In this special feature article, we go on a quest to better understand what is behind the unremitting rise of luxury watch prices, and to do so, we will explore how and why Rolex prices have increased over the last 60 years. You see, while the steep increase of high-end watch prices has become evident to every discerning watch buyer on this planet, it remains difficult to point out exactly why and how things have changed so radically… or, if they have changed at all.

This is, without a shadow of a doubt, one of the most pressing issues in the world of watches today, something that has raised countless questions and fueled numerous debates among watch enthusiasts, collectors, and experts alike. It has directed the spotlight on issues such as value proposition, the economic state of both the industry and the luxury consumer, and has made us want to discover the “hidden driving forces behind it all.” To answer as many mysteries as we can – and perhaps to ultimately raise new, previously unasked questions – we decided to scrutinize the pricing practices of one of the absolute benchmark brands of the luxury watch industry: Rolex.

About the process

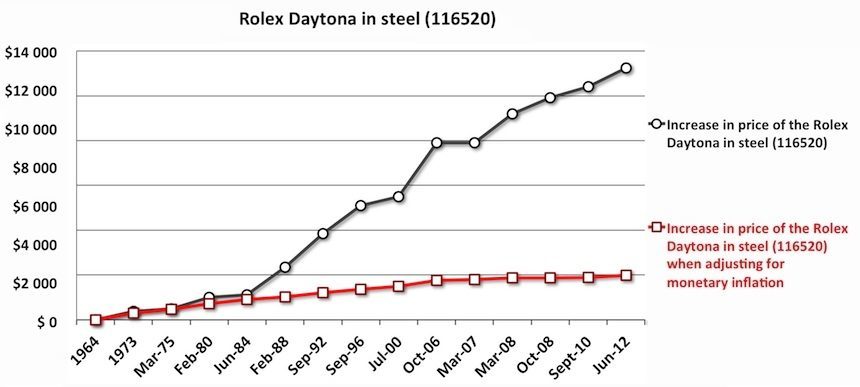

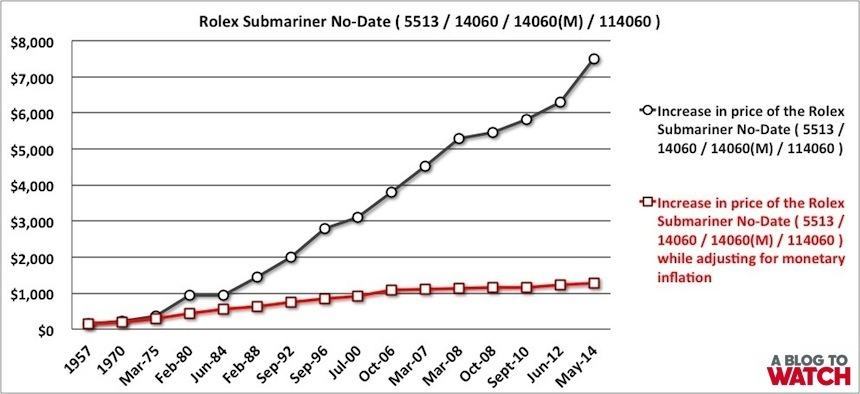

To begin with, we used official retail prices dating back as far as 1957, based on data compiled by Minus4Plus6.com. This magnificent price table contains authorized retailer prices in about 5-year steps for just about all important Rolex references that debuted in or after 1957. We processed the raw data linked to two of the more popular models of the brand, namely the Submariner no-date and the Cosmograph Daytona, and we have also looked at the Submariner in 18k gold to see how this precious material has affected affordability. We dedicated charts to each of these examples. On the charts, we have marked in black the respective retail prices for each year, while in red we indicate how the price of each watch would have changed over the years had Rolex raised prices only to counter the effects of monetary inflation.

Naturally, there are many other factors beyond inflation that can define a fine watch’s retail price, such as costs related to base materials, labor, research and development, marketing and brand positioning, as well as long-term investments related to advancements in manufacturing processes. With that said, our primary goal now is not to find a detailed answer for each respective model’s appreciation but rather to acquire a comprehensive understanding of how and why luxury watch prices have changed so much in general.

The key steps in the process of “luxurification”

In an ideal world, no brand can go on for decades making the exact same product while gradually raising prices to several times of what it initially sold said product for. Regardless of whether we are talking about a historical model or a new one, we all expect our latest purchase to pack a number of new features or developments, refinements that grant that our latest and greatest piece is truly that, with advancements in terms of design, comfort, reliability or accuracy.

