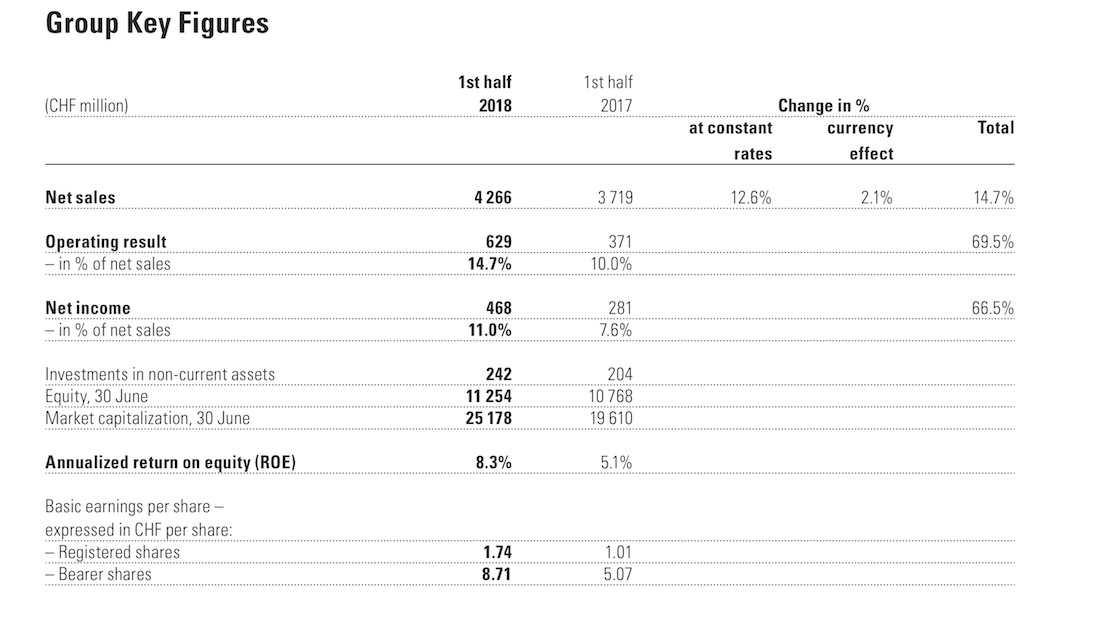

The Swatch Group recently released its unaudited “Half-Year Report” for mid 2018 that offers some hints behind the activities of the major watchmaking group, which owns brands such as Omega, Hamilton, Tissot, Longines, Breguet, and more. The tone of the report – as is the custom – is very positive with a series of optimistic declarations about the future and the group’s performance. The report begins by pointing out that the first half of 2018 saw “record half-year sales in the history of the Swatch Group (You can check out some recent Swatch Group financial reports here and here). It also goes on to suggest that the group is experiencing “growth in all regions,” “strong product demand by its own brands,” and “massive gains in market share in all price segments and categories.” Things look positive, yet we look into the detail of the report to determine what can be learned from the 12 page document meant for Swatch Group shareholders.

Note that these investor relation documents are not true glimpses into individual brand performance or even a look at what is and isn’t working from a business perspective at the company. The numbers are designed to help bolster investor confidence while also being required by stock exchange authorities. One must read into the statements made by the Swatch Group (as well as its competitors, such as Richemont’s recent 2017 financial report) to get a more precise understanding of what the company is doing, which is also modified by anecdotal evidence our team has on situations in the watch industry that can clarify some of the statements made in the report.

For example, Swatch Group reports “massive gains in market share.” Well what does that mean? It could mean that Swatch Group products are being preferred more than competitor products (either by retailers or consumers – it doesn’t say). Or it might also mean that less competition in the market naturally results in more market share for Swatch. Less watches are being produced by many brands, which could explain why the Swatch Group is able to excitedly claim its market share is going up across all areas.

