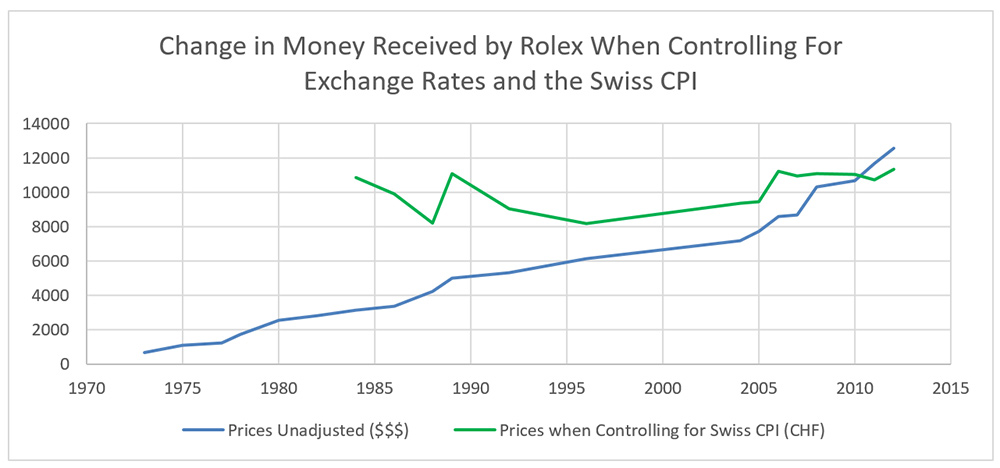

The green line below shows the financial benefit Rolex has gotten from the sale of an average Rolex since 1984 when factoring in the exchange rate and changes to purchasing power in Switzerland (I could only get reliable Swiss CPI data for beyond 1983). When you look at price increases through the lens of the financial benefit Rolex receives from the sale, prices have only gone up by 1.04x since 1984. In other words, when factoring in the exchange rate and changes to the effective purchasing power of a Swiss franc that Rolex pays their employees with, the Swiss haven’t increased prices much at all.

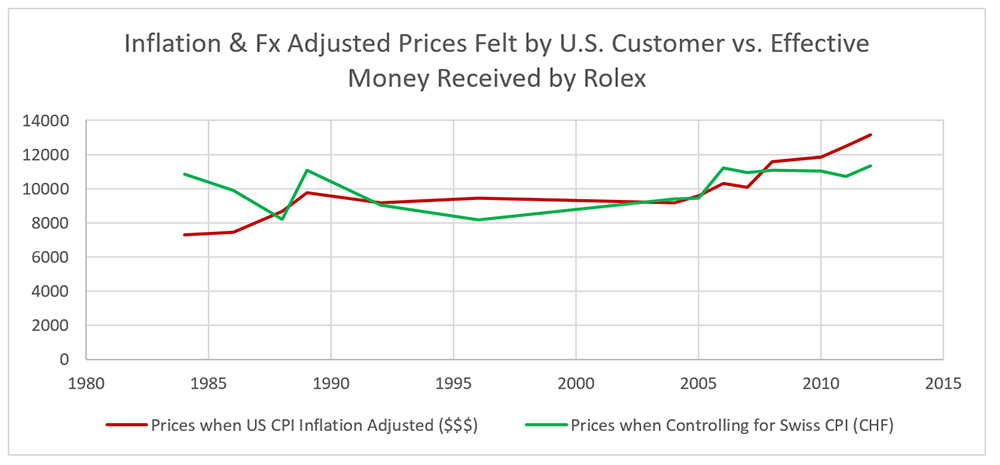

The last step: Compare these charts. How much my grandpa would have paid in 2016 dollars versus Rolex’s effective benefit from the sale. When we look at the period of 1984 to the present, it shows that prices haven’t increased much at all when we consider the purchasing power of money then and now both in the US and Switzerland.

