For 2020, the major wristwatch trade show event Baselworld has announced a partnership with a business seeking to connect watch manufactures and brands (presumably mostly in Switzerland) with third-party entities known as distributors whose aim is to import their goods into particular markets (often countries) and then sell them to locals in that market.

Just a couple of generations ago, the entire watch industry was powered by the model of watchmakers working with watch distributors to power the Swiss timepiece industry as a commercial enterprise. After being acquired by foreign luxury conglomerates or as a means of increasing profit margins, Swiss watch brands (mainly starting in the 1990s and then heavily into the 2000s) started dabbling in distributing watches to other markets themselves by operating wholly-owned subsidiaries in other markets, such as the United States, Australia, France, etc…. The current norm for big luxury watch brands is to operate in foreign markets with wholly-owned distributorships. This has helped them recoup more of the sales margin, but not everyone in the watch industry agrees that it’s right for their brand or market.

The last 10-20 years, the watch industry has seen a lot of bitter fights between watch distributors and watch brands seeking the legitimate power to control sales for that brand in a distributor’s market. Statistics seem to suggest that when a watch distributor controls its own market, sales performance is almost always universally better. A personal touch when it comes to marketing, communication, advertising, retailing, and sometimes even pricing allows different watch markets to adapt the brand message and personality to the market’s own culture and expectations.

When a brand itself seeks to control a large diversity of markets at the same time, it often struggles to keep up sales performance to the level of investor expectations. Bitter upper-management transfers and toxic internal politics often ensue when today’s luxury watch brands seek to take on more than they can chew, often resulting in the need for “bailouts.”

Now in 2020, we’re seeing a return to watch brands working with third-party distributors as a possible answer to a lot of the world’s watch industry marketing and advertising problems. “Big Watch” doesn’t seem to work outside of a few narrow examples (albeit highly significant ones), such as Rolex and Patek Philippe. The rest of the market share doesn’t seem to allow for too many mega-company names (perhaps a few dozen, max). If this is true, then the business models for luxury Swiss and other country’s watch makers might benefit from some serious re-thinking over the next 10 years. A return to working with third-party distributors should decrease operation costs and overhead, while truly offloading the need to conceive, produce, manage, and implement global marketing, advertising, sponsorship, event, and other communication needs. The market would bear such costs (or markets, as they can always work together to collaborate on regional or cultural strategies) with a more direct impact on their performance.

What comes with a return to third-party watch distribution is also the opportunity to re-think the notion of market boundaries. The traditional boundary of markets was regional borders. Today, in our connected, globalized world, markets might be something else entirely. Languages might be a market, and so might cultural preferences, or even particular product lines might be markets unto themselves. The entire Internet might be a market distinct from the physical retail space in a particular market.

A principle that the Swiss watch industry has always seemingly relied on is, “If you make an exceptional product to meet your high standards, someone somewhere else will probably also value it and wish to buy it.” This rule has been borne out for quality watches — they are most always eventually discovered and valued. As Switzerland (for example) began to compete in other areas, such as advertising agility or marketing worldliness, it failed to compete with other countries who might not be as skilled at the bench, but could out wordsmith them any day.

Before I present an interesting interview with a representative from Baselworld and The Watch Distributor Directory’s Thierry Huron and Thomas Baillod, I’d like to discuss precautions watch brands often need to take when considering a business relationship with a third-party watch distributor. This first considering is how long term of a investment they are seeking to see returns from. All business ventures are an investment, but some are designed to yield shorter or longer-term returns.

With high-end watches (as is the case with most luxury goods), a long-term vision is always the more profitable way to go. That said, it can take a number of years to ramp up even potentially explosive luxury brands. Historically, watch brands have ended relationships with watch distributors (or vice versa) from having competing interests when the two parties want to see returns on their investment. A watch brand seeking to profit in 12 months should not venture out with a distributor who wants to carefully build roots and allow a product to marinate in the market for up to 10 years.

