One of the strange new wrinkles of buying a luxury watch today is that the very same company that produces new timepieces, might also offer to sell you a used one (one that they originally produced, of course). While it isn’t unprecedented for companies to be officially involved in the resale of used versions of their products, it isn’t common either. Traditionally, wristwatch makers had nothing to do with what happened to their timepieces after they were first sold either to an end customer (the person wearing the watch) or through wholesale (to retailers and stores that then sell those goods to consumers). Today, the biggest name in luxury watches — Rolex — makes “certified pre-owned” (aka “CPO”) available to buyers through a growing selection of authorized dealers. Why exactly is the high-end watch industry interested in pre-owned, and what does it mean to the people who buy watches?

The reason each company enters the pre-owned watches space is unique, and the ways they go about it differ as well. For instance, some companies (like Rolex) offer extra buyer assurance when buying certified pre-owned watches as they come with a warranty and ostensibly a seal of quality and condition. Rolex does not directly sell certified pre-owned watches to customers but rather allows its dealers to certify and sell such watches. Other companies specifically buy back their own watches from the market, only to later resell them back to buyers who may have missed the first chance at buying a limited production unit. In both instances, the watch market today already has mechanisms for people to purchase pre-owned watches – the only difference being involvement from the company that originally produced the watch.

Against the backdrop of this conversation is the larger context of the luxury watch market. The Internet has democratized watch retail in huge ways but also opened up enormous areas of potential fraud or simply poor customer experiences. Whereas the ability to purchase a used watch has always been available online – layers of protection or assurances of quality were often missing. On a basic level, given the large number of pre-owned wristwatch transactions that occur on a daily basis, it is only logical that business interests will be curious about how they can profit from popular consumer behavior.

For me, the most important questions relate to if a brand’s being involved in CPO makes the customer experience better or worse. A better customer experience would be purchasing a good-condition watch at a fair price presented with excellent customer service. A bad experience would be where a consumer is at the least, expected to pay more money for the same product quality and condition available elsewhere. More dangerous would be an erosion of the customer service experience combined with higher prices. Watch brands typically mean well when involving themselves with pre-owned watches because they feel, at the least, that they are improving upon the buying experience for consumers. At times, however, it is possible that watch brands add bloat without value, and that the price increases which result after they officially involve themselves with pre-owned watches sales offer little to no customer value. Let me now articulate most of the main reasons why watch brands (both big and small) may decide to get into the pre-owned watch business:

Being Able To Control The Condition & Quality Of Pre-Owned Watches

This is a double-edged sword but you can appreciate how watch brands can easily win this argument. In essence, the idea is that many pre-owned watches out there are in poor condition, and thus no one really wants to wear them. By inspecting watches prior to them being made available for purchase, a watch brand can ensure that many of the used versions of its products on the market will lead to a good wearing experience. While people will buy anything for the right price, it is true that most people do not want to wear cosmetically or mechanically imperfect luxury watches. Watch brands make a winning argument that even if prices for their used watches go up, it is worth it because there is less risk when buying a pre-owned timepiece from them or certified by them.

There are ways that watch brands can take advantage of this psychology. One area is when they add cost by offering unnecessary servicing to a watch. They might claim that the used watch has been “thoroughly overhauled and serviced.” That can involve the replacement of parts or the polishing of metal that not everyone wants. Watch brands make a lot of money when timepieces come in for repair – and thus any excuse to get the service department involved can be a revenue driver. If brands are able to pass off the cost of servicing a watch to a consumer willing to pay extra for a used timepiece, it can be a win for the watch brand. With that said, a large area of trust and mutual respect must be in place to ensure that well-intentioned consumers are not being asked to pay for unnecessary “restoration work” on relatively new watches that may not need it.

Overall, though, consumers do win when brands control quality because the upside is fewer ownership headaches and unfortunate surprises when purchasing a product sight unseen. The unfortunate reality is that there is still far too much deception or information withholding in the context of people selling used watches online or otherwise remotely. On balance, brands have the winning argument here when it comes to telling consumers they will have far less risk when purchasing a used watch from them or as a certified pre-owned product.

