How did watch prices get so high? The number one response from watch enthusiasts seems to be “greed” – though “maximizing profits” would be the politer way to say it. Looking at the recent history of watch industry growth, I don’t see evidence for pure greed. Instead, I see companies investing in what seemed to them (at the time) like sustained and unrelenting growth between 2005 and 2015. In this article, I will walk you through the increases in watch prices and why they have gone up faster than the rate of inflation. In the next article, I will explain why all of the sudden people aren’t willing to pay those prices anymore.

While some enthusiasts may not care how much a watch costs and why (a scant few), many of us who follow the industry find it interesting to consider this complex question. This article is intended for those curious about the forces behind the watch industry and would like to examine them with a business and finance perspective.

Ariel Adams wrote an article back in 2010 on this topic as well. Both his article and mine cover valid but different points. While we do have some overlap, I focus on the topic mostly from a marketing and economic viewpoint. I recommend you read both for a well-rounded perspective. Here is part II of the Watch Pricing series.

Recap of the First Article

In the first article of this series, titled “From A Swiss Perspective, US Watch Prices Haven’t Increased That Much,” I showed that when inflation and exchange rates are factored in, watch prices in the US since 1984 (for Rolex) have only increased 2.5x (if you are in the US) or 1.04x (if you are Rolex). Yet still, there have been price increases. The purpose of this article is to explore why? On my Watch Ponder blog, I like to investigate watch industry business questions like this (You can read my open letter to watch companies about prices here). While there are an infinite number of possible explanations starting at the retail level all the way up to macro economy, I’ll offer a few that stand out to me.

