Three proprietary hairspring designs: Omega’s Si14 by Nivarox-FAR, The Parachrom spring by Rolex, and the Silinvar Balance Spring by Patek Philippe

It seems then that everything was perfect in ETA-world. However… it was this extreme extent of centralization that soon became one of the greatest problems for Nicolas Hayek and the group itself. While this excessive re-structuring undoubtedly helped them to recover and gain momentum, ETA’s significance within the industry soon proved to be much, much too large – and by the time they realized this, it was already too late. You’d have every reason to think that such a dominant position is a good thing, but it actually is something against which the Swatch Group has been fighting for more than a decade now. Here’s why.

A Reason to Reduce Supply

As the industry was growing, more and more brands were “revived” or created from scratch and – quite obviously – they all needed movements to equip their watches with. So why didn’t newcomers develop their own movements in the first place? Firstly, because ETA was there to supply high-quality, reliable, easily customizable movements any time of the day. Secondly, the problem is with cost and time. Developing a movement from scratch can take five years or more and might require an investment of up to 10 million francs. It requires a more reasonable investment to come up with a design, create the case, the dial, the marketing campaign and buy a finished movement from ETA, than to spend years without selling anything only to start your brand with a proprietary movement. Last but not least, an in-house movement all by itself will never be a guarantee for success. If any one of the aforementioned factors are flawed (the design, the marketing, the distribution) you can boast about your 10 million franc movement, but the watch will never sell.

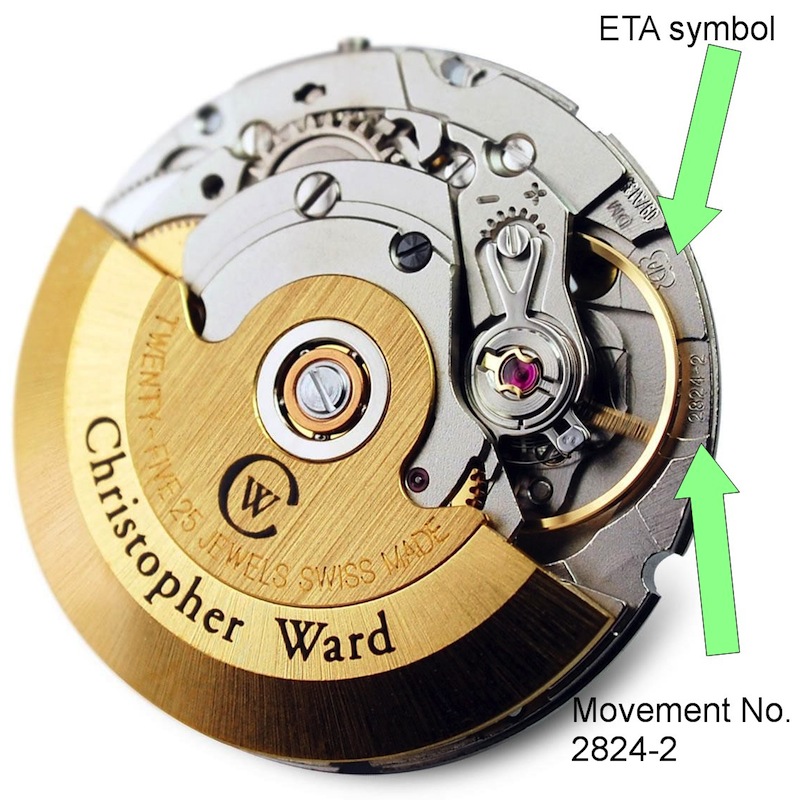

What you do instead is buy tried and proven ébauches or finished movements from ETA and slightly modify them to suit your requirements. For those not familiar with them, the most ubiquitous ETA movements are the hand-wound 6497, the automatic 2824-2, the automatic chronograph 2894-2 (a modular chronograph, produced since 1996) and the 7750 (an automatic, integrated cam/lever chronograph produced since 1973). These all have several different variations and there are several other calibers as well, but the history of the movements deserves a dedicated article. What we must mention though is that ETA calibers come in four different “grades” that correspond to different levels of finish, quality of execution and – unsurprisingly – different prices as well. Standard is the cheap and cheerful solution with an accuracy of +/- 12 seconds per day and 30 seconds maximum positional variation. Elaboré is a step up with a performance of +/- 7 and 20 seconds in those fields. Top Grade has the finest finish and higher quality components overall than the previous two grades with an accuracy of 4 and 10 seconds. Finally, there is the Chronometer grade which is a Top Grade movement with COSC certification. This clearly shows just how superb ETA’s selection is and how well-catered to external brands are when it comes to choosing what movement to use.