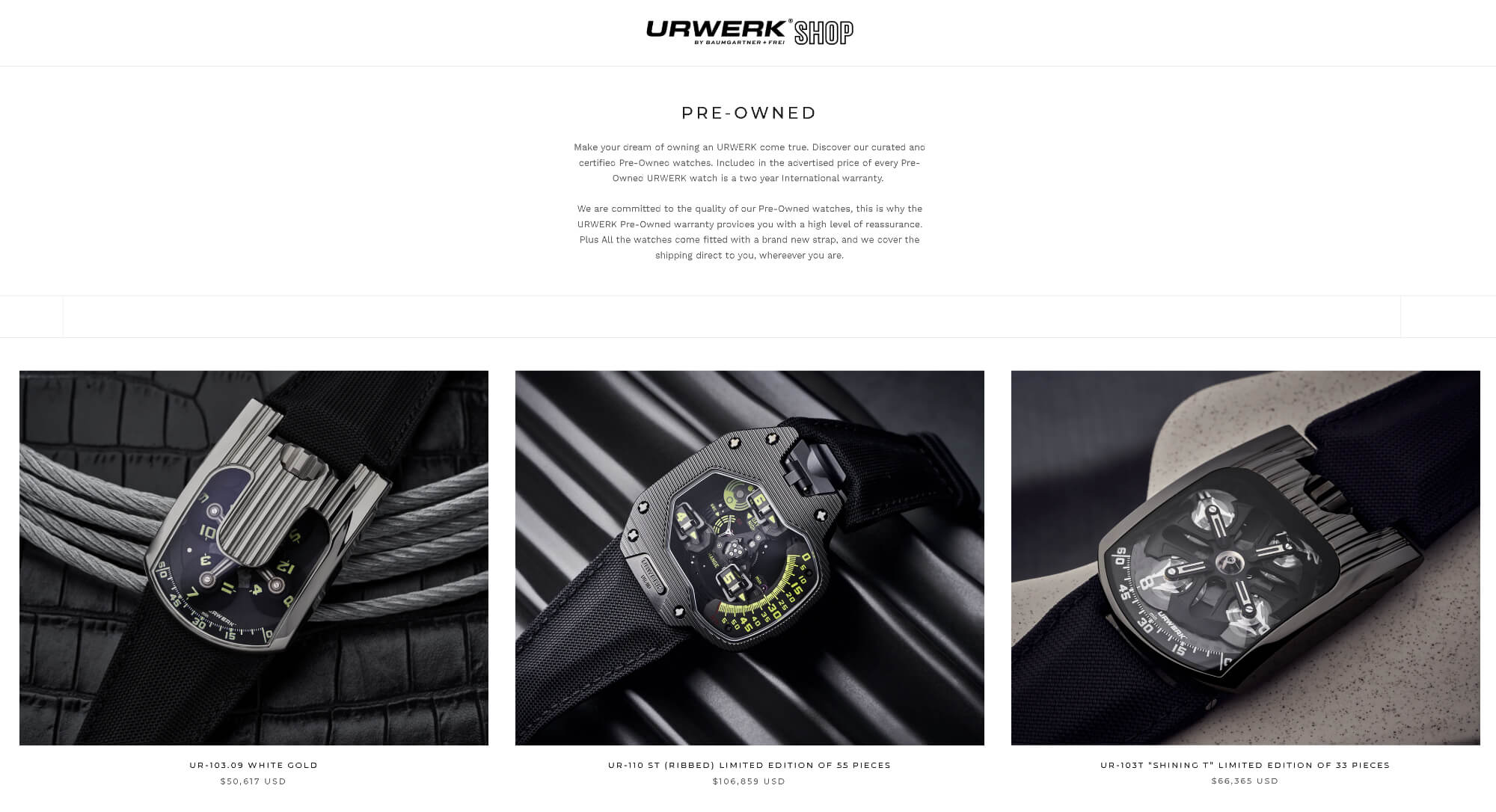

Urwerk’s official CPO program launched in 2019, and each listing includes reflections on the model from both Felix Baumgartner and Martin Frei.

Hoping To Stabilize Or At Least Legitimize Used Watch Prices

If you have been buying used watches for any length of time, you immediately realize that prices really are all over the place. What a used watch costs depends on a large variety of factors and thus allows smart buyers to shop around looking not only for the correct watch but also for the correct situation to get it (from a seller who is able to part with it for less). This of course can lead to some serious advanced-level watch hunting behavior, but it is how serious collectors manage to find the best prices. This part of the hobby is more like treasure hunting than it is product buying. While it is fun for some, the optics of used watch prices having a large range causes issues with mainstream consumers.