Depending on how they calculate currency exchange rates, the Swatch Group claims overall sales increased by between about 12–14% in 2018 compared to the same half-year period in 2017. To me that is one of the more sober statements made in the report. With that said, the numbers do not specify whether those sales are “sell-in into the market” or “sell-through to customers.” The former is merely the sale of watches to retailers, which sit in stores and the latter is the more important metric of how many people are actually buying the products. If it isn’t clear on why this distinction matters is it because watches sold into the market and not to end-customers present a potential liability in both the near and long-term. The Swatch Group and others like to classify watches as “durable consumers goods.” This is of course true compared to food and other consumables which can expire. With that said, watches like all products have a limited lifespan of when someone is willing to spend retail prices on them.

Large watch groups have for a number of years now produced more watches than end-customers can buy in that year. Unsold watches to consumers in the hands of retailers are classified as profit even though at times those watches may need to be purchased back. Worse is when those watches enter the gray market – which tends to have the effect of disincentivizing consumers from paying full retail prices, given the widespread availability of discounts. For this reason I have regularly advocated for groups to make distinctions between sell-in to the market and sell-through to consumers in such fiscal report documents.

The Swatch Group does hint that the brands are currently engaged in massive production efforts which are actually causing production bottlenecks at the group. The report does mention one massive investment of “inventories” by the group whereby investment increased by 80% in one year from 380 million Swiss Francs to 6.7 billion Swiss Francs. What does that mean? My understanding is that this figure is related to the purchase of raw materials needed to construct watches. The report actually mentions that most of this increase in value is due to the purchase of gold and diamonds by the group. Somewhere the Swatch Group is storing several billion dollars in gold and diamonds. I’d be keen to see what the security for that facility looks like.

Remember that the Swatch Group includes a number of brands that do business with one another. Some of these increases or exciting performance metrics could apply to business that Swatch Group brands are doing with each other. An example would be ETA selling movements to Longines. Both are in the group but the purchase might be calculated in “sales,” even though it might not apply to overall group income.

My suspicion is that Swatch Group is using this relatively slow economic period to cut costs while at the same time keeping its manufacturing base busy. Manufacturing is where many of the over 35,000 Swatch Group employees are placed, especially in Switzerland. The group – like its colleagues in Switzerland – is reluctant to terminate employees or be seen as doing so for a series of political reasons. Thus, it makes sense that the Swatch Group is keeping its factories busy.

Doing what though? If you read between the lines of the entire report, two things are clear. First is that Swatch Group was able to increase operating income by reducing operating costs. Marketing and advertising activities were especially vulnerable – with reports from various market sectors that these were large areas of at least temporary cost-cutting by the group. At the same time Swatch Group appears to be either currently producing large quantities of watches or investing in materials necessary to make additional large quantities of watches. For financial report purposes this latter move is good because the raw materials (as well as unsold watches) are often classified not as an expense, but as an asset (assuming the market agrees with the value Swatch Group places on these assets).

One of the most interesting statements in the entire half-year 2018 report is a list of three bullet points which indicate important Swatch Group strategies. They are:

– to keep its personnel employed and maintain its production capacities in order to be prepared for the upswing

– to make long-term investments in product innovation and marketing

– to regard inventories as an absolute prerequisite for growth and market share gains

We see a group cognizant of its basic market responsibilities in the immediate, while anticipating future growth and at the same time investing in it. The Swatch Group does not seem to offer evidence or an explanation for the “upswing” if refers to, nor does it specify in what areas it is investing in marketing or product innovation. With that said, statements like “long-term” and “prerequisite for growth” allude to a company that knows it will be a while before it and the industry return to appreciable growth in both market demand and sell-through to consumers.

I was excited to read about Swatch Group growth in the Americas and Asia, but the report failed to go into more detail. The report merely mentions “double digit growth” in these regions without further explanation. In regard to performance by brand, country, product segment area, or price, this and other investor report documents are silent, and as far as I know the Swatch Group and others rarely, if ever, produce this type of full information (so it leaves us guessing).

What is clear (and positive) is that the Swatch Group appears to be in the midst of a full transitional mode. It must appear to be stable in front of investors to maintain investment confidence, but at the same time the Swatch Group is anything but ignorant of various market realities and challenges. As a group they can’t simply pivot all of their strategies at once, but I am hopeful that various types of reorganization and investment efforts internally will result in strong brands, better marketing, more compelling products, and real leadership in the watch industry (which needs stronger leaders). swatchgroup.com