A common complaint about third-party watch distributors is that they feed the gray market. It is true that third-party distributors have been one party — in addition to the brands themselves — who historically have fed the gray market (product sold at a deep discount) with inventory that was supposed to be sold via authorized dealers (where product discounts are available but certainly more modest). This was often before the practice was demonized and certainly before it was known how much the proliferation of gray market watches has made it a challenge for the traditional retail world to remain competitive.

Relationships with third-party watch distributors today should operate on the assumption that the true measure of performance is “sell-out,” or otherwise the number of times a consumer buys one to wear on his or her wrist. The is in contrast to market “sell-in” which is simply the number of watches placed in stores available for a consumer to purchase at some later time. Having a plan about what to do with watches that aren’t sold, or how to limit the number of watches that are intentionally sold out of the market, should be clearly articulated in contracts between watch brands and third-party watch distributors.

Finally, successful third-party watch distributors today will understand mastery of markets in their own neighborhoods. Their performance will come from creating relevant and demand between watch product and consumers in their territories or niches alone. A watch brand should always make sure a third-party watch distributor is committed to developing a loud and ongoing conversation with customers in their market and the brand.

For at least some brands, working to manufacture products while venturing with any number of third-party watch distributors to market and sell them in particular markets is a very viable business model today, and it likely will be tomorrow. For some brands, it will still make sense to own all or many of the distribution across markets. For the rest, understanding how to juggle product design and development along with manufacturing and sales will often result in outsourcing the latter, in part or entirely.

Baselworld seems dedicated to the idea that watch brand distributors are an important part of the wrist watch industry’s ecosystem and their partnership with the Watch Distributors Directory says just that. Here is a brief interview on the matter:

Ariel Adams (AA): Not all watch brands (especially new ones) or consumers truly understand each of the ways a timepiece can come to market. Help explain the traditional and current role of wristwatch distributors in the larger global timepiece market.Watch Distributors Directory (WDD): Imagine 20 years back, or 50. How would a person connect to a watch brand to try the watch and receive a professional advice? Or would a customer send by mail or bank transfer $3,000 to a remote company on the other side of the world, hoping that they will send by return mail the watch he/she has seen once in a magazine? Probably not.

To make a sale happen, you need basically three things in order: a place, a service and a stock. Historically, brands have leaned on a worldwide network of intermediaries (distributors) and retailers to allow a transaction to happen. The distributor has been in charge to dispatch stock to his/her country. There, the goods are then sold to retailers who will offer a sanctuary allowing a smooth and secure transaction to happen.

The recent development of Internet, combined with the evolution of mentalities, has enabled a new channel to develop that puts in direct contact brands and end consumers. This new channel is poor in customer experience, but extremely advantageous in terms of margins, since it disrupts the three basic costs related to distribution, bypassing the intermediaries and repatriating their margins.

Great customer experience with low margins, or high margins but poor customer experience and a totally new business model for brands? This is today’s biggest dilemma in the industry.

AA: What need was the Watch Distributors Directory originally designed to meet? How did brands connect with distributorships before such a directory and in what ways do you feel the Watch Distributors Directory has helped the brands that rely on it?