A few years ago, I did a study about how used prices of a popular luxury watch retailing for about $8,000, had a delta of about $3,000 via results on the first page of Google, meaning that when searching for used watches of this particular model, the prices that came up on the first page of Google varied by a maximum of about $3,000. My conclusion was that anyone “price hunting” for this watch would be so worried by these large discrepancies in pricing that they very well could opt not to purchase something they otherwise would. Conversely, if that same watch has used prices with a narrower delta (say just a few hundred dollars, or even less), you could make the argument that consumers would respond to those prices with more confidence. That confidence then creates assurances that prices are stable and legitimate and thus that making an instant purchase is a safe decision. In essence, the effect on consumer buying confidence of large price deltas for used watches can easily stop purchases dead in their tracks.

The thing is that the above scenario (which isn’t uncommon at all) also tends to have a negative effect on consumer confidence in the price of new (not used) watches of that same brand. Consumers who see wild fluctuations in the price of pre-owned watches from a particular brand, thus are wary of the price stability as well as the legitimacy of their brand-new products. Watch-making companies have become a way of this situation over the last few years and have realized that the only solution is to endeavor to create more price stability in the used market. In practice, this has led to certain small companies actually buying their own used watches on the market, in order to keep low-priced objects away from consumer eyes. Doing this enough, smaller brands realized that the volume of their watches on the open market was often small enough that they could purchase back many of their used watches. Not only are those used watches products that they can later resell as certified pre-owned goods to new buyers, but they can also remove from the market low published prices from their pre-owned goods.

In this regard, watch companies can reap multiple rewards from removing low-priced pre-owned goods from the market. Not only can they spruce up that timepiece and sell it to someone down the line, but they can also price that watch however they like and make sure it isn’t too low. Low used prices (when compared to new watch retail prices for that same good) erodes consumer confidence in the legitimacy of retail prices. Watch companies win, but do consumers? It is true that this scenario often asks consumers to spend more. And when watch brands (or otherwise) engage in the practice of selling used watches for more than the price of new watches, then this can lead to a dangerous level of consumer manipulation. So there are some very real dark sides to what can happen when a watchmaker gets a bit too excited about rarifying their pre-owned goods. With that said, most of the time the attempt to stabilize pre-owned watch prices by controlling prices can be a positive thing for buyers. The reason for this is that it can help ensure stable resale prices, and it does help protect the high level of cost “investment” that it can require to purchase many elite luxury watches. I would say that while consumers do need to push for deals and offers when possible, there is a lot to be said for brands attempting to stabilize the prices of their pre-owned watches in a market when used prices can really be all over the place. With that said, there are still going to be advanced-level watch buyers who will rarely want to purchase used watches from the company that made them given the lack of thrills involved in the process.

