Usually, news that a watch is no longer being made doesn’t cause much raucousness. In the case of the Patek Philippe Nautilus 5711 (aBlogtoWatch review here), it has caused a veritable uproar. Since Patek Philippe announced early in 2021 that its star steel watch with a decade-long waiting list would stop being produced, the timepiece enthusiast community can hardly ponder or discuss anything else. That an older model Patek Philippe watch is being discontinued is hardly remarkable. What is noteworthy is what life was like for the 5711 product just weeks before Patek Philippe announced it would stop producing new ones. Let’s start with some luxury watch industry context.

The pandemic has wreaked havoc on the long-term planning needs that high-end watch manufacturing requires to be successful. Slumps in traditional retail sales have been somewhat boosted by now prolific online orders, but the men’s watch industry is still mostly a real-world affair when it comes to global commercial value. My little industry (like many others) is waiting out the pandemic mostly quietly, but odd things happen during periods of economic stress, such as certain status symbols and assets rocketing in value when, at the same time, most other products in that category fall in value. That means while demand is huge for particular products like the Patek Philippe 5711, at the same time availability of other high-end luxury timepieces of similar functionality and use are plentiful. What this means is that people are spending a premium on the Patek Philippe 5711, not because of its competitive advantage as a wristwatch, but because of the good-natured envy it elicits in others — and because of its rare ability to often be sold on the aftermarket for more than retail value.

What the watch industry can still make are highly sought-after products that in modern times (thanks to social media virality network effects) can quickly become popular all over the world at the exact same time. Watch collecting can be a very fashionable pursuit for many – leading to a follow-the-leader consumptive behavior for a fair number of participants. To keep the social part of the collecting experience interesting, watch enthusiasts who frequently interact with one another (e.g. everyone on Instagram) often like to show off their hipness (and, at times, wealth) by demonstrating that they are wearing the most talked about and “fresh” products.

At the same time, a depressed investment asset economy has targeted luxury watches as a sort of alternative investment to the stock market or other more traditional investor vehicles (a topic discussed at length on aBlogtoWatch here). A well-funded cottage industry has formed around the desire for people with cash (their own or others) to spend it on luxury watches — touted (but never promised) as being assets likely to increase in value. The pitch is that if you spend a lot of money on a rare watch today, it is acceptable because someone tomorrow will be even more desperate than you and will end up spending even more money on it. The watches-as-investment mentality has added a new flavor to timepiece collecting over the last few years, as we have seen former rare wine and fine art buyers eye timepiece enthusiasm as the next profit frontier. The behavior I am talking about does involve the sale of timepieces, but is only tangentially related to the pursuit of wearing a good watch because you appreciate finely made, cultured machines.

Patek Philippe has found itself in the middle of these various buyer communities for a number of years now. As a rich, stable company, Patek Philippe has the luxury to do what it wishes and often displays a cavalier attitude as they exhibit a deep focus on making hyper-traditional, super-refined watches. This personality and character have earned the Swiss watchmaker prestige in many of the highest circles.