So what’s the problem? The problem for ETA and Swatch was that they simply had to sell movements to any Swiss watch company regardless if it belonged to the Swatch group, was an established manufacture with centuries of history, or was a new fashion brand created two months ago. Switzerland’s Competition Commission (or Comco, as it is frequently called) ruled that since ETA (and Nivarox-FAR) were in a monopoly position, they had no freedom in deciding who they would supply with ébauches, movements and components and who they would not.

The authorities’ reasoning is that there hardly were any alternatives to ETA and if ETA stopped supplying parts and movements to others, then those affected would be practically out of business because they have nowhere else to go. All this is more or less true. In two stages ETA had absorbed a vast number of smaller and larger workshops and companies. Firstly when it took over all manufactures within ASUAG and secondly when it underwent Swatch’s expansion craze. In the eyes of the authorities, ETA was the movement supplier in Switzerland. Hence, if they decided not to sell to external companies they risked anti-trust violations with stratospheric fines. The Swatch Group, ETA and Nicolas Hayek became the prisoner of the industry that would never have survived without them.

All this was not so much of a problem for Swatch during the early ’90s when there were fewer brands to cater to. But as Mr. Hayek put it, by the early 2000s ETA became a supermarket for watch brands. Just about anyone could have created a brand and ETA was bound to sell movements to them. To give you an example: if you wanted to create your very own watch company but preferred to start out without investing millions into manufacturing, what you did is go to an établisseur company (much like an OEM manufacturer, these are firms that purchase movements or ébauches in huge volumes from ETA and will build watches for just about anyone), you tell them what design you want, they’ll make it and print your name on the dial. ETA, as I just mentioned, was unable to decide which company they would or would not supply with movements and so they had to sell blanks and complete movements to these établisseurs too. By 2001 Nicolas Hayek had had enough of this. His, and hence the Swatch Group’s view on the situation is as follows.

What he saw is that the Group spent billions of francs on expanding ETA, improving its manufacturing abilities and developing better movements, only to be bound to sell these to big and small brands alike who would then directly compete with Swatch group brands. As the New York Times quotes Nick Hayek, CEO of Swatch Group and son of Nicolas Hayek: “We are in a ridiculous situation that would be like having BMW supply all the engines for Audi and Mercedes. In no other industry do you have one company supply all the critical parts to the people who then compete directly with it.” To top it all off, Swatch was not allowed to raise its prices without Swiss authorities immediately investigating the move. Therefore not only was Swatch bound to sell movements but they were prohibited to raise profit margins either (ETA did increase its prices a few times over the years but the raise was always strictly moderated by the authorities).

What was told by many was perfectly summarized by Jean-Claude Biver (Chairman of Hublot) for the NYT: “Thanks to Swatch, there is no other industry with such cheap entry costs.” Well, Nicolas Hayek wanted this to be over once and for all. To be fair, we have to note that Hayek Sr. did began warning all brands to start investing into their own manufacturing facilities as early as the end of the 1980s. From 2002 however, he was determined to make ETA perform serious cuts for all three of its main profiles: manufacturing ébauches, movements and key components.

It all began with ébauches in 2002. A plausible reason for this is that the ébauches-issue starkly signified just what was driving Nicolas Hayek to be so furious. These semi-assembled movements were purchased by établisseurs (that I previously mentioned) as well as external watch brands and were often built into movements that would later on go into high-quality counterfeit watches, or were completed by Swiss brands who would then communicate that these were their proprietary, in-house movements. Needless to say, none of these trends made Hayek or ETA particularly happy. What is more is that ébauches accounted for a microscopic amount of profit of the Swatch Group. Hence, in August 2002, the Group announced that it wants to drastically reduce the amount of supplied ébauches to external companies and to completely stop such operations by 2005. This, of course, caused major upheaval in the industry and Comco immediately intervened. To keep a long story short, ETA agreed to keep on supplying ébauches until 2008 without reducing quantities and to not stop altogether before 2011.