Why You Can’t Blame Profits for the Price Increases

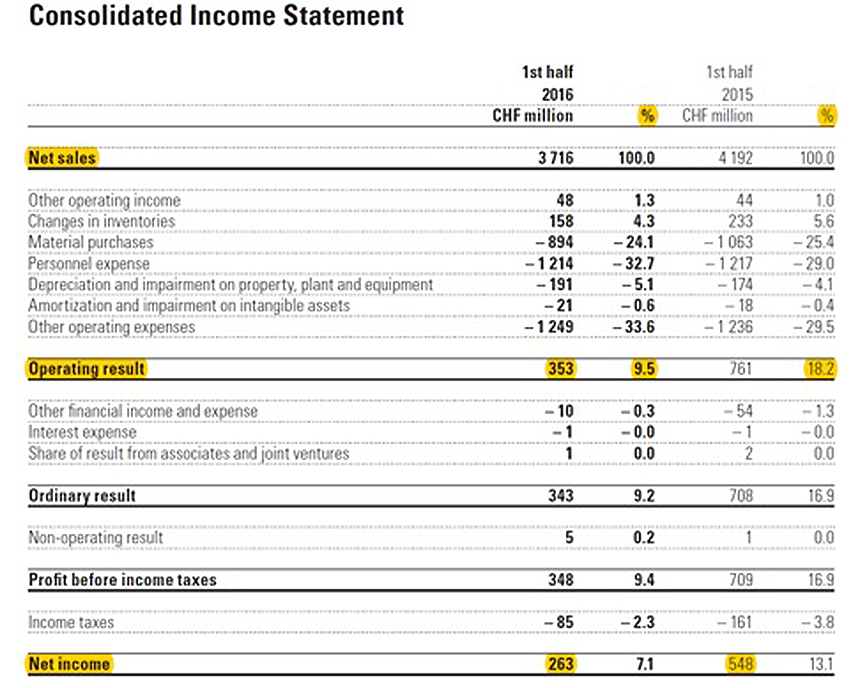

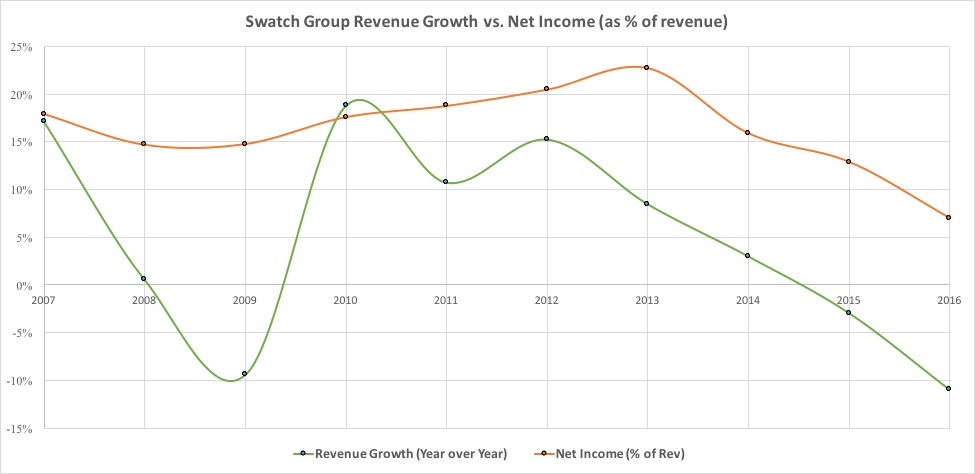

Note: In the previous article, I focused on Rolex. However, they are a privately held company so their financial statements are not public outside of widely varying analysts’ estimates. Therefore, I use the Swatch Group for this article as an example of the watch industry because they are the largest company and also publicly traded with published financial data.The net income for the Swatch Group over the last 10 years averaged only 17%. The green line below shows the percentage increase/decrease year-over-year of Swatch Group’s revenues, and the orange line shows the percentage of those revenues that were net income (aka final profit).

Why is this important? Because it shows that the Swatch Group is not increasingly growing their profit margins through price increases. The Richemont Group shows a similar trend. If the goal of the watch industry were greed through raising prices, the orange line should be rising every year. However, this is not the case – the recent price increases have not resulted in growing profits.

Comparing the growth of Swatch Group revenues vs. the percentage of net income yearly. Based on company financial data on Morningstar and Swatch Group 2016 semi-annual letter to shareholders.

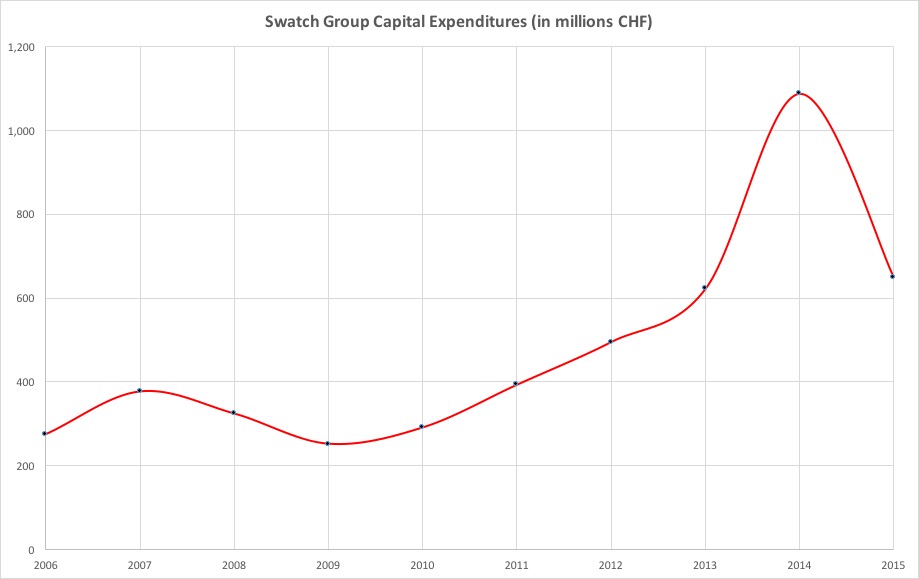

Where did all the revenues go if not to profits? Much of the increased revenues fueled investments in growth – new factories, new equipment, and new staff. The chart below shows the amount Swatch Group spent each year investing in their own capital growth (i.e., equipment, buildings, etc.). Investments in buildings and equipment result in future fixed costs (power bill, phone bill, repairs, etc.) that a company must pay regardless of whether they sell any watches. You can read in more detail on this here.