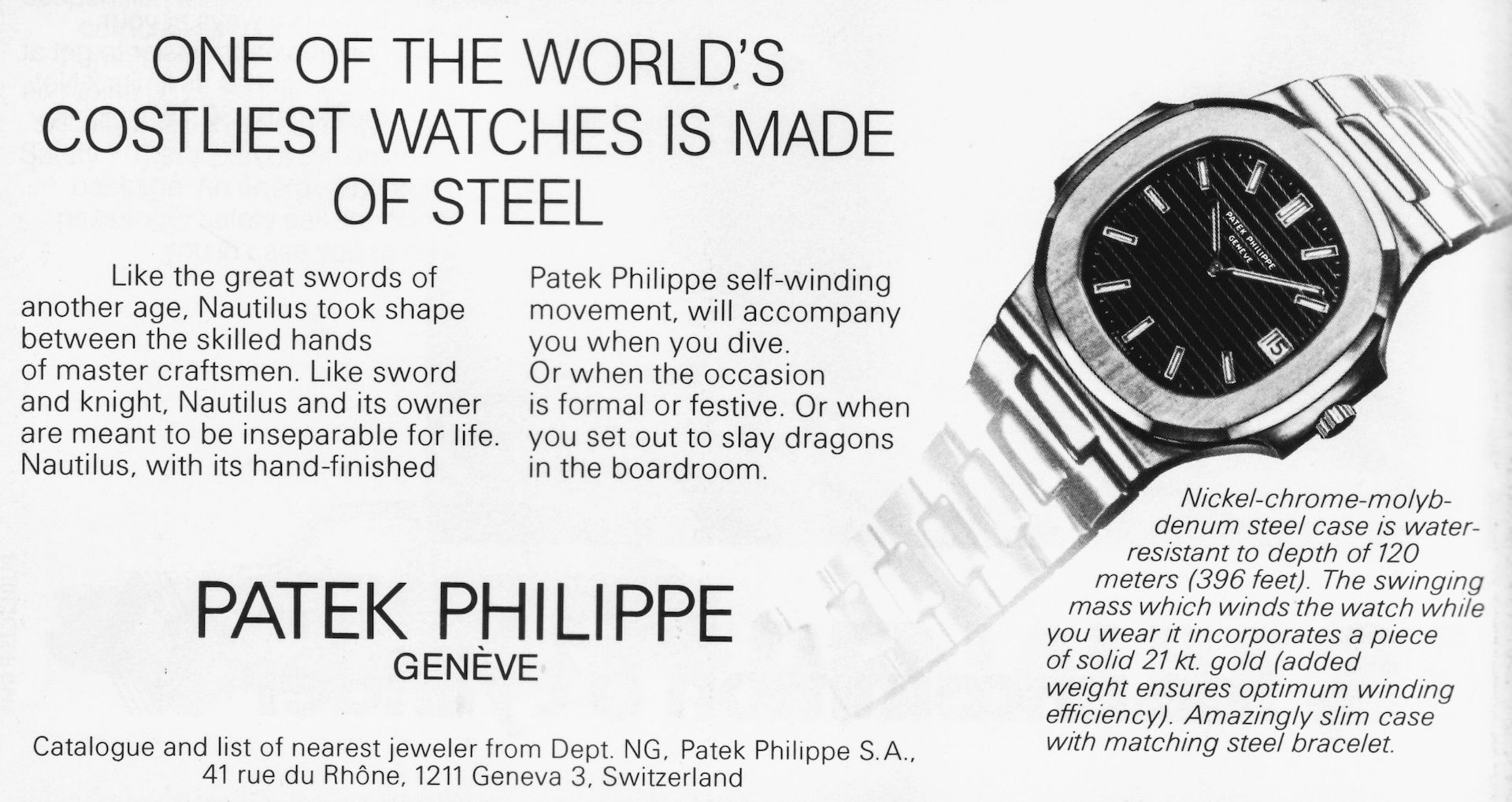

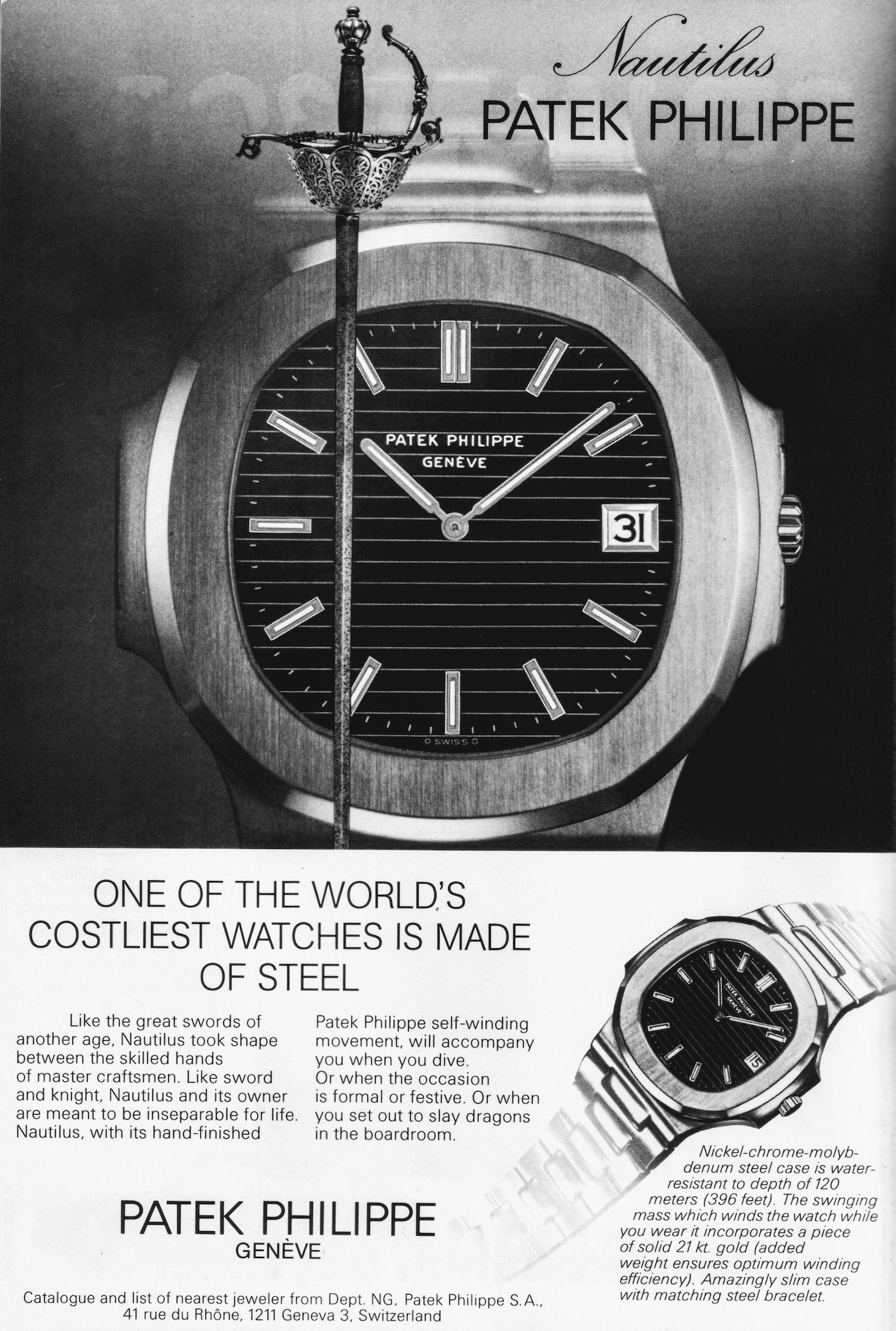

Patek Philippe has traditionally benefited from this renown at the highest end by selling elite customers marvelous mechanical complexities and lavish bejeweled treasures (typically on order). Then, something weird started to happen. Some of the top Patek customers seemed to be overly interested in a steel bracelet watch mostly celebrated for its distinctive design and quality polishing. The watch’s loose association with sport and its “relative” lack of pretentiousness had the ironic effect of making the Patek Philippe Nautilus suddenly the must-have Patek Philippe piece to wear. Since then, the 5711 family never stopped being voraciously hunted-for, once it became popular.

One good reason for the popularity was that Patek Philippe was never really able to meet demand for the 5711 set by the world and sort of always operated at a production deficit. This rarity only added to the product’s allure. A second reason for such intense popularity is related to Patek Philippe’s vaunted status as being among the few watchmakers who make at least one product that can increase in value after it is originally sold. The 5711’s popularity grew after it was already hard to get because of how aftermarket prices started to spiral out of control. Thus, authentic product rarity and low production volumes fed a popularity cycle that saw after-market prices gradually climb.

The combination of hunger from the investor community for watches that retain value — and because the Nautilus 5711 watch was en vogue with a community highly inclined to act “fashionably” and wear popular watches — saw prices of the Patek Philippe Nautilus 5711 inflate rapidly. Ironically, the last thing Patek Philippe did to the 5711 Nautilus was to dramatically increase its retail price to nearly $30,000 USD. Then not long after, the 5711 version of the Nautilus watch family was discontinued. Was this planned? Not likely, at least not when the aforementioned price increased went into effect.