When it comes to wristwatches, there are many ways we could define what sets a luxury item apart from the rest, but for now we will say that a luxury item is one that goes beyond meeting the requirements set strictly by necessities only. Ever since the first wristwatches became commercially available around the early 1900s, there have always been superior – and hence more expensive – as well as cheaper watches, differing in the level of quality that they offered in the aforementioned factors. But despite that 100-year-long history, the dawn of the luxury watch industry as we know it today dates back to the mid-1980s. It was around then that the Swiss finally found their way out of the quartz crisis that almost completely destroyed them.

To understand the evolutionary cornerstones in the development of a fine-watch-turned-luxury-product, we must examine a product with an expansive and continuous history, one that dates back way beyond the ’80s. A model we found to be most suiting for those purposes is the Rolex Submariner. Although its history is rather complex, for now we will say that upon its debut in 1954 it was one of the few professional dive watches out there at the time, and as such, it was more of a tool than anything else. By contrast, today’s Submariner, the tool-watch of yesteryear, has transformed into an internationally recognized status symbol, consequently becoming one of the most widely imitated watch designs of them all. That is quite some transformation, and upon closer look, we will see how nicely this one model comprises the steps in the transition from a tool to a luxury product.

To The Left Is The First Rolex Submariner From 1953, While Next To It Is Its 60-Year Successor, The No-Date 114060.

As the story tells – and the picture above beautifully illustrates – the Rolex Submariner remained more of a tool watch than anything else during its first few decades of existence. Its initial 100 meter water resistance was quickly doubled by the company and as such its 660 feet / 200 meter depth rating, rotating bezel and durable (for the time, that is) construction made it a perfect device for divers. By contrast, while the more modern iterations of it have been improved in just about every aspect one can imagine, the Submariner has gradually left the depths of the oceans and started a new and successful career in business meetings, spending vastly more time hidden under cuffs than exposed over diving suits.

It went on to incorporate better quality steel, replaced aluminum bezels with more beautiful and resistant ceramics, substituted most stamped components with milled ones, has become more legible, and much more accurate. But why was all that necessary, if only a microscopic percentage of its owners actually harness its enhanced capabilities? Because it has become a luxury item, something that must not only look, but also perform better than its more widely available counterparts – even if its heavy-duty construction will not once be put to test in its lifetime.

When it comes to Rolex and their historical models, we have seen them perform a large number of subtle as well as some major modifications over time. There is a peculiar way of coupling these two kinds of enhancements, meaning that smaller improvements are generally synchronized with the debut of more considerable alterations. In Rolex history, this generally translates into presenting a new, more refined movement which is accompanied by more minor improvements on the watch, such as a more durable and comfortable bracelet, a new bezel or luminescent material, and other tweaks.

That same trend widely applies for the luxury watch industry as a whole. Since the dawn of the new millennium most high-end brands have gone out of their way to emphasize the importance of “in-house” movements as they realized the potential in how this positively separates them from their non-manufacture counterparts. Researching Rolex history reveals that there have been some vital turning points in the lives of their products, gradually making them more refined in every way. But an obvious consequence of “more refined” is “more expensive.”

But how much do such advancements actually cost the consumer? On the chart above, you will see in black how prices of the Rolex Submariner No-Date changed from 1957 all the way through May, 2014. In red we marked how the original 1957 price of $150 would have changed had it followed monetary inflation only. The math is simple behind this one. If we adjust the original $150 price from 1957 with inflation to 2014 US Dollars, we end up with a price of $1,265 while the watch actually costs $7,500 today. This means that one could say the no-date Rolex Submariner costs six times more than it “should.” Things are not that straight-forward, however.

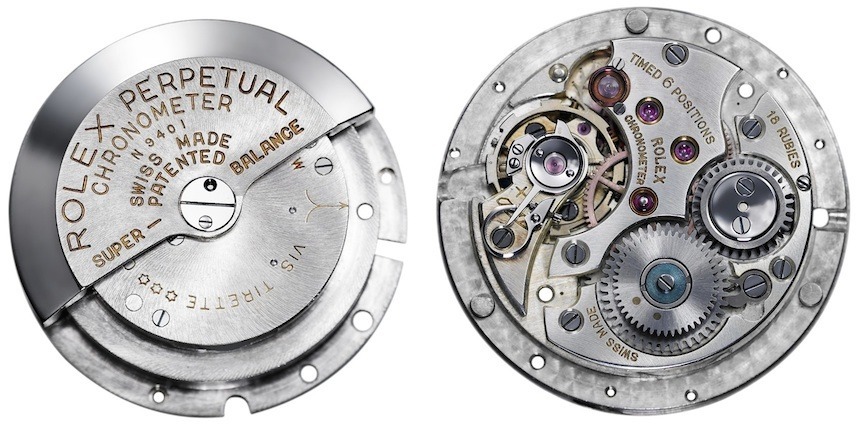

In 1931, Rolex Invented And Patented A Self-Winding Mechanism With A Free Rotor, Called The Perpetual Rotor – Seen Here Is The First Rolex Perpetual Chronometer Movement