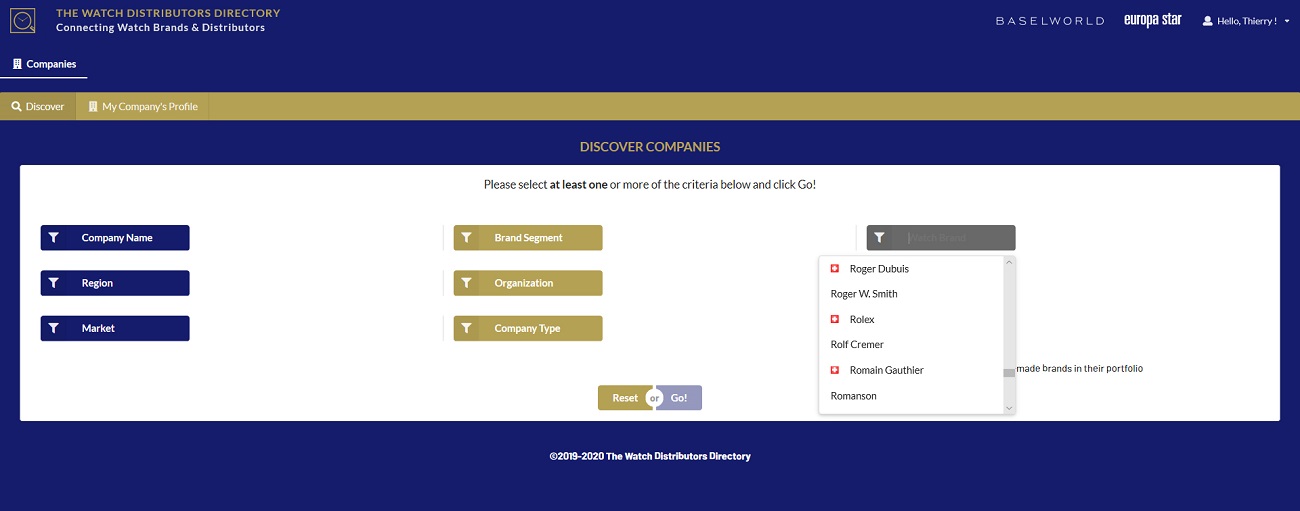

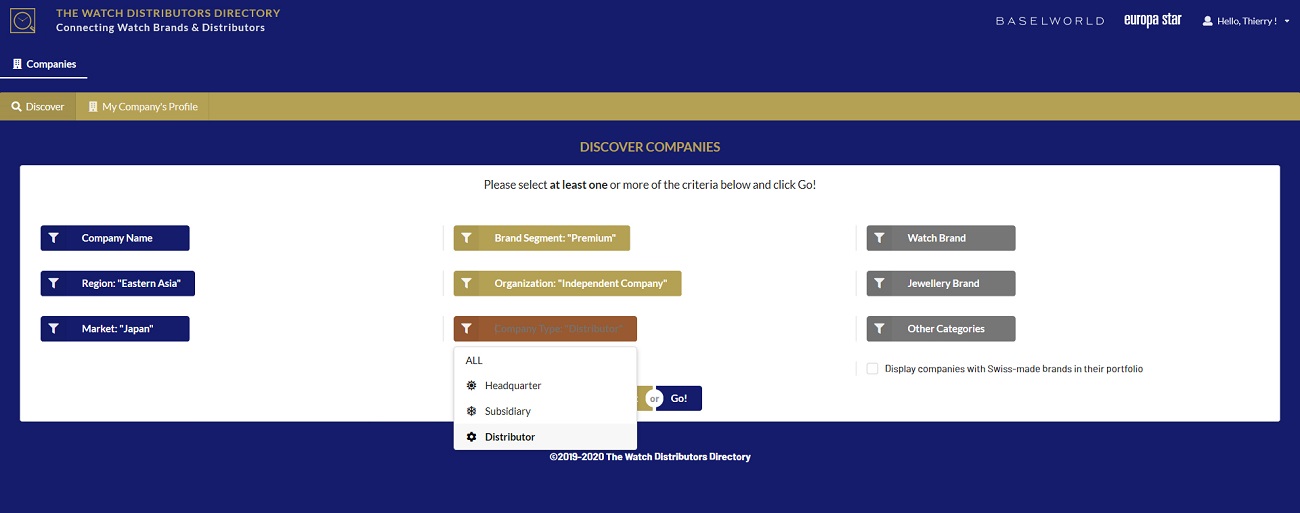

WDD: The directory fulfills a basic need in the industry: to connect brands with distributors efficiently. Today, a new brand that is willing to start a traditional distribution will have to figure out by itself who are the players in the market. Search the web, check competitors network, request here and there advice from friends or consultants. And knowing a name is just the start, you have to find out the address, the contact person, make sure your brands fits in their portfolio, while being in line with your sales strategy. This takes months and a lot of research. The WDD compiles this information and allows you to target the right partners all around the world. Time is beautiful, but for a company, time is money!