One could argue the desire for growth is in itself bad, but most publicly traded companies in capitalist economies seek to grow because that’s where future value is captured. Growth depends on a company’s ability to produce more “stuff” (aka capacity), and then actually sell the increased volume of product. Most public companies growing sales by an average of 9% a year (as was the case for Swatch from 2010 to 2015) would seek to grow capacity.

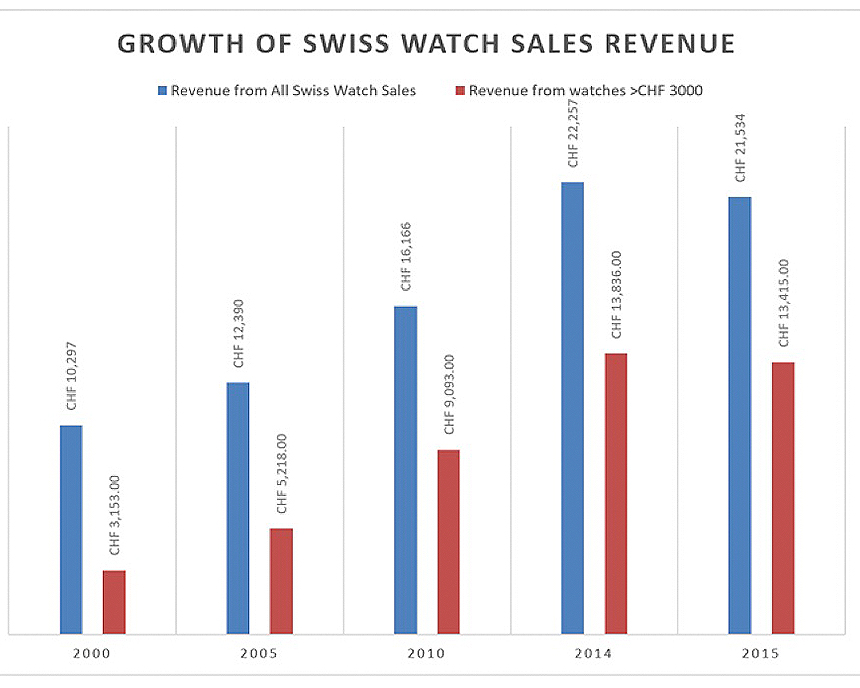

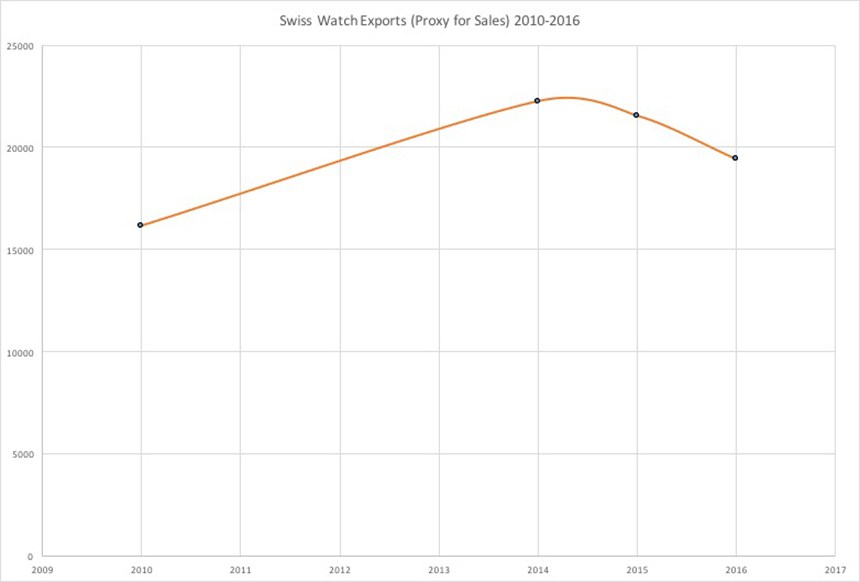

In 2000 to 2014, expensive luxury watch sales (>CHF 3,000) were growing at very quick rates. Many luxury watch companies who couldn’t keep up with the consumer demand made investments in growth such as new factories, boutiques, etc. A logical question to ask at this point is whether or not the consumer demand was both actual and sustainable? However, that is a different story I will cover in the next article.