Extending The Life Of Limited Edition Or Production Watches

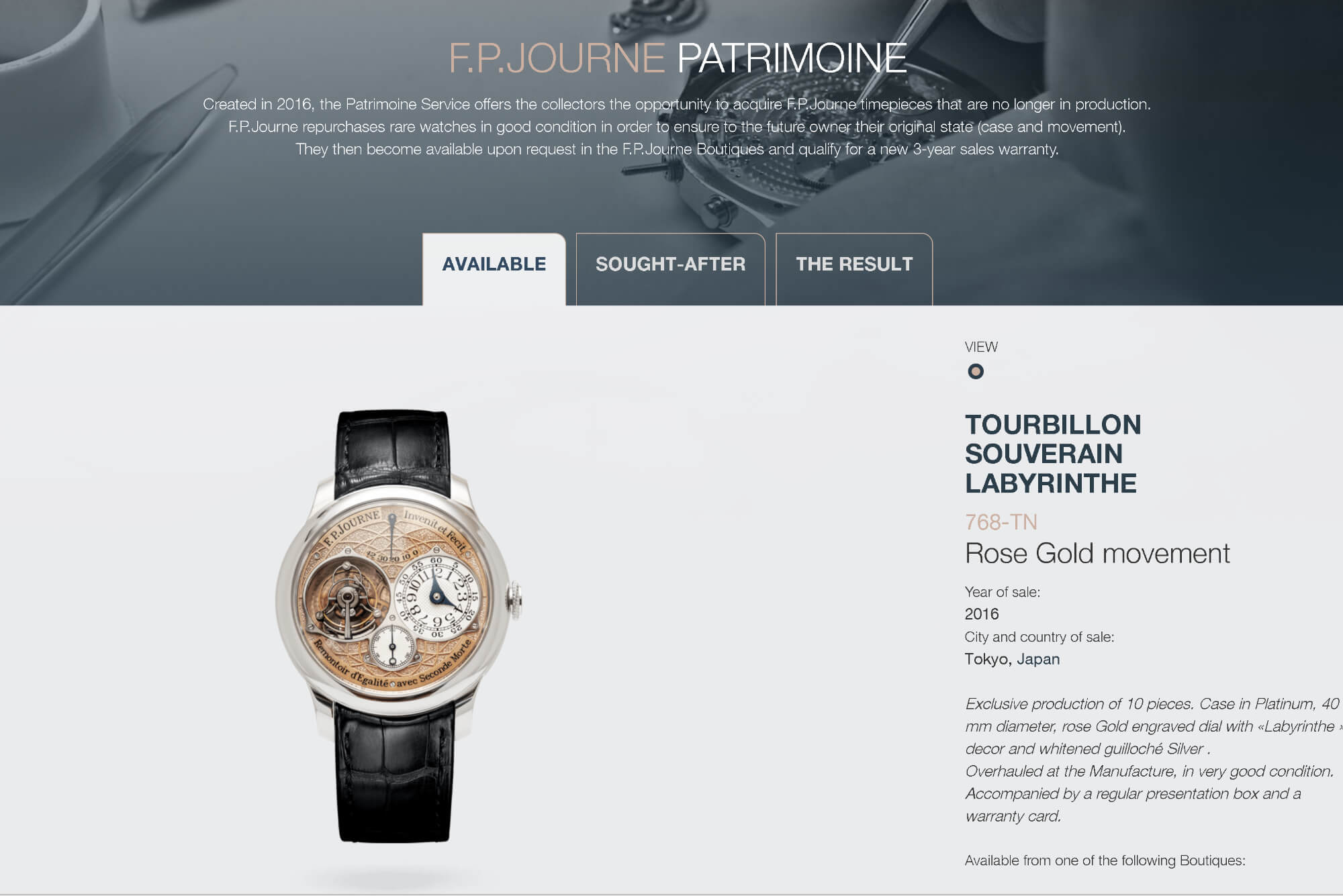

While this is not the case with large-volume watchmakers, smaller companies can really benefit from being involved in the sale of their pre-owned goods. This is especially the fact with high-end companies that specialize in very distinctive limited production models. Original buyers of these watches who are no longer interested might want something else that is newer from the brand. So what companies have found is that they can trade back used limited edition watches from consumers or dealers, in exchange for new watches to own or later sell. Once the watch company has that used limited edition watch, it can then resell it to a buyer who may have missed out on owning it the first time. We are in an era where it is not inconceivable for one watch to have two, three, four, or even more buyers.

It was once thought that most people own watches until they die, or simply give them as gifts to family members and friends when they are done with them. Over the last 20 years or so, people have been selling their used watches back into the market much more often. What is more interesting is that popular watches can sometimes pass between a variety of owners all happy to enjoy the watch (provided the condition stays good). The combination of consumers wanting to purchase pre-owned watches and that desire for people to want to sell pre-owned watches has collectively created a very long theoretical profitable lifespan for a timepiece. Some watch dealers and makers dream of “revolving door” marketplaces where they buy back and resell the same watch more than once. Each time they do this they can reap profit while not having to invest in the cost of new watches.

The most important theoretical advantage of this practice is that it will lead to the production of fewer new watches. I know many people in the watch industry don’t want to hear this, but the reality is that the watch industry of today probably continues to produce too many watches. When production levels were forced to decrease during the pandemic, it only helped demand and proved how companies can still make good profits while producing fewer watches. Now that many production and supplier bottlenecks have dissipated, production levels are back up. I truly hope that at least some watchmakers understand that by extending the life of their existing watches they can keep inventories low and thus prices high by not flooding the market with too many new goods. The unspoken implication of course is that people who want one of their watches will buy a certified pre-owned versus brand new timepiece happily. That way the brand and the consumer are happy, while the industry doesn’t need to produce any more timepieces.