Consider that the Nautilus was due to be retired soon, anyway. Patek Philippe has been producing the same generation Nautilus for 15 years — a fairly long time for a wristwatch product generation. Patek introduced the 5711 back in 2006. The watch still remains competitive in a number of areas but lags behind on Patek Philippe watches in the most modern materials and their latest innovations. The shock of discontinuing the 5711 was mostly related to the fact that even used ones can go for double the retail price. At the time of writing this article, a number of listings on eBay for the blue-dialed Patek Philippe Nautilus 5711/1A were averaging well over $100,000 USD. That is more than triple retail — and for a relatively basic (albeit well-made and classic design by Gerald Genta) steel watch with time+date automatic movement. Incredible stuff, and certainly anomalous when it comes to defining the performance of the greater luxury wristwatch market.

Consider that the Nautilus was due to be retired soon, anyway. Patek Philippe has been producing the same generation Nautilus for 15 years — a fairly long time for a wristwatch product generation. Patek introduced the 5711 back in 2006. The watch still remains competitive in a number of areas but lags behind on Patek Philippe watches in the most modern materials and their latest innovations. The shock of discontinuing the 5711 was mostly related to the fact that even used ones can go for double the retail price. At the time of writing this article, a number of listings on eBay for the blue-dialed Patek Philippe Nautilus 5711/1A were averaging well over $100,000 USD. That is more than triple retail — and for a relatively basic (albeit well-made and classic design by Gerald Genta) steel watch with time+date automatic movement. Incredible stuff, and certainly anomalous when it comes to defining the performance of the greater luxury wristwatch market.

Aside from the Nautilus 5711 being a gracefully aging product, Patek Philippe’s management had another good reason to halt production of this legend — in short, because it was creating an unstable bubble. One net effect of having hyper popularity in one Patek Philippe product model is that consumers start to expect the same price retention (or increases) in other Patek Philippe products. That simply isn’t practical, and no company (not even a storied Swiss watchmaker) can be expected to produce retail products that routinely go up in value after being originally purchased. Patek Philippe gains nothing by having consumers who have unreasonable expectations of how their products should behave on the pre-owned market. Patek Philippe fully profits when a consumer purchases their items at retail price. Any amount spent over retail price in the market does not directly profit Patek Philippe.

Accordingly, Patek Philippe decided to shut down production of the Nautilus because it knew the steel watch’s popularity was a bubble, and that by feeding its growth, the company would just be contributing to the damage caused by an eventual burst. This is long-term thinking in the watch industry at its finest, and probably a decision only easily made at a privately run firm such as Patek Philippe.

Patek Philippe isn’t even being cruel about the termination of the Nautilus 5711 family. Our colleagues atWatchPro, have reported that Patek Philippe will immediately replace the 5711 with a next-generation product that Patek Philippe President Thierry Stern promises will be better in every way. Many speculate that the next product will be called the Nautilus 6711, and it will probably have a refined case and dial, along with a new generation in-house-made automatic movement. Patek Philippe, for the foreseeable future, will only sell the 2021 and beyond Nautilus watches directly at its own brand boutiques. This is ostensibly to help prevent a “gray market problem,” where watches intended to be worn by consumers are sent to be re-sold at higher prices.

Have no doubt that even if the Patek Philippe 5711 bubble bursts, it will not deflate immediately. Watch collectors and would-be investors will remember tales of the $100,000 Nautilus watch for years to come. The halo effect that such a reputation has put on the Patek Philippe brand will have lasting value for at least a few years.

The enduring recommendation from the aBlogtoWatch team is that there are too many available watches out there for anyone to have to spend more than retail on a fine wristwatch. In other words, we can’t condone the practice of spending more than retail on a watch — unless you truly must have something and are entirely comfortable giving up all that money for the privilege of owning it.

That said, the fact that some people clamor to own or order watches whose market prices will go up in value brings needed attention to the luxury wristwatch arena during an otherwise challenging economic moment (due to the pandemic) for “celebration items” like timepieces. Patek Philippe absolutely made the correct decisions to end production on an aging timepiece, even if it could have produced it for another 15 years without too much effort. Patek Philippe wisely adopted a long-term approach in which flooding the market with too much product, while also allowing for a dangerous bubble to grow, is a bad idea. And a lot of other members of the watch industry can learn from Patek’s practical play. Speculators are already wondering if the Nautilus 6711 can spark the same type of demand fire.