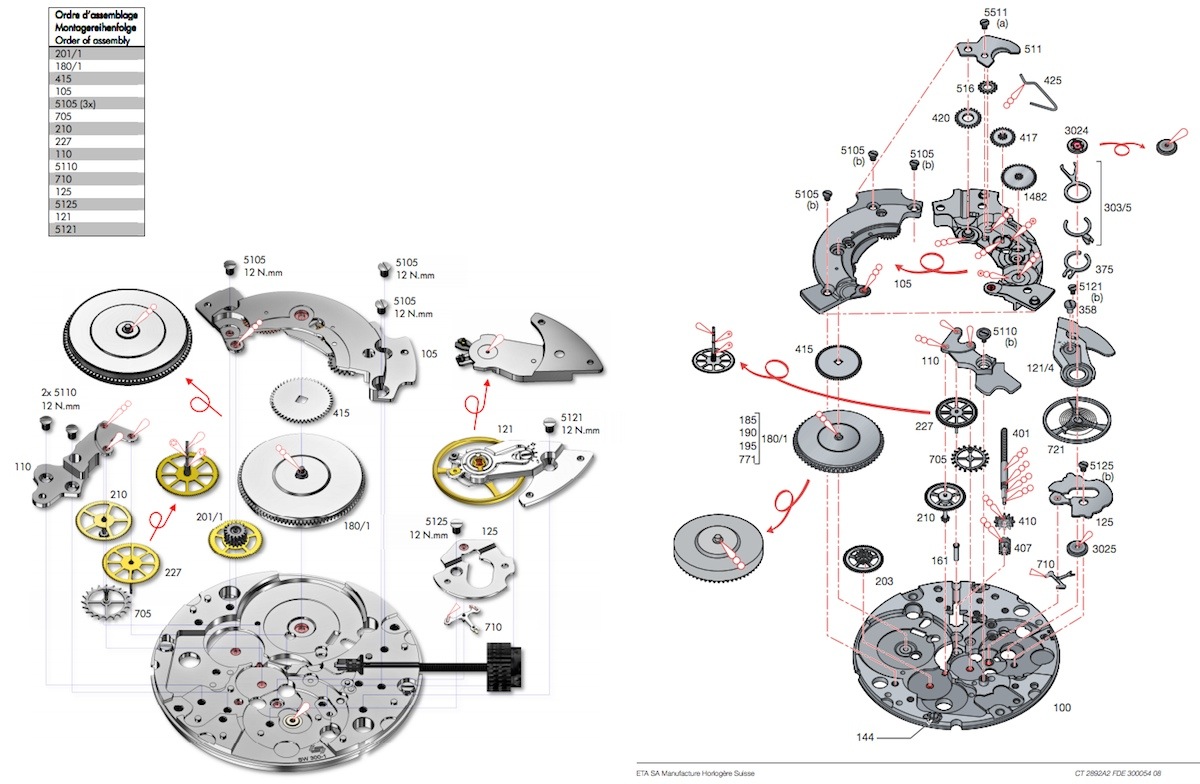

Then it was the case of supplying complete movements (made by ETA) and components (from Nivarox-FAR). In 2011, Swatch sought Comco’s permission to decrease the number of movements and components it sold to competitors. It is important to bear in mind that the availability of movements and that of parts are taken into different consideration by Comco. We already mentioned just how much of a task it is for small and major brands alike to develop their own movements, but creating the infrastructure that allows one to produce key components in-house is even more demanding than that. Most patents have long expired on many ETA movements so it’s relatively easy to clone them (like Sellita did when designing several of its most popular calibers), but it is borderline impossible to gain access to the know-how that allows Nivarox-FAR or Rolex to make their own springs. This resulted in two different rulings by the competition authority.

I created a montage from the official charts for the Sellita SW300 (on the left) and the ETA 2892 on which it is based on (to the right). For the ultimate watch nerdery experience compare the base assemblies of the two and see how remarkably similar they are.

It allowed the Group to cut back on the supplies of completed movements. And although nine companies (including Sellita, Frédérique Constant, Louis Érard and others) separately challenged the ruling in court, in December, 2011 the Federal Administrative Court rejected their appeal against the Federal Competition Commission’s (Comco) decision. This practically allowed Swatch to reduce the amount of supplied complete movements by the end of 2012 to 85% of 2010 levels.

As Watchtime.com reports, “The reduction was extended through 2013. ComCo announced on July 12 [2013] another 10-percentage-point reduction in 2014, bringing the amount to 75 percent of the 2010 quantities. Having said that, authorities were not so allowing when it came to Nivarox-FAR cutting back on assortment supplies (such as levers and pallets, balance wheels and springs, escape wheels, etc). They ruled that it would be ‘premature’ to allow them to withhold deliveries of such parts to non-Swatch companies.” As told by Watchtime, “In 2011, it [the Competition Commission) allowed provisional cuts in assortments of five percent of 2010 quantities, which it extended for 2012 and 2013. Those cuts apply until the end of 2013, ComCo said. It said nothing about 2014, presumably supplies of assortments will return to 2010 levels.”

To try and make sense of all this bureaucracy let’s see what the reactions were within the industry. Essentially, there are two very different approaches to this issue. Some say that what is happening now might (and as they say, most likely will) eventually result in a crisis that is of similar significance to the quartz crisis. Their reasoning is that if small brands will not be able to receive movements from ETA (and more importantly hairsprings and other indispensable components from Nivarox), then these brands will simply “cease to exist.” Others say that in the long run, this will serve the industry by eliminating those who have exploited it by relying on the comfort of its infrastructure, purposefully avoiding making any serious investments and spending on advertising and marketing instead.