To ensure that limited production watches have long lifespans, brands need to put a lot of attention and time. This requires carefully monitoring the market on a daily basis while juggling the purchase, servicing, and resale of pre-owned along with new watches. The task is doable but hard to scale or simply reproduce in different office and team environments. Elite high-end watchmakers will be the most adept at curating the marketplace and buying back watches to earnestly give pre-owned limited edition watches as much sales appeal as brand-new ones. Though it is possible and a great place for brands to aspire to.

Audemars Piguet is reported to be launching the test phase of its in-house CPO program in late 2023.

Not Wanting To Miss Out On Profit Opportunities

It is also true that if there appears to be money to be made, watch brands want to earn some of it. If you examine the watch retail space right now, you will see that many new developments or stores revolve around the sale of selling pre-owned watches. Part of this is a mere trend, that is true, but at the same time, all the buzz is on pre-owned and less on brand new (even though that is changing). This means that watchmakers hear “pre-owned” in the air all the time and concurrently feel that people are out there making money selling their used watches. If they can get in on it, then why not?

Many companies that sell watches are relatively small, and each new profit stream can make a big difference for them. At the same time, the pre-owned space is also populated by huge names such as the aforementioned Rolex, as well as even Cartier. Richemont in general is experimenting with selling certified pre-owned through some of its channels. There is already big corporate money behind watch makers officially selling their pre-owned stock as well as used watches in general.

Whether or not participating in the sale of pre-owned watches is a profitable win for brands is really yet to be seen in any long-term manner. My suspicion is that some but not most watch brands involved in pre-owned sales will profit from doing so. I believe that the cost of acquiring/servicing/posting used watches will be too high for most companies to bear and that the volume of used watches they sell will not make up for it. I have long since believed that used watches for the most part should be sold by specialist dealers who understand daily fluctuations in demand and what motivates specific buyers. I don’t see too many ways of systemizing this or building a large economic model around it for corporate interests to copy. Success in the curation and sale of certified pre-owned watches comes down to personal attention and the gained experience of specialist team members. I say all this to explain to consumers that even though a brand is involving itself in pre-owned watch sales does not mean that it is working for them or that they will be doing so forever. It is worth understanding that for many companies this is still an experiment designed to see if it will be profitable. Accordingly, user experiences will vary greatly.

