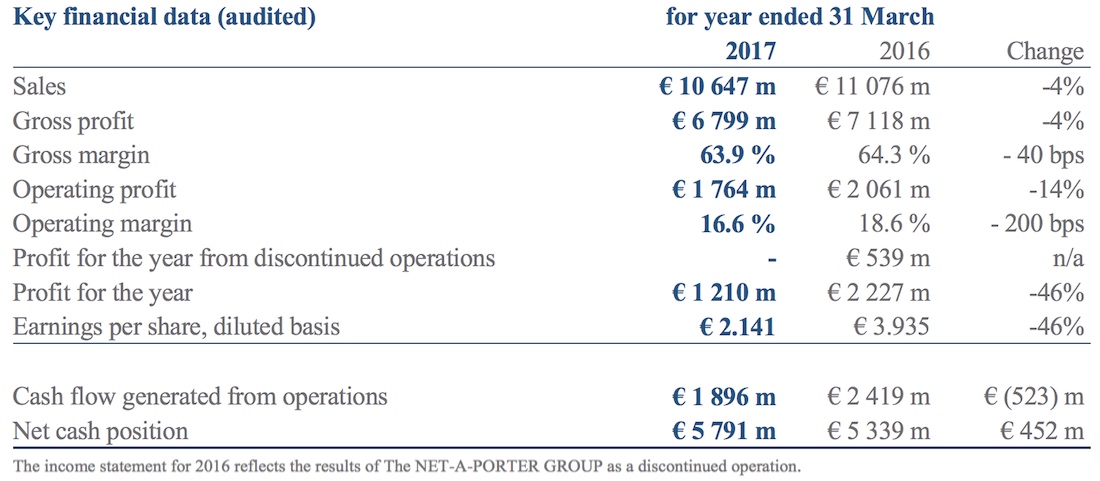

Performance Of The Entire Richemont Group

As such, the big news from the Richemont earnings report is that “profit for the year” is down 46%. Half of that headline figure is to be accounted for a one-off charge associated with the merger of Net-A-Porter with Yook, excluding this exceptional item, net profit would have dropped 24%. Richemont’s group-wide sales and gross profit are both only down 4% and operating profit is down 14%. Operating margin is only down 2%.

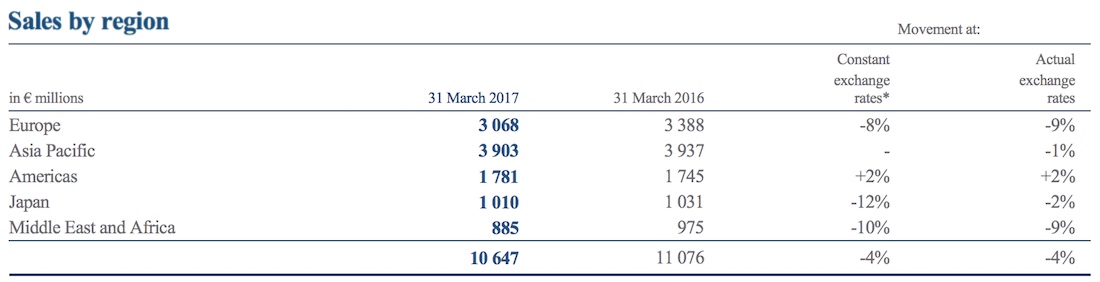

A regional breakdown of sales is no fairy tale either, unfortunately, as Europe was down 8%, Asia Pacific 1%, Japan 2%, and the Middle East and Africa 9%. However, the Americas have recorded a 2% gain, driven by good sales in jewelry.