In summary, here is a table that shows how much prices have changed since 1984 when considering these relevant factors. (For reference, a 1984 Ford Mustang Coup sold for $7,088. When that is adjusted to the purchasing power of 2016 dollars, it would cost $16,444. Yet today, an equivalent 2016 Ford Mustang Coup retails for about $32,000, so a Ford Mustang Coupe has effectively doubled in price – and you only get a 6-cylinder engine).

Other Ways To Look At The Issue:

There are other ways to look at the issue beyond using the purchasing power of adjustments of the consumer price index (though the CPI is considered the baseline). Website measuringworth.com is frequently used by watch historian Richard Watkins and allows you to see how prices have increased using other methods.

Below are a few other methods that offer other measures for how much a 1957 Rolex DateJust Two Tone (retail $360) would cost in 2012 dollars under the various measures:

- Consumer Price Index method, a.k.a. Real Price (the method I used): $2,980

- Consumer Bundle method, a.k.a. Real Value: $3,700

- Accounting for the relative wage of an unskilled worker then and now: $3,720

- Accounting for the relative wage of a skilled worker then and now: $4,420

- GDP per Capita Method, a.k.a. the Income Method: $6,760

While the nuances of each method are not too important for this article, the point is that the 2012 DateJust Two Tone actually retailed for $10,900. This means the price of this watch has increased by anywhere from 3.6x to 1.6x since 1957 even when adjusting for price inflation with these various methods.

Let’s look more broadly at watches in general, considering the some of the first mass-produced watches. The American watch industry was the first to fully mechanize and by 1877 Waltham had produced over 1 million watches (compared to tens of thousands from the largest Swiss firms). The American companies had figured out how to cheaply produce watches and became the dominant producers by this point in history. Therefore, they provide the earliest opportunity to compare prices for mass-production watches. Adjusting for the various methods, a $300 Waltham American Watch Co. Grade watch in 1868 (which would compete with some of the nicest non-complicated watches of today) would cost:

- Consumer Price Index method, a.k.a. Real Price (the method I used): $6,790

- Accounting for the relative wage of an unskilled worker then and now: $46,800

- Accounting for the relative wage of a skilled worker then and now: $74,000

- GDP per Capita Method, a.k.a. the Income Method: $84,900

Obviously, factories are significantly more efficient today than in 1877, so this should make watches cheaper today, not more expensive. If companies can produce watches more cheaply today, shouldn’t they be making massive profits? The problem is they are not making massive profits. In mid-2016, Swatch Group reported a 9% profit margin (technically, an operating margin, but I will use the terms interchangeably for ease of reading). Even at the height of growth in 2013, they only had a 27% profit margin – nowhere near the margins that people assume. Maybe people’s watch preferences are shifting and leading to declining sales? How is this possible? That’s what we’ll explore in part 2 of this series.

In Conclusion

What this does not answer is how consumers actually value watches. We may very well be at a point where the cost of production, high fixed costs of producing in Switzerland, and economic conditions have surpassed the customer’s willingness to pay as is evidenced by the 2016 slump in Swiss watch sales. I will explore this topic more in the next article in this series.

The other topic this does not answer is why not drop the prices anyway? If consumers aren’t willing to pay the current prices, why not lower them? The law of supply and demand should remedy the problem. I will address this proposal in the third and final article of the series.

What you should get from this article is that it is safe to say that watch prices are higher today than what grandpa paid in 1957, but it’s not fair to say that the industry is being irrational or greedy. Then again, a discussion of whether or not the watch industry in Switzerland should control their own costs more efficiently is an entirely different conversation. A simple glance at retail prices makes it appear that watch prices have gone up by as much as 4x since 1984, but once factoring in adjustments to the value of money and its purchasing power, this quickly diminishes.

US consumers feel these price increases more acutely because of exchange rates and differences in inflation between the US and Switzerland. The issue is not greed, rather increased costs of living in the US and Switzerland, and volatile exchange rates that make US consumers feel the pain more than one might think. While watches should become more accessible for many people due to increases in standards of living, the prices of watches are also increasing. To little fault of the Swiss, what was starting to become more accessible is also becoming increasingly unattainable luxury. Stay tuned for “part two” of this three-part series next…