AA: A number of watch brands today are seeking a direct-to-consumer model or other ways to market that don’t necessarily rely on third-party distributors. In what instances or for what types of companies is working with a third-party watch distributor a wise idea when compared to the alternatives?

WDD: Purely-direct-to-consumer players opted to sell exclusively online. This online presence is poor in customer experience and has to be compensated for by intensive marketing. In addition, e-commerce works well for entry-level brands but less so for a newcomer selling in the middle to high-end segment. Distributors address an audience that is looking for an experience, which can best express in a dedicated environment, the store. In addition, a traditional distribution setup works on a logic of sell-in. This allows brands to focus on their core business, which is to produce and to sell in bulk, while delegating the burden of handling the multitude (the end consumers) to experts: the intermediaries.

Another important point: The top-selling markets are saturated with brands and advertising. The entry ticket is extremely expensive for newcomers. There are many secondary markets that offer niche business to brands, and many of those markets still work in the traditional way and haven’t been disrupted by the B2C trend. Examples: Most Latin American countries, Eastern block, southern Europe, Indian subcontinent, etc.

AA: How will a partnership with Baselworld help the core mission of the Watch Distributors Directory and in what ways will the Watch Distributors Directory help the core mission of Baselworld?

Baselworld: Both Baselworld and the Watch Distributors Directory put themselves at the service of the industry. Baselworld’s historical mission is to connect physically all the stakeholders of the industry. The Watch Distributors Directory purpose is to connect digitally the watch brands with the wholesalers from all over the world and facilitate the matchmaking.

The Watch Distributors Directory is a new exhibitor service made for an efficient preparation of the show on the brand side.

Baselworld is the perfect platform for the international launch of this new tool, bringing to its exhibitors and all the stakeholders of the industry, a new digital service that goes far beyond the show.

AA: What effect does a brand working with a third-party watch distributor have on the consumer experience? How can this make selling watches to end-consumers more effective or efficient?

WDD: The distributors play the role of vectors. They are the intermediaries between a brand and many retailers in a specific country (multiplied by many countries for a global brand). They know their territory, the language, the culture, their people, and have personal relationships with retailers, etc. They act, in this sense, as a translator for the brand. Good luck doing business in Iran, Russia, China and Argentina without a local “interpreter.” In addition, the distributor acts as a “buffer” for the brands, since they keep stock available in their territory, ready to be dispatched the next day (or same day) within the territory. They deal with the multitude and the burdens it represents.

It’s easier if you’re a cook to prepare one meal for all instead of having to prepare each and individual plate for every particular person, dealing with personal requests and tastes. Brands serve one meal, distributors keep it warm and season it for every retailer.

AA: Assuming a watch brand feels that working with a third-party distributor is a wise idea, what are some key tips to finding a good distributor partner? What are some of the most important questions a brand should ask a potential distribution partner? What are some of the most common things to watch out for in order to determine if a brands/distribution relationship will not benefit the parties? Are there any examples to mention of particularly effective watch brand/watch distributor relationships?

WWD: That’s a vast question, kind of like if you asked me what are the parameters to consider before getting married? Because it’s like this, but with money in the middle. You need to have the right personal match, fit in the distributor’s portfolio, make sure the distributor has the right contact in the market and a good relation with those contacts. You must have financial and personal resources and knowledge to activate the sales in the country, as merely putting watches in the retailers’ window usually doesn’t produce a big sales effect. You have to check that they offer you a dedicated brand manager. Agree on the common qualitative and quantitative objective and make sure you define clearly the vision and mission. In addition, make sure you define what happens if you wish to “divorce.” Who takes the stock, etc…?

A good way to evaluate a distributor is always to request a three-year business plan. Most of the distributors won’t send you anything or, perhaps, just a one-page draft… this makes you directly understand that they have no clue how to make it happen. A good distributor will highlight key information and figures that make you understand that they speak the same language and know their job. Having the right match is THE key to success in any given country.