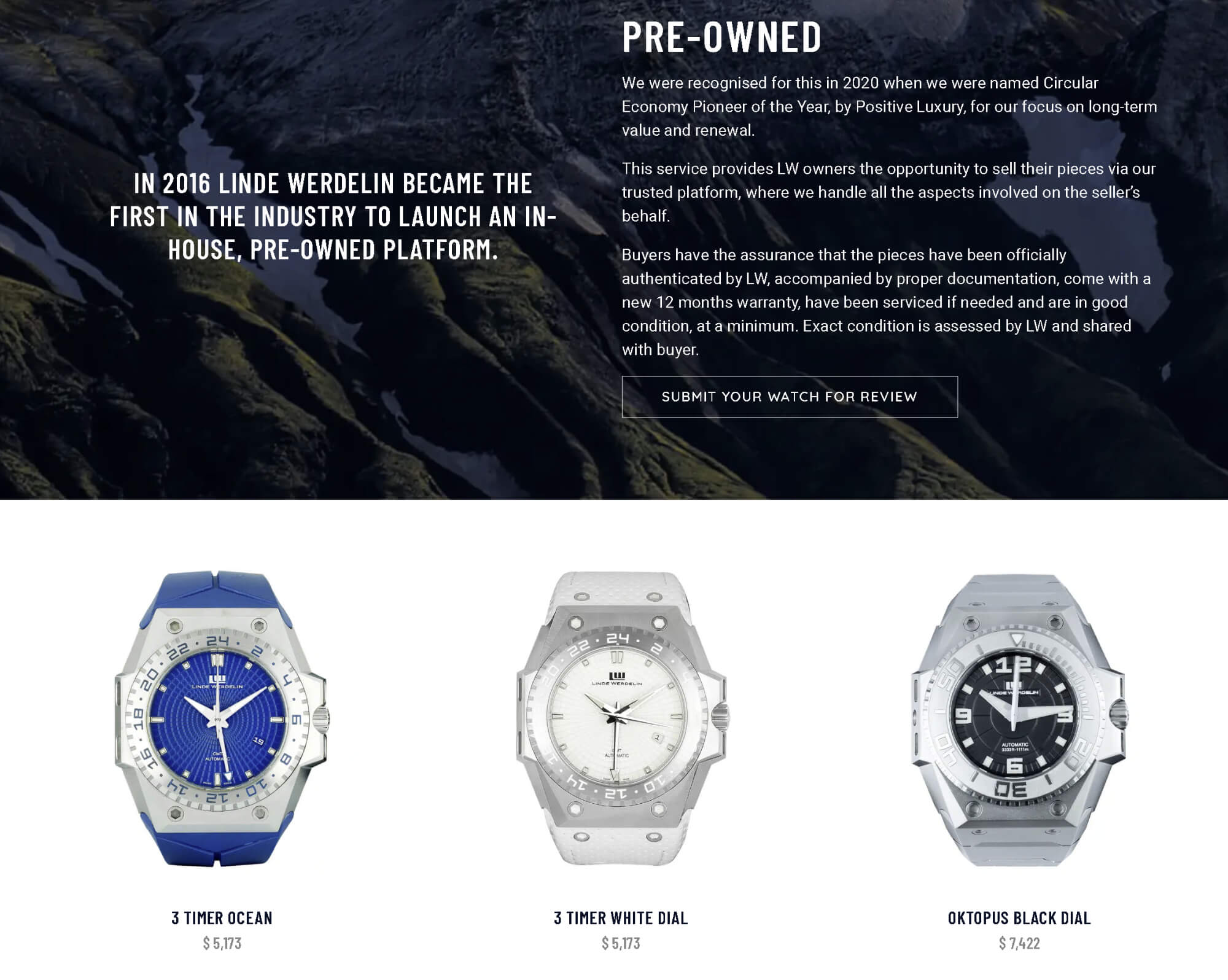

Linde Werdelin was one of the first brands to launch a brand-curated CPO program when it did so in 2016

Curating The Entire Brand Buying & Owning Experience

Finally, watch brands like the idea of selling their consumers pre-owned and new watches because it allows them to offer an even wider brand experience. These are the types of companies that like to have personal relationships with each of their buyers. To them, consumers don’t just ask them to buy watches but rather form a relationship with them. That relationship is curated with particular experiences, opportunities, and even struggles. Maybe a brand has decided that they want someone to first own one of their pre-owned watches before they are “ready” for a new one. Being able to offer a consumer both products can thus be an important component of a curated brand relationship that goes far beyond simply responding to when people say “I’d like to buy this.” This is especially true when that same consumer may have the chance to purchase a used watch from that brand from someone else. If they do so, then that consumer doesn’t participate in the larger brand experience that the company might otherwise want them to have. Whether or not you as a consumer agree with this process, you can understand that when used and new watches of a desirable brand are all sold from the same place, then it forces them down a particular experiential path.

At best this can offer consumers excellent experiences. They can be contacted when a particular pre-owned watch they want becomes available and can have the brand guide them from watch ownership to watch ownership experience. This can be like a friend doing a lot of the hard work for you. It won’t be cheap, but for elite collectors, this can be a very rewarding experience. Conversely, it can be a rewarding and profitable experience for the watchmaker and brand because it allows them to replace the role of a retailer and thus capture much more profit for themselves.

In summary, the commercial and logistic hurdles of successfully maintaining a new and pre-owned watch sales business will be highly burdensome for many brands. Though not all of them. At least a few watchmakers will specialize in owning the entire customer experience, which often necessitates being involved in the world of used watches. Thus, for these companies, they will be forced to become pre-owned watch specialists as a side-effect of wanting to improve their direct relationship with consumers. Most of these instances will only involve rather high-end products. Companies that produce high volumes of watches will be more interested in the business of used watch sales as opposed to client relationships. These companies face a lot of challenges when it comes to creating processes that allow for less cost going into selling certified pre-owned watches than is made through the profit of sales. This could lead to unfortunate cost-cutting measures or at the least, great misunderstandings about the effort needed to sell used watches directly to consumers.

Whether or not watch brands being involved in certified pre-owned watches is a good or bad thing for consumers on a wholesale basis is hard to conclude. I think it is safe to say that experiences will vary greatly today and that only a small number of watchmakers will truly get the balance right when it comes to integrating pre-owned watches sales into their business models. Consumers will (as is typical) have to approach the purchase of both new and used watches with a degree of skepticism to ensure that their interests are being properly met. Please do share your personal experience on this matter in the comments below.