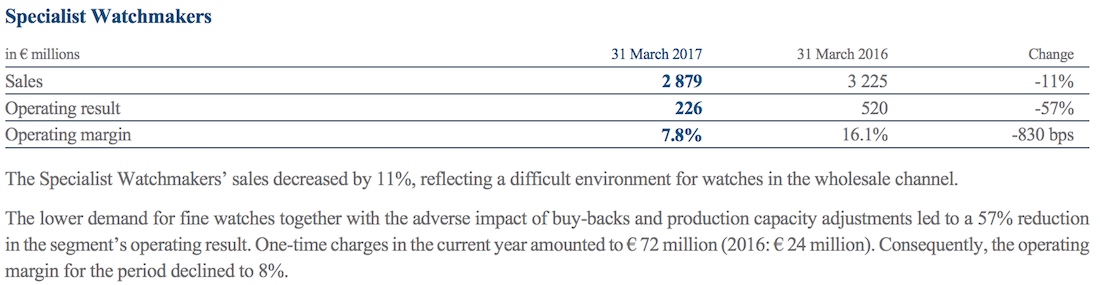

This also highlights the fact that when we say Richemont, we are talking about a massive luxury group, with nearly 60% of its €10.647 billion annual revenue made up of Jewellery Maisons (which includes Cartier and Van Cleef & Arpels watch sales, to be fair), and only less than 30%, some €2.879 billion come from its Specialist Watchmakers annually.

To clarify, Richemont’s Specialist Watchmakers comprise A. Lange & Söhne, Baume & Mercier, IWC Schaffhausen, Jaeger-LeCoultre, Officine Panerai, Piaget, Roger Dubuis, and Vacheron Constantin. Richemont lists Cartier and Van Cleef & Arpels among “Jewellery Maisons,” while Montblanc, because of its accessories business, is mixed into their “Other” grouping along with Alfred Dunhill, Lancel, Chloé, Purdey, and a few others, plus investment property companies and other manufacturing entities.

Richemont’s (CFR) share prices reacted expectedly, dropping some 6% and closing Friday’s trading down 5%. At CHF81.60, the stock is still up 54% from its 52-week low from mid-2016 when it traded for CHF53 – after last year’s gloomy performance, things, at least in this department, have been looking up.

Sales down 11%, operating result down 57% for Richemont’s “Specialist Watchmakers.” Source: Richemont SA

Performance Of Richemont’s Watchmaking Division

When it comes to fine watches, Richemont specifically indicates that sales in this segment are down 11%, totaling €2.879 billion for FY2017 against FY2016’s €3.225 billion. Operating result for its watchmaking division is down from €520 million to €226 million, marking a 57% decline compared to FY2016. The group sees growth in the sale of items such as leather goods, jewelry, and accessories other than timepieces – even though those items together account for a relatively small percentage of the group’s income.

Richemont has tripled its buybacks and increased its production capacity adjustments in its Specialist Watchmakers division, leading to a 57% reduction in the segment’s operating result. One-time charges in the current year amounted to a very notable €72 million (exactly triple the €24 million in 2016). Consequently, operating margin for the period halved from 16.1% to 7.8%.

Richemont, like other groups, is in a tough position because over the last decade or two their brands simply got too large, and in the process have invested heavily into producing more watches than the market can now sell. The natural reaction to that is to decrease the size of the watch brands it owns – returning them to positions where they are making as many watches as consumers are buying each year. Doing so would have a major impact on established business units in Switzerland – which means letting go of a lot of employees. This is one thing Richemont really doesn’t want to do, and it is likely that they are finding ways of cutting costs as much as possible outside of terminating key employees and closing down manufacturing operations throughout Switzerland.

The letter from Richemont is signed by Chairman Johann Rupert himself, and in closing, he notes that “volatility and uncertainty in the geopolitical and trading environments are likely to prevail. Our attention is focused on transitioning the Group to adjust to operating in a more sustainable growth environment, by adapting our product offer, communication and distribution to new consumption patterns while allocating resources primarily towards research and innovation, digital marketing, online sales platforms and training in all of our Maisons.”

Moreover, Richemont communicates that “The past year posed challenges for Richemont. The Group responded to changes in demand, which particularly affected our watch businesses, and shifting patterns of consumption. The Group has addressed those challenges by taking significant measures which, while having weighed on short term financial performance, will ensure Richemont is well positioned for the future.” Those significant measures include the €72 million inventory buy-back, closing of stores and reconsidering their strategies for product development and marketing. In reality, though, many of these are temporary tactics which do not represent the type of shift the luxury watch industry needs in order to earnestly grow once again.