Surely, not everyone is able to make a 5-10 million franc investment, but then again the Group’s intentions had been made clear long ago. Politics aside, the actual managerial/strategical reactions are as diverse as the brands in the Swiss watch industry themselves. Several small and large companies have decided to start developing their own movements with more or less success. These brands often work together. Some belong to the same luxury-group and so the group’s management orders one brand in the portfolio to “help” another. We will also see some independent brands unite their forces to share the related costs while others will look for other major suppliers such as Sellita, Soprod, Vaucher Manufacture or try and purchase movements from watch brands who make their own (like Zenith, Jaeger-LeCoultre, Girard-Perregaux, etc). Finally, there is a mixture of these realized through obtaining a solid base movement and modifying that to suit unique needs with the use of different modules from Dubois-Depraz (read about Ariel’s visit to the manufacture here), Vaucher Manufacture, Fleuier (and here’s my visit to the VMF manufacture) and others.

ETA Today

In conclusion, we can say that the late Nicolas Hayek wanted to give the Swatch Group the right to decide whom it would or would not supply with movements and components. He believed that this would serve the long-term interest of his group and the entire industry as well. He articulated his intentions (that he wanted to quit selling everyone everything) many times and he advised brands to start focusing on manufacturing their own parts and calibers instead of financing marketing campaigns and ambassadors.

Having said that, not everyone would be out of the ETA “circle of trust.” As Watchtime magazine quotes him in its 2010 August issue: “We will keep our promise to sell movements to our traditional watchmaker clients. But the development of the industry in the wrong direction over the last few years forced us to react now against delivery to all others.” This means that the Group will continue selling parts to several external companies (a majority of those that have invested into making their own movements will receive supplies in the future, such as Patek Philippe will continue to receive hairsprings from Nivarox and Rolex’s Tudor will still get movements from ETA). But the Group will not be selling to everyone and anyone from now on.

One of the alternative solutions is the use of movement modules. Pictured is the VMF5000, a perpetual calendar module by Vaucher Manufacture Fleurier. Looks fantastic!

I feel that a primary reason for the deafening outcry we have been hearing from the industry is to be found in the level of comfort it enjoyed for the last 25-30 years. A great number of non-Swatch brands relied exclusively on ETA/Nivarox without seriously investing into their independence. However, what used to appear as nothing more than an improbable turn of events, suddenly (in such a technologically sophisticated industry 1-3 years is “sudden”) became harsh reality.

Affected brands will have to leave the well-worn path of constantly relying on a single external supplier and go down either one of the following two routes. The first option for them is to work together to create new matrices of companies in order to re-allocate the responsibilities linked to the supply of movements and different components. The second option for each is to fight on their own and invest extremely heavily into their own manufacturing capabilities – but this will cost them an even greater amount of resources and time.

Further, former suppliers to ETA such as Sellita are proving extremely capable in the mass production of ETA movement clones. Because patent protection no longer applies, anyone with the industrial skill can technically copy any of the older ETA movements whose patent rights have expired. So while it isn’t clear whether Sellita (also Swiss) and companies like it will innovate, they should be able to meet at least a large chunk of the demand for ETA movement clones.

Having said all that, I still believe that this will not be yet another end for the industry. On the contrary. Everything is given to make for a future that is more sustainable and that is with more genuine inner values. I am greatly excited to see what the next 5-10 years will bring because the present situation will inevitably force luxury groups, major and minor companies, high-end and more fashion-oriented brands alike to either invest into technology and develop their own movements and parts or purchase from new companies who have done it for them. It will force the industry to think more. With ETA out of the equation I am eager to see what the coming years will bring us on the level of mass-produced movements that go into luxury watches. This is not about ETA anymore, it is about an entire industry. And I feel that – in part – is what Nicolas Hayek wanted to achieve.

Since the 1856 establishment of its origins as “Dr. Girard & Schild,” ETA has fused with a nearly infinite amount of smaller and larger Swiss manufactures. This unique past allowed the company to obtain the priceless know-how and experience of these participants and transform them into a group which was ultimately responsible for saving and revitalizing the Swiss watch industry. Despite the several key roles it played during the 1900s, for the coming years it is destined to give more and more room for others to develop and to ultimately create a more versatile world of watch making. There are several unique watch manufacturers with great heritage and tradition, but if anything, ETA SA has a history of dizzying heights and drops, flecked with great success stories and some of the most severe crises of the 20th century.