The chart below shows how from 2000 to 2014, expensive luxury watch sales were growing at very quick rates and high-end companies like Rolex, Omega, Jaeger-LeCoultre, Patek Philippe, Audemars Piguet, and others accounted for the majority of the growth. It is no surprise that they sought to expand their ability to produce more to meet growing demand. Again, sales demand drives future growth investments.

One could argue that the industry did not adequately prepare for the downturn of 2015 or beyond (more on that here). Perhaps, but that isn’t a totally fair statement either. Few (if any) can accurately predict downturns. In preparation, many of the watch companies carry little to no debt, making them very unlikely to become financially distressed. In that sense, they have prepared themselves. In all fairness, very few companies or industries can see rapid shifts in the market before they happen. The judge of a company’s performance during downturns is always time – only time will tell how well they can react to the quickly shifting markets.

What does this all mean? Well, so far in this article series, I have explained that the rising watch prices are in part due to exchange rates and inflation, but those only account for some of the price increases. Above, I explained that the price increases weren’t purely a result of increasing profit margins. While the increased revenues went towards growth investments, those didn’t cause the price increases – rather, the price increases made the further company growth possible.

The question remains – why have prices increased? While there are many explanations, I will offer a few anecdotal arguments.

Why Have Watch Prices Increased?

Brand Equity and Reputation Count for Something

A company’s brand becomes equity for them when they have a good reputation and perceived demand. Companies such as Rolex, Omega, Patek Philippe, or Audemars Piguet have reputations for quality and fame that lead consumers to be willing to pay more for their version of a watch over an alternative. Functionally speaking, there are alternatives to these expensive watches that perform the same job and look similar for much less. However, customers choose these more expensive watches for any number of reasons that range from signaling wealth or interests, to quality or reputation. Moreover, it remains a fact that in many instances if a company increases the price of their products, at least some segment of the consumer population will deem those products to be more valuable.

This fact about “brand premiums” is not unique to the watch world. In virtually every luxury segment, consumers pay more because a brand has earned a positive reputation and leads customers to pay more over a functionally similar product. Customers have the choice to buy a cheaper alternative but choose not to. This is not because consumers are misinformed or incapable of making a rational decision. Rather, what seems irrational to those looking from the outside in seems completely rational to the one buying. This is not a secret or even a theory, rather a reoccurring phenomenon. Here is Investopedia’s simple but very salient summary:

It’s well known that people don’t behave rationally, and considering the enormous consumer debt Americans have, consumers clearly don’t always act in their best financial interests. Luxury goods are a great example of how irrational we can be; a decent and sturdy handbag can be purchased for $50, yet people will still spend thousands to buy a brand name.

It is a completely rational purchase to the one buying. The luxury brand cannot be blamed for the price; rather, it is the consumer who makes the decision to pay more for the luxury alternative, which they could easily choose not to buy. In short, the brands that have built reputations can command higher prices because customers are willing to pay those prices. Which leads me to the next point.

This chart shows the rapid increase and then decrease of Swiss watch exports (based on data released by the FH Jan. 26, 2017)

Supply and Demand Allowed Price Increases.

The simple fact is more people want a Rolex Submariner at $200 than Rolex can make. More people want one at $5,000 than Rolex can make. At $8,000, people still buy 100,000+ Rolex Submariners every year. That is about 2.5x the total number of watches sold by most luxury watch brands every year. People keep wanting Submariners for many reasons, but I will rely mostly on the reputation of the brand as a driver for the majority of customers (I acknowledge individual reasons vary).

Unadjusted prices of a Rolex Submariner have gone up substantially, yet people keep buying the Rolex Submariner. However, the Sub is not an isolated example. Why did every other luxury watch company increase their prices too? Because they could. Just as a rising tide floats all boats, so did common performance and increased sales across the watch industry benefit all (or let’s say most) watch brands. Maybe you wanted a Rolex Submariner but the price was out of your range, so the next best alternative by Brand X became your choice. The demand for the most desired watch models demonstrates how the economic principle of substitution benefited “the alternatives” as many other Rolex Submariner substitutes have also benefited (and sold very well).