A fine watch has never been cheap

You see, while adjusting for inflation could be indicative of how watches have become more expensive, this must be taken with a (substantial) pinch of salt. What primarily defines the affordability of products is not just the price and how that changes in comparison to monetary inflation over time, but rather, how the price of the product compares to people’s average income. As we know, inflation is the rate at which the general level of prices for goods and services is rising and, subsequently, how purchasing power is falling. With that said, the increase of average income should – and in the long term it does – outperform inflation, meaning that if the price of a fine watch followed inflation only, it would actually be getting cheaper as consumers have incomes outperforming the rate of inflation.

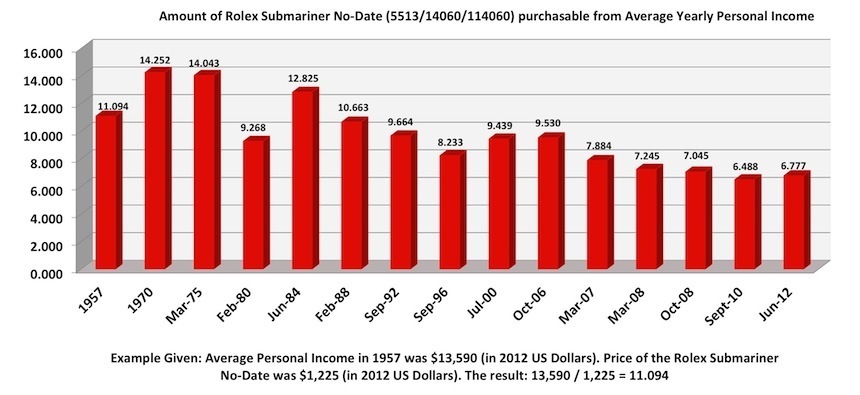

After that brief 101 in basic economics, let’s bring theory into practice and see how all that translates into watch prices and overall affordability. To show you just that, we created the following chart illustrating how the affordability of the Rolex Submariner no-date, one of the key models of Rolex, has changed in the United States, between 1957 and 2012.

Let me explain what you just saw above. The results you see labeled above every column range from around 6.7 up to 14. This figure indicates the amount of Submariners which the “average yearly income per capita” could purchase in any given year. Since we are talking about a time scale of over 50 years here, for easier understanding and actual comparability, we have transferred all US Dollar prices and wages into 2012 US Dollars. In other words, in 1957 when the average yearly income was $13,591 (Source: US Bureau of Economic Analysis) and the price of the watch was $1,225 (originally it cost $150 which, when calculated into 2012 US Dollars, is $1,225).

Now, in 1957 if the average watch lover spent all his/her hard-earned yearly income on Rolex Submariners, he could have bought 11 of them. By contrast, in 2012 when the average per capita income in the United States was $42,693 and the same model cost $7,500, the average US yearly wage bought you only 5.65 no-date Submariners.

We admit that this might sound like an unreal proposition – because it is, as no one in their right mind would spend all their income on Rolex Submariners! But, let’s put that aside for a minute and concentrate on the point that is to be made here: when considering the average US income, the Rolex Submariner has become three times less affordable since the 1970’s – and that is tangible, factual proof for a high-end watch gradually becoming a luxury item. In 1970, the average American earner worked 3 weeks to earn the price of a Submariner, while in 2012 the price of one accounts for over two months’ worth of his income. This goes to show that although a fine watch has never been particularly cheap, some very evident repositioning has happened over the course of the last few decades.

Outlining a trend

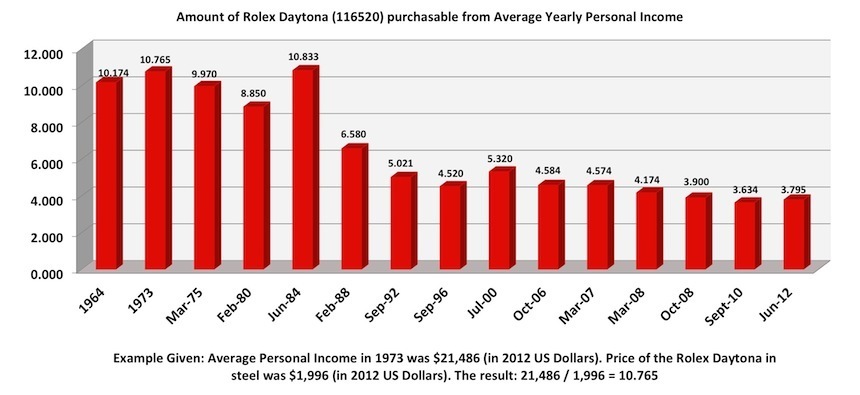

Thus far, we have been looking at the price changes of the Rolex Submariner, so now let’s examine other models the brand has repositioned since their debut decades ago. On the chart above, you will see the Rolex Daytona in stainless steel and how its prices have changed. Again, in black, is the actual price of the Rolex Daytona, while in red is the original price adjusted for monetary inflation. If we look at the chart at the 2012 mark we will see that the watch, priced at $11,250 was nearly six times as expensive as it “should have been” based on prices merely adjusted for monetary inflation, which came in at $1,996. So, has the Rolex Daytona in steel become six times as expensive as it once was, in 1973?

Well, in 1973 the average personal income (which was $21,486 in 2012 US Dollars) purchased nearly 11 Rolex Daytona watches in steel, priced at $1,996 each. Meanwhile, nearly forty years later, in 2012 when the average per capita income in the United States was $42,693 and the Rolex Daytona in steel costed $11,250, that figure drops to a mere 3.8 pieces. That means that while the Daytona has received a new in-house movement and has arguably improved in many more subtle ways, practically it has not become six times as expensive as our calculations based on monetary inflation would suggest. In truth, once we compare average personal income in the US, we will find that the 2012 purchasing power of the average yearly wage has dropped to 35% of what it was in 1973 – speaking about the Rolex Daytona, that is.

One may of course rightfully say that the volatility of base material prices have largely affected the final price of the product, and again, we do not disagree. For the aforementioned examples however, we have made an exception and have not taken that into consideration. So for our third, and last scrutinized model we will actually incorporate historical base material prices in our calculations… so read on to learn about the Rolex Submariner in 18k gold.

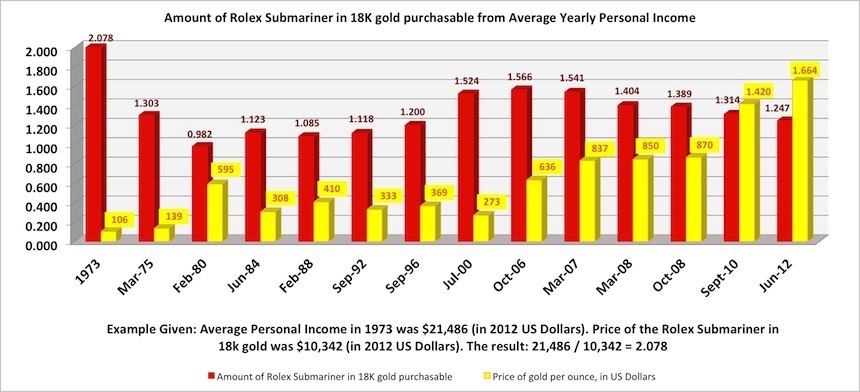

On the chart above, you will see the same red columns which you have already become familiar with, as they (and the data labels above them) indicate the number of Rolex Submariner 18k gold watches that the average yearly income in the US could buy in any given year. In yellow, however, we have introduced a readout for the price of gold, indicated by yellow columns and yellow data labels (we must note that there may be some minor differences in gold prices in different online databases, but the point here is to see the trends change and not to track down negligible differences in gold price records).

The Rolex Submariner Reference 116618LN In 18k Yellow Gold With A Black Dial And Black Ceramic Bezel

With that said, the correlation between gold prices and the Rolex Submariner 18k gold watch prices are evident. Let’s direct our attention to the noticeable trend between 2006 and 2012. In 2006 the price of an ounce of gold was around $630 US Dollars, and the Rolex Submariner 16618 in 18k yellow gold cost $23,100. In 2012, when gold prices have nearly tripled to a whopping $1,600+, the updated version of the Submariner, i.e. the 116618 in yellow gold retailed for $34,250 – a whopping increase of 48% over the course of just six years! In other words, a 260% increase in the price of gold (and a model update with new ceramic bezel, bracelet design and other minor updates) have cumulatively resulted in a Rolex price increase of 48%.

So, what have we learned here? The price increase of luxury timepieces unquestionably is a complex topic and one that we are definitely going to further elaborate on in the future. As a first step, we hope to have shed light on some of the previously unseen aspects of how prices and also personal income levels have changed over half-a-century. We have seen some of the steps in the long and rather intangible process of how Rolex watches have become a luxury item from a tool, initially